- Net absorption in Q3 reached 47 MSF, a 64% increase from Q2, reflecting a demand rebound though still below historical norms.

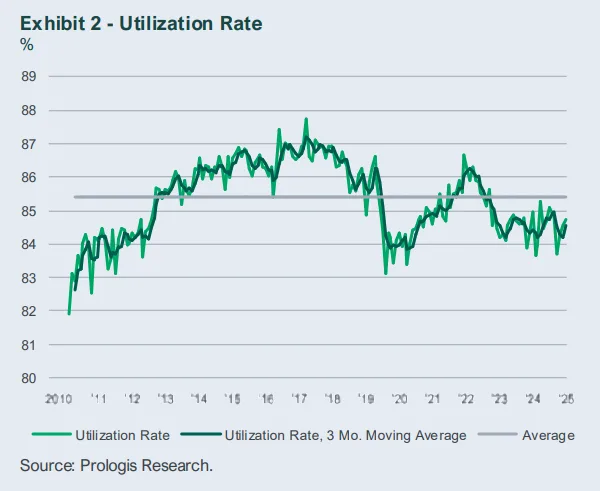

- Utilization rates climbed to 84.7% in October, showing improved inventory flow, though customers remain cautious with “just enough” inventory strategies.

- Speculative construction remains low, constrained by rising costs, regulatory barriers, and land scarcity—leading to emerging shortages in select markets.

- Larger tenants are driving leasing activity, prioritizing network optimization and build-to-suit facilities as they move past a cautious stance.

A Turn in the Market

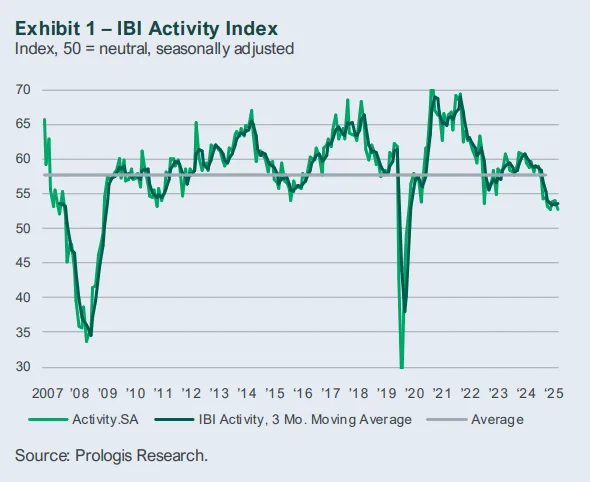

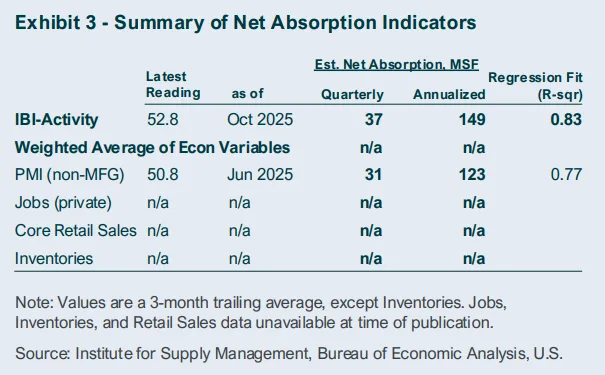

As reported by Prologis, logistics real estate demand reached a turning point in Q3 2025, signaling renewed confidence among tenants. Net absorption rose to 47 MSF, a significant quarterly jump, even if still lagging pre-pandemic levels. New leasing activity also improved, climbing 10% over Q1 levels, as more companies resumed long-term space commitments.

Strategic Shifts in Supply Chain Behavior

Large and e-commerce-focused companies led the recovery, actively reconfiguring distribution networks after a cautious start to the year. This was reflected in higher utilization and leasing volumes among manufacturers and wholesalers, while retailers trailed slightly due to front-loaded inventories and slower consumer spending.

Utilization reached 84.7% in October, up from Q3 averages but still below levels that signal full expansion. Most tenants continue to favor lean inventory strategies, balancing flexibility with cost control. However, any upside in consumer demand could trigger stronger leasing momentum.

Construction Slows, Scarcity Emerges

Speculative development remains well below pre-2020 levels, as developers face rising costs, land constraints, and regulatory hurdles. The current construction pipeline continues to shrink, contributing to emerging shortages in certain markets and size categories. Built-to-suit projects are increasingly favored by tenants seeking customized, future-ready logistics space.

A ~20% spread between replacement costs and current market rents has discouraged new speculative starts, particularly in high-barrier locations, adding further pressure on availability over the medium term.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

A More Measured Recovery

Despite macroeconomic uncertainty and muted holiday spending (up only 3.6% YoY in real terms), customer sentiment is stabilizing. Leasing activity is strongest in sectors like food & beverage, e-commerce, and healthcare, while demand from discretionary goods tenants remains subdued—yet poised for a potential rebound as interest rates ease.

Vacancy rates are expected to hover in the mid-7% range, suggesting a stabilizing market. However, continued supply constraints may push rents higher again in 2026, especially in markets with tight land supply and strong long-term demand.

What’s Next

The inflection in Q3 suggests logistics real estate is entering a new phase of recovery, led by well-capitalized tenants making strategic, long-term decisions. With fewer new deliveries and rising constraints, securing space early may become a competitive advantage—especially for users with highly specific or large-scale requirements.

Conclusion

After a period of caution, the logistics real estate sector is seeing renewed momentum. Demand is improving, speculative construction remains restrained, and long-term planning is back on the agenda. As the supply-demand balance shifts, space scarcity in key segments may define the market heading into 2026.