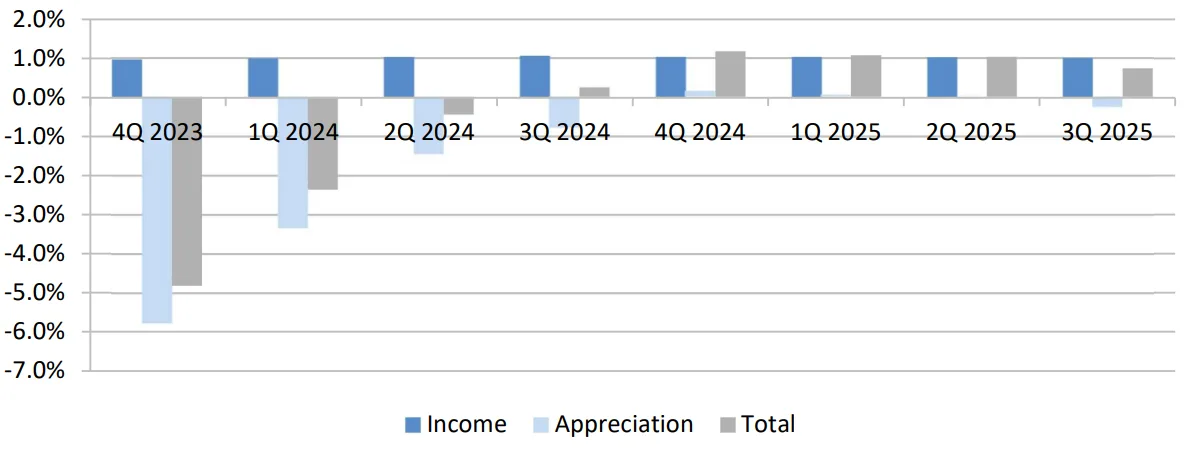

- Q3 2025 total return for NFI-ODCE was 0.73%, down from 1.03% in Q2 2025, but still an improvement from 0.25% in Q3 2024.

- Appreciation return slipped to -0.26%, while income return remained steady at 0.99%.

- Annual gross total return rose to 4.04%, marking the strongest 12-month performance since late 2022.

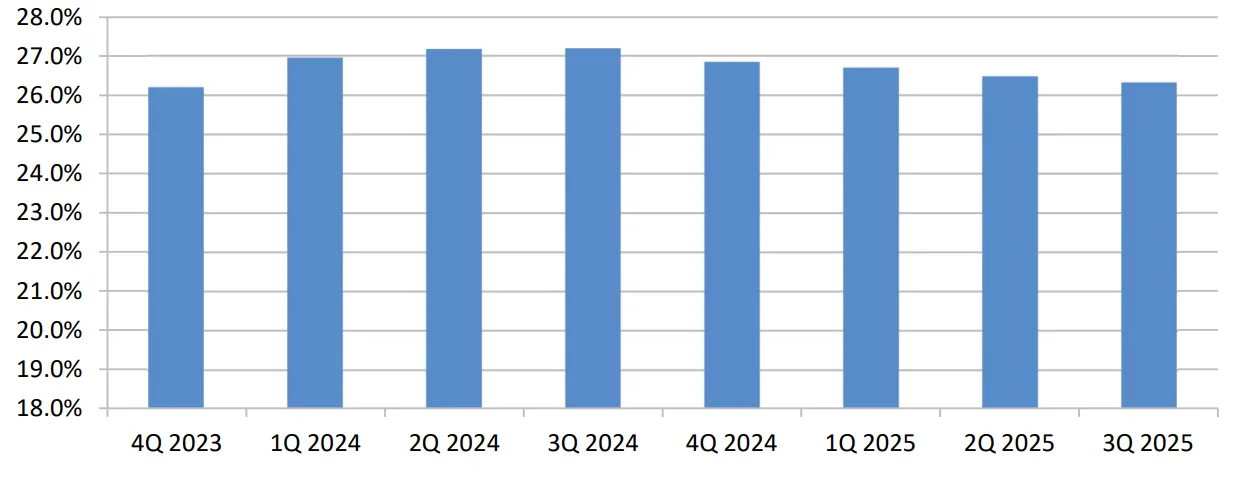

- Leverage across funds held steady at 26.3%, slightly above the long-term average.

A Moderation in Returns

The National Council of Real Estate Investment Fiduciaries (NCREIF) released its Q3 2025 results for the NCREIF Fund Index – Open-end Diversified Core Equity (NFI-ODCE), a key benchmark tracking institutional core real estate funds. While the index continued to post positive total returns, momentum has slowed.

The total return gross of fees for the quarter was 0.73%, down from 1.03% in Q2 2025. Although this marks a slowdown, it’s a notable improvement from 0.25% posted during the same period in 2024, as reported by Institutional Real Estate, Inc. (IREI), based on data from NCREIF.

Appreciation Lags, Income Steady

Performance was led by the income return of 0.99%, down just slightly from 1.01% in the prior quarter. However, appreciation was a drag on performance, with the appreciation return slipping to -0.26%, compared to a flat reading in Q2. Still, this marks an improvement over the -0.79% recorded in Q3 2024.

Since inception in 1978, the NFI-ODCE has posted average quarterly returns of 1.97% total, 1.63% income, and 0.33% appreciation.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Annual Performance Ticks Higher

For the 12-month period ending September 30, 2025, the index delivered a gross total return of 4.04%, the strongest annual performance since Q4 2022. The yearly total included 4.10% income and -0.06% appreciation, underscoring how income continues to support overall returns amid muted valuation gains.

Conservative Leverage, Negative Cash Flows

Leverage across NFI-ODCE funds stood at 26.3% of total assets as of Q3, slightly down from 26.5% last quarter but still above the 22.3% average since 2000. Leverage levels remain conservative given the funds’ core strategies.

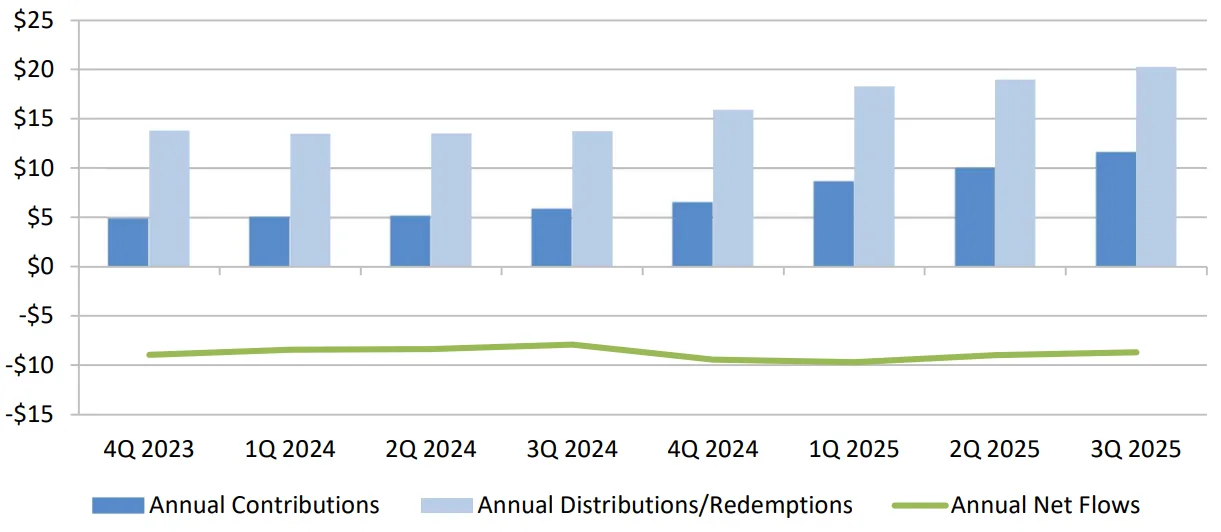

Investor sentiment remains cautious. Quarterly net cash flows were negative $1.9B, continuing a trend of outflows. That said, contributions jumped 97.2% year-over-year, suggesting renewed interest or reallocation into core funds. For the year ending Q3 2025, net outflows totaled $8.7B.

What’s Next

The market will be watching how appreciation trends evolve as the sector continues to digest past rate hikes and valuations reset. NCREIF will host a webinar on November 18 to provide further insights into NFI-ODCE and related indexes, including farmland and timberland.