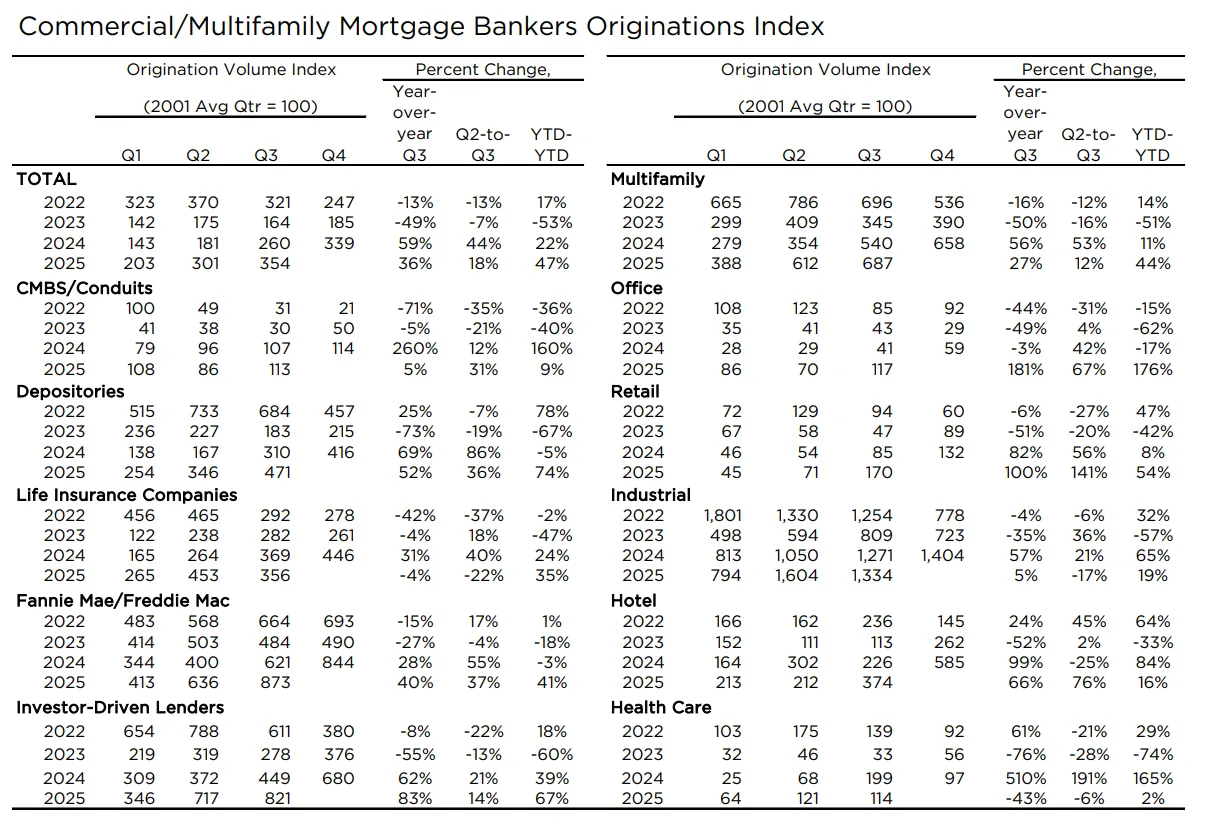

- Lending activity jumped 36% year-over-year and 18% quarter-over-quarter, reflecting stronger market confidence.

- Office, retail, and hotel properties led the increase, with office lending rising 181% compared to Q3 2024.

- Investor-driven lenders and depositories drove origination growth, posting 83% and 52% annual increases, respectively.

- Life companies cut back their lending, marking a 4% year-over-year decline and a 22% quarterly drop.

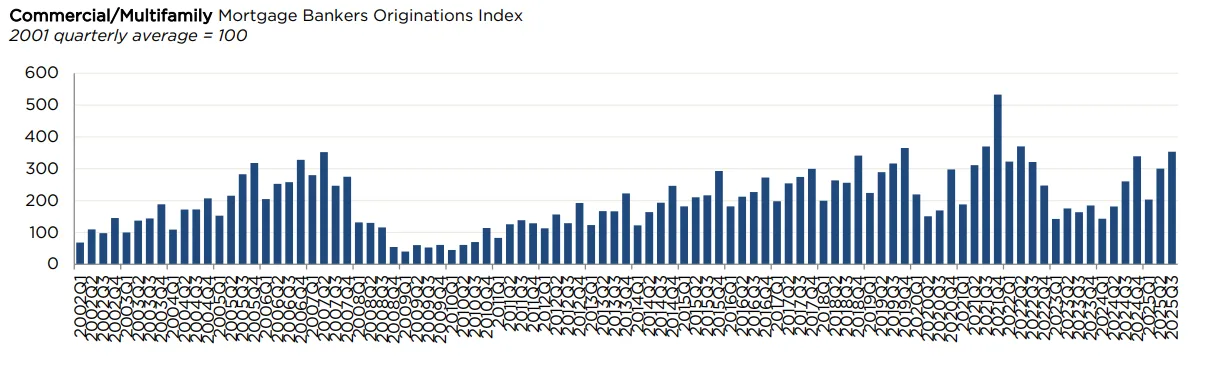

Lending Activity Continues Upward Trend

In the third quarter of 2025, commercial and multifamily mortgage borrowing extended its upward trajectory. According to the Mortgage Bankers Association (MBA), originations rose 36% from the same quarter last year and 18% from Q2 2025. These gains marked the fifth straight quarter of year-over-year and sequential growth.

Reggie Booker, Associate Vice President of Commercial/Multifamily Research at MBA, noted that improved borrower sentiment and stabilized property values played a key role. In addition, many borrowers refinanced loans that had reached maturity.

Sector-Specific Growth Signals Market Shift

Most major property types saw increased lending activity, although growth varied widely:

- Office properties recorded a dramatic 181% year-over-year jump, suggesting renewed interest after a sluggish post-pandemic recovery.

- Retail lending doubled, up 100% year-over-year and 141% compared to Q2.

- Hotel originations rose 66% year-over-year, supported by steady gains in travel and tourism.

- Multifamily loans increased 27%, continuing a strong upward trend.

- On the other hand, industrial lending inched up just 5% year-over-year and fell 17% from Q2.

- Health care properties faced a 43% drop, the largest annual decline across sectors.

These shifts reflect a broader rebalancing of investor priorities as different asset classes move through their post-pandemic recovery phases.

Capital Sources Show Mixed Momentum

Various lender groups participated in the Q3 upswing, though some pulled back:

- Investor-driven lenders increased originations by 83% year-over-year, showing the strongest growth.

- Depositories raised lending 52% compared to Q3 2024 and 36% from the prior quarter.

- GSEs (Fannie Mae and Freddie Mac) expanded their multifamily lending by 40% year-over-year and 37% quarter-over-quarter.

- CMBS lenders also contributed, with a 5% annual rise and 31% increase from Q2.

- Life insurance companies, however, reduced their activity, cutting loan volume by 4% year-over-year and 22% quarter-over-quarter.

This variation suggests that while overall market confidence is improving, capital deployment strategies still differ across investor types.

Why It Matters

Rising originations across most property types and lender groups point to a more optimistic financing environment. Developers and owners are seizing the opportunity to refinance existing debt and pursue new projects. Notably, the surge in office and retail lending indicates that previously challenged sectors may be turning a corner.

Moreover, with capital flowing back into commercial real estate, borrowers are gaining more options—though those in specialized sectors like health care may continue to face hurdles.

Looking Ahead

As 2025 winds down, the outlook for commercial and multifamily finance appears increasingly stable. If current trends persist, 2026 could bring continued growth, especially if interest rates remain favorable and investor demand holds up.

MBA’s data suggests that the industry is adjusting to post-pandemic realities, and capital is beginning to flow back into both core and value-add assets. However, lenders remain selective, and performance will likely continue to vary across asset classes.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes