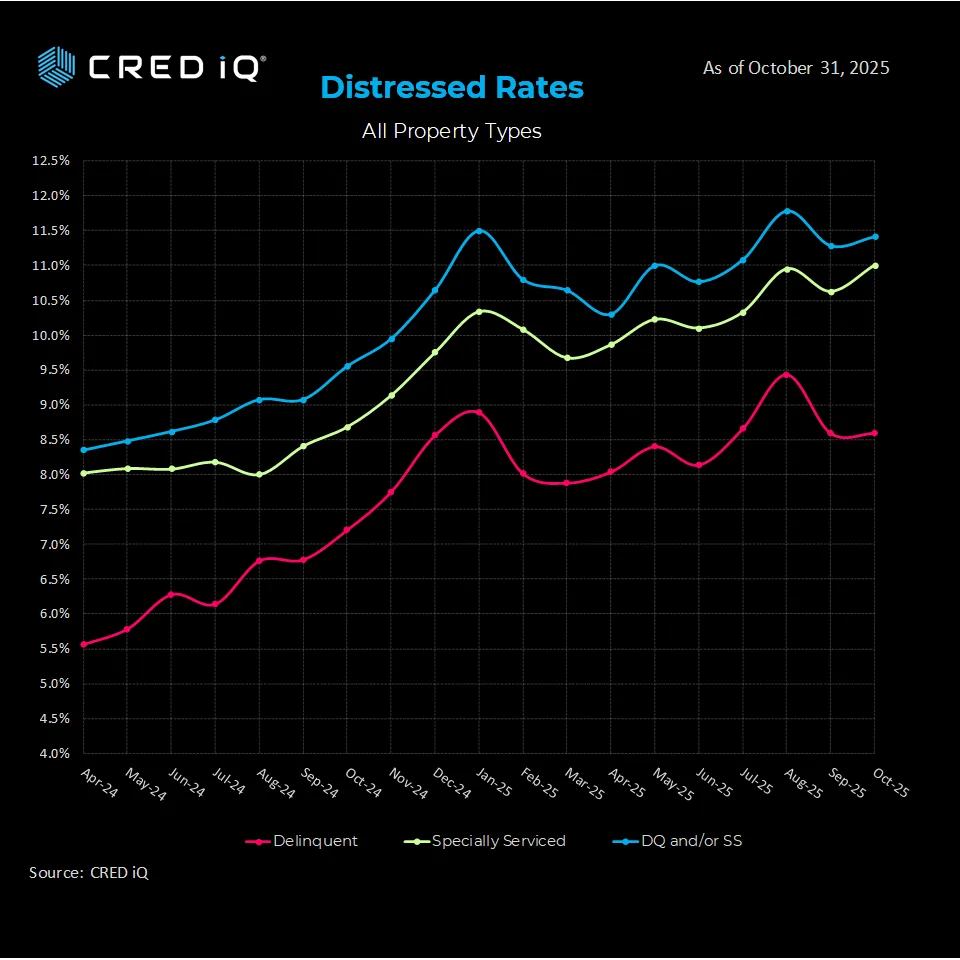

- CRED iQ’s distressed rate increased by 13 bps in October to 11.41%, reversing part of September’s improvement.

- While delinquencies held at 8.59%, specially serviced loans rose by 38 bps to 11.00%, showing continued challenges with loan workouts.

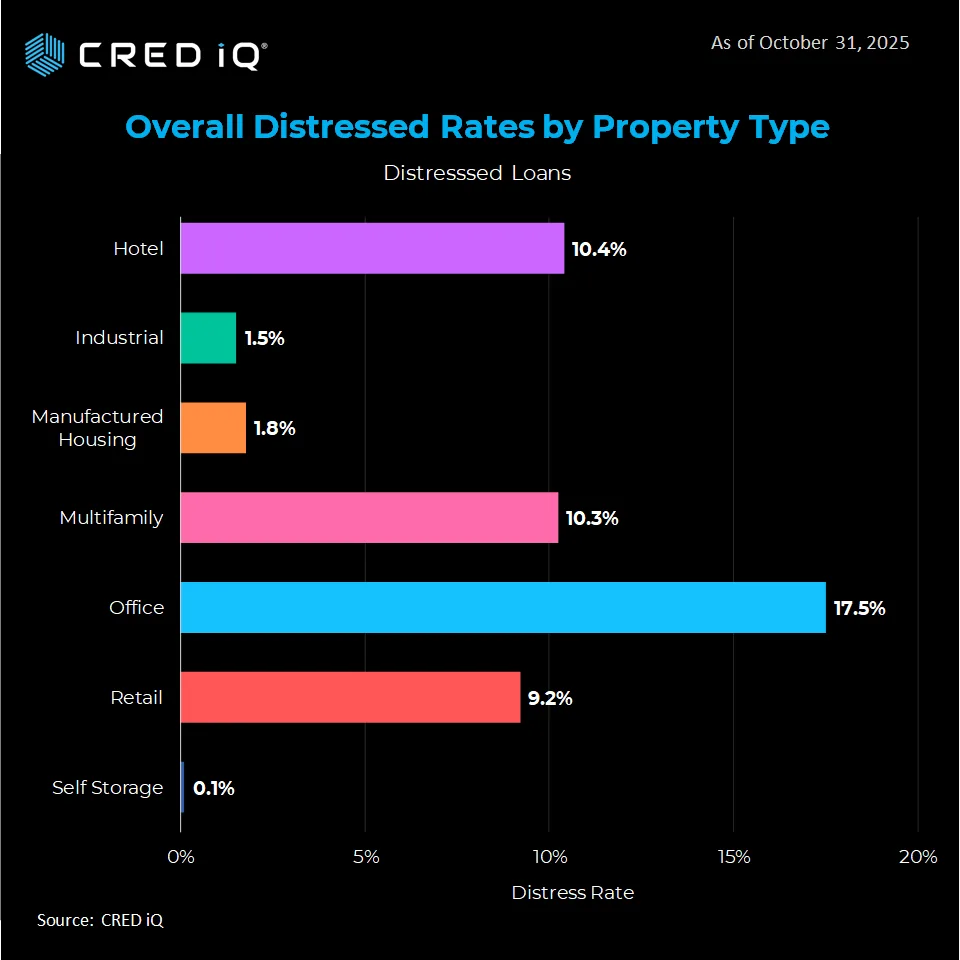

- Office loans remained the most troubled at 17.5%, though slightly better than earlier in the year.

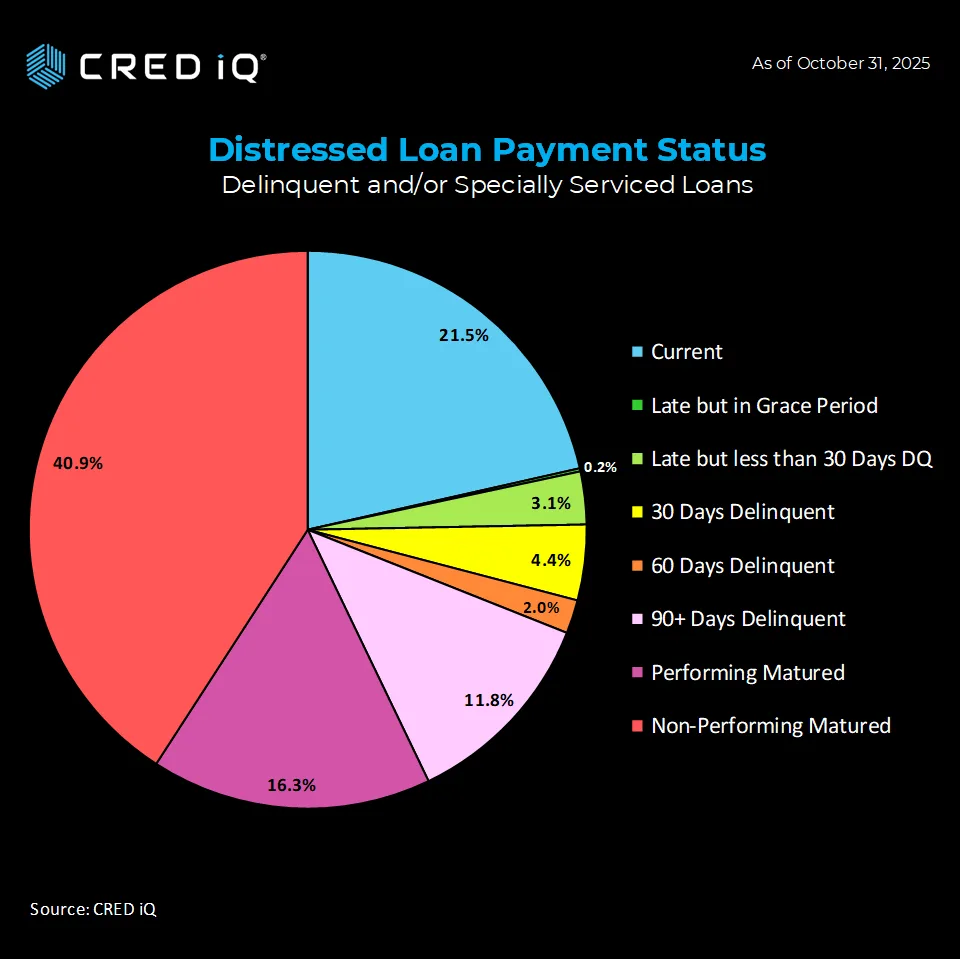

- Nearly 57% of distressed loans are matured, with many either not paying or at risk of default.

CMBS Distress Ticks Up

In October, CRED iQ’s CMBS distress rate rose to 11.41%, up 13 basis points from the prior month, reversing half of September’s 50 bps decline.

The delinquency rate stayed flat at 8.59%. However, the special servicing rate jumped to 11.00%, reflecting growing trouble for loans that reached maturity without resolution. CRED iQ defines distress as any loan in special servicing or at least 30 days past due.

Sector Overview: Office Still Struggling

Office loans remained the most distressed, with a 17.5% rate in October. This was down from Q1 but still reflects issues tied to hybrid work and refinancing risk.

Hotels and multifamily also showed elevated distress but improved since Q1. Hotel distress dropped to 10.4%, helped by seasonal travel. Multifamily fell to 10.3%, supported by rent growth.

Retail distress rose to 9.2%, facing pressure from e-commerce and shifting consumer habits. Industrial, self-storage, and manufactured housing remained the most stable. Their distress rates were 1.5%, 0.1%, and 1.8%, respectively.

Loan Status: Maturities Drive Distress

The biggest concern is the growing share of matured loans that haven’t been resolved.

- Non-performing matured loans made up 40.9% of the distressed pool.

- Performing matured loans made up 16.3%.

- Loans 90+ days late accounted for 11.8%, while another 4.4% were 30 days delinquent.

Only 21.5% of distressed loans were still current. These numbers point to extension risk and possible forced sales as 2026 draws closer.

Why It Matters

Distress is climbing again, and maturing debt remains the top risk in the market. While industrial and self-storage continue to perform well, office and hotel properties are still struggling. Investors may find chances in discounted assets, but need to stay alert to fast-changing conditions.

What’s Next

CRED iQ tracks over $600B in CMBS loans, giving insight into loan-level trends. As maturities stack up and interest rates stay high, loan performance will remain under pressure. Look for more data in the next update as the market prepares for a critical 2026.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes