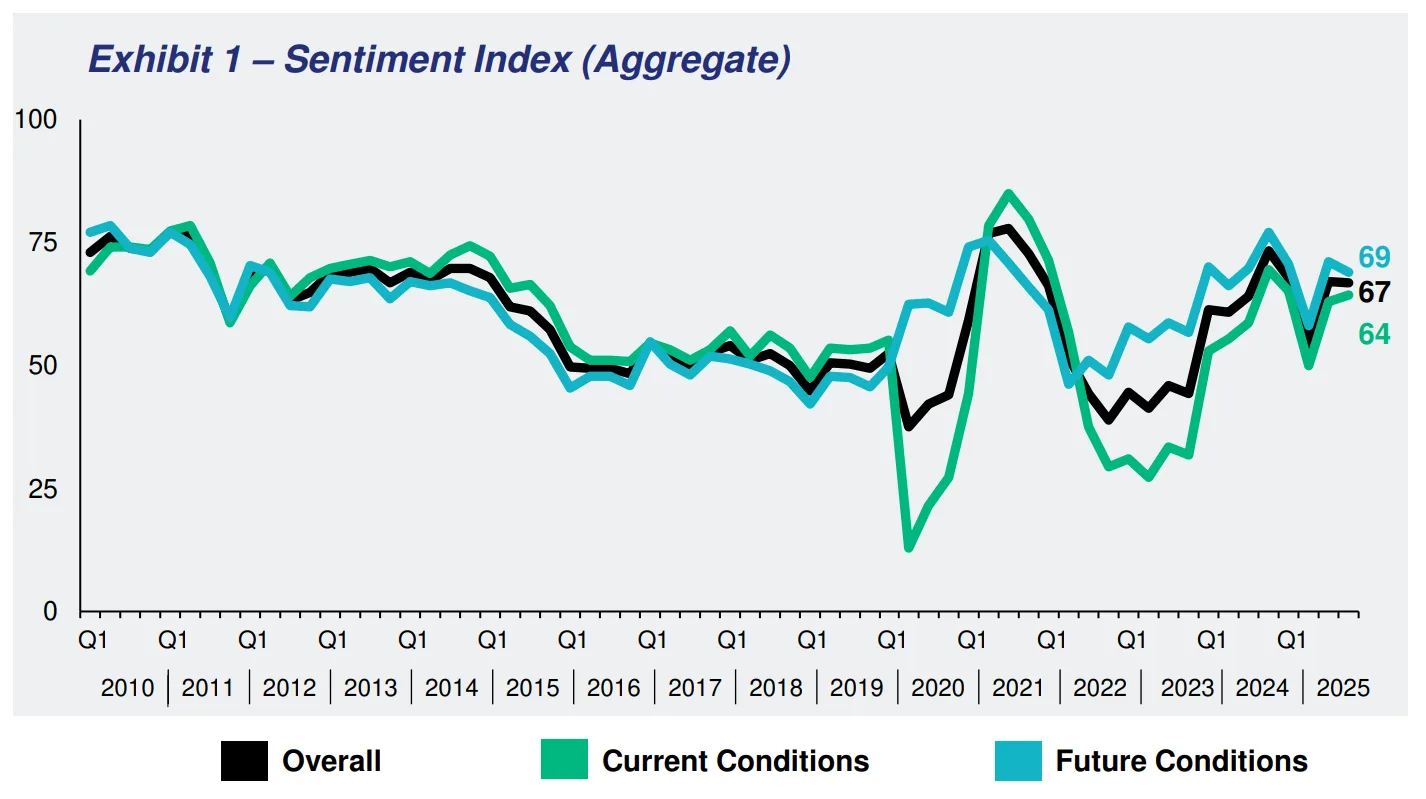

- The Q4 2025 Sentiment Index held at 67, with market leaders expressing cautious optimism amid stabilizing conditions.

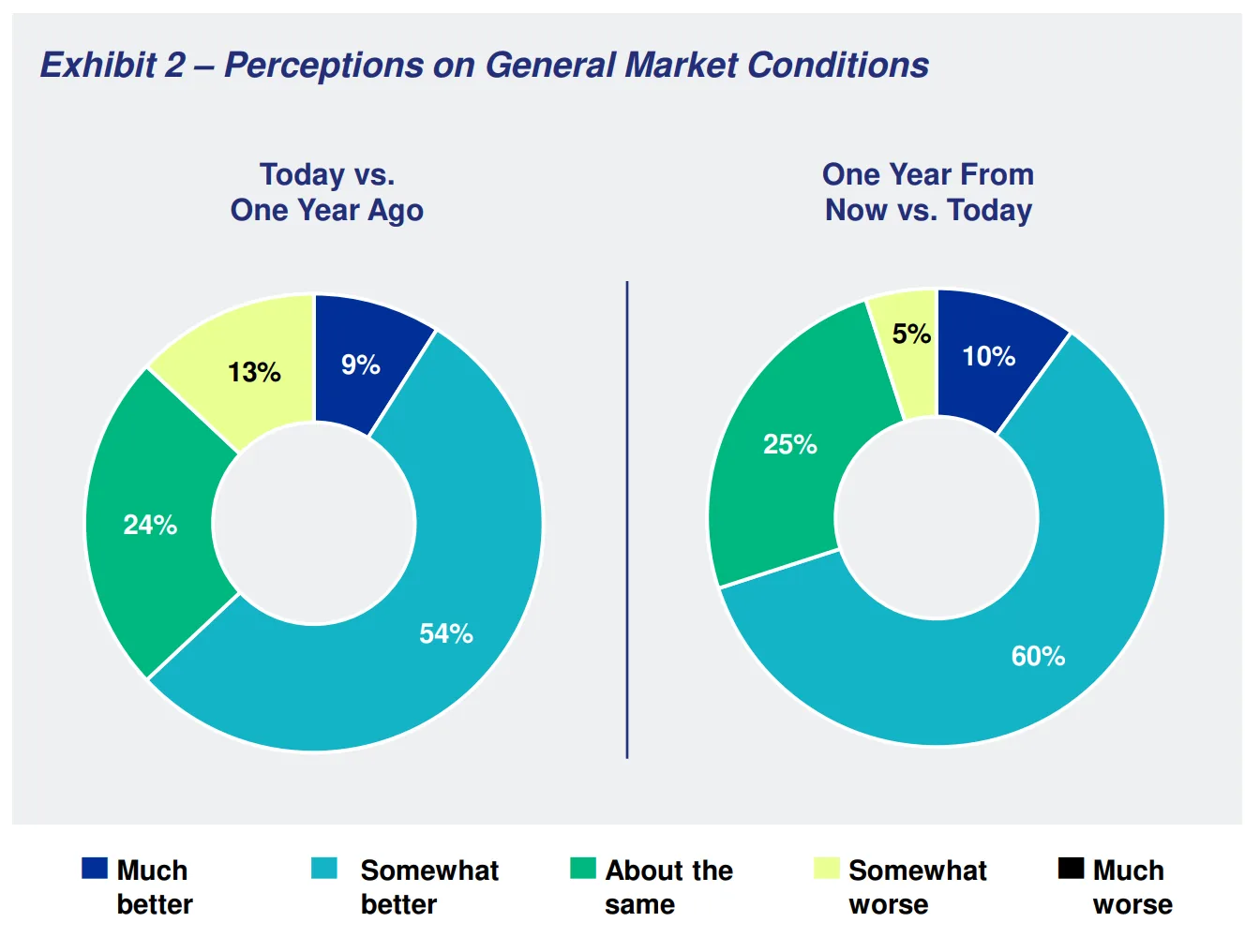

- 63% of respondents say general market conditions have improved year-over-year, while 70% expect further improvement in 2026.

- Asset values are trending upward, with 42% reporting increases and 72% anticipating growth in the year ahead.

- Debt capital access has significantly improved, with 78% noting easier borrowing conditions compared to last year.

A Market in Transition

The Real Estate Roundtable’s Q4 2025 Sentiment Survey shows steady momentum in commercial real estate confidence. The overall index remains unchanged from Q3 at 67, as current market conditions notch a slight gain to 64, and future expectations ease slightly to 69. The flat quarter-to-quarter reading suggests the sector is emerging from volatility into a more balanced—but still cautious—environment.

“The market is still challenging, but the wind isn’t at your back or your face this time, it’s going sideways,” said one executive. Others noted that the post-Labor Day period marked a turning point in sentiment, with optimism building around macroeconomic stability and potential rate cuts in 2026.

General Conditions Improve, but Policy Concerns Persist

Most survey participants are seeing progress: 63% believe market conditions are better than a year ago, while only 13% think they’ve worsened. Expectations for 2026 are even stronger—70% of respondents anticipate improved market fundamentals within the next 12 months.

Sector performance remains uneven. Multifamily, senior, and student housing continue to benefit from clear demand trends. Retail and hospitality are showing steady recovery, while office remains the weakest link—though top-tier buildings in select markets like San Francisco are beginning to show signs of life.

Despite improving fundamentals, several respondents voiced concerns about the broader policy environment and trade-related disruptions. “Tariffs have been a disaster,” said one participant, citing uncertainty in material costs and long-term planning.

Asset Values Regain Traction

More than 40% of CRE executives say asset values have increased from a year ago, while another 43% report stable pricing. Only 15% indicated declines—down from the higher volatility seen in prior quarters. Bid-ask spreads are narrowing, suggesting capital is more willing to transact as valuations stabilize.

Looking ahead, sentiment is increasingly bullish: 72% expect asset prices to rise in 2026.

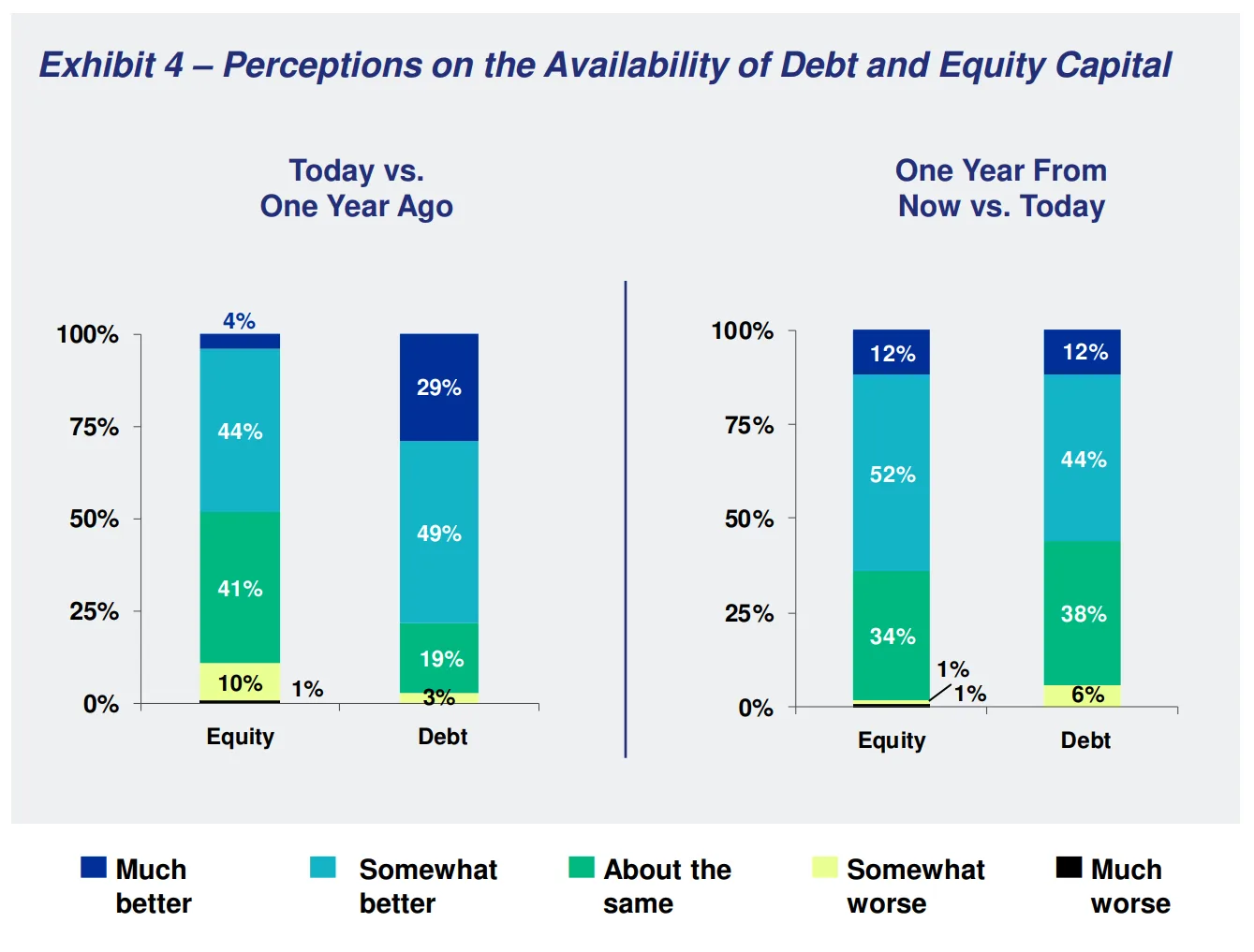

Capital Access: Debt Opens, Equity Still Thawing

The debt markets have rebounded notably. 78% of participants report improved access to debt capital compared to a year ago, with banks, insurance firms, and private credit providers becoming more active. Several cited a return to “covenant-light” lending and compressed spreads.

On the equity side, sentiment remains positive but tempered. While 48% report better access to equity than a year ago, the pace of capital deployment is cautious, particularly for ground-up development or non-core assets. That said, 64% of respondents expect equity availability to improve in the next 12 months.

Looking Forward: Guarded Optimism Into 2026

The Q4 2025 survey indicates the industry is shifting out of the defensive stance that characterized the past two years. Stabilizing asset values, improving capital markets, and a more resilient economy are driving modest optimism, though political and policy-related uncertainties remain a headwind.

With CRE leaders eyeing stronger transaction volumes in 2026, the prevailing view is that while recovery is uneven, the worst is likely behind the industry.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes