- CRED iQ analyzed $31.5B in Q3 2025 issuances across 576 loans and 51 deals. The data revealed a narrow spread of 23 bps between average cap rates (6.34%) and interest rates (6.57%).

- Hospitality posted the widest spread at 106 bps. Industrial had the tightest at 35 bps, exposing it to refinancing risk.

- Q3 activity declined across all categories. Deals, balances, and loans dropped 9%, 18%, and 50% respectively from Q2 levels.

Q3 in Review: Market Adjusts to Elevated Rates

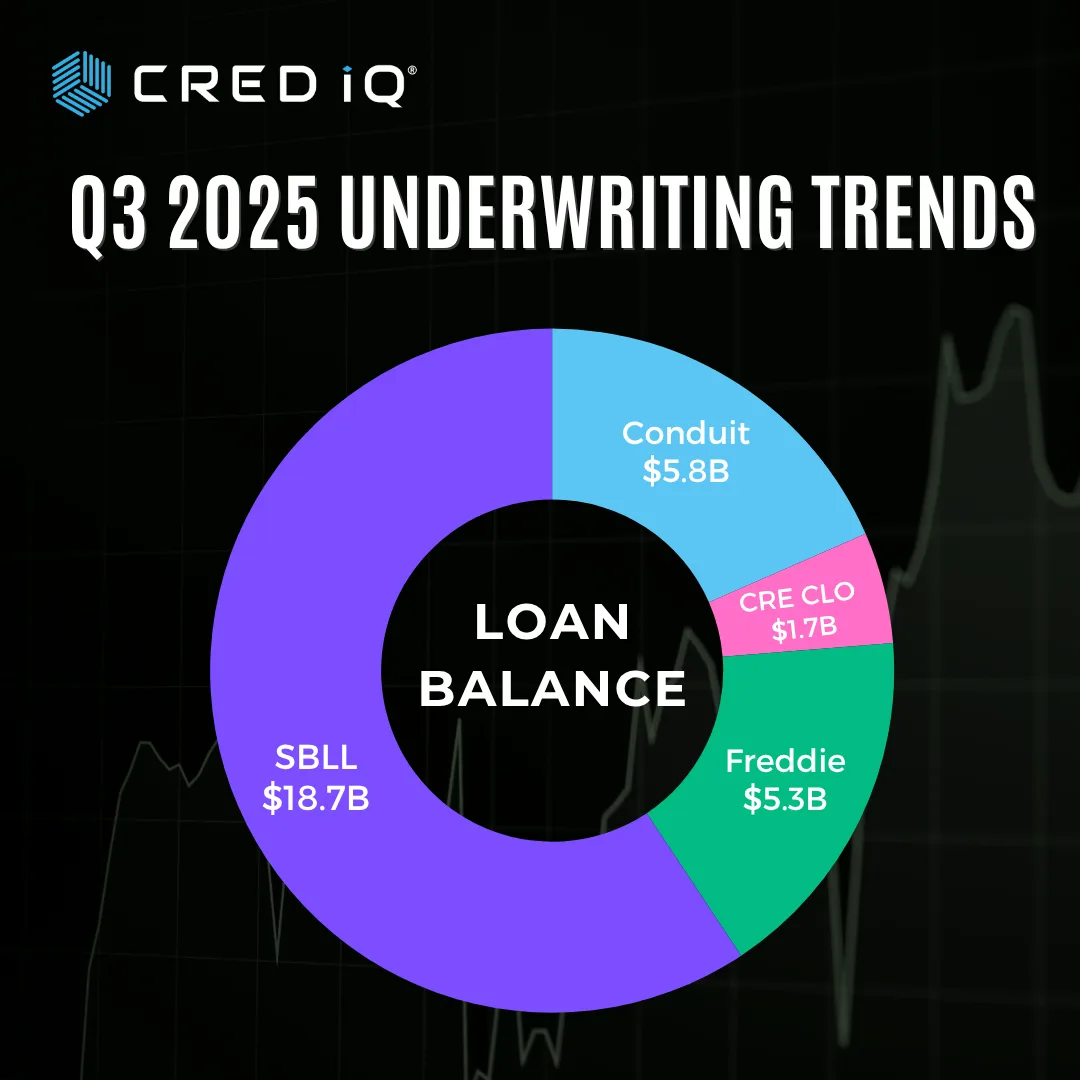

According to CRED iQ, the CRE market is still adjusting to the higher-for-longer interest rate environment. In Q3 alone, $31.5B in new issuance hit the market. That brought year-to-date issuance to $123.8B.

However, volume pulled back across the board. Compared to Q2, deal count fell 9%, balances declined 18%, and loan volume dropped by half. This shift signals greater investor caution and tighter underwriting.

Narrowing Margins Signal Debt Service Pressure

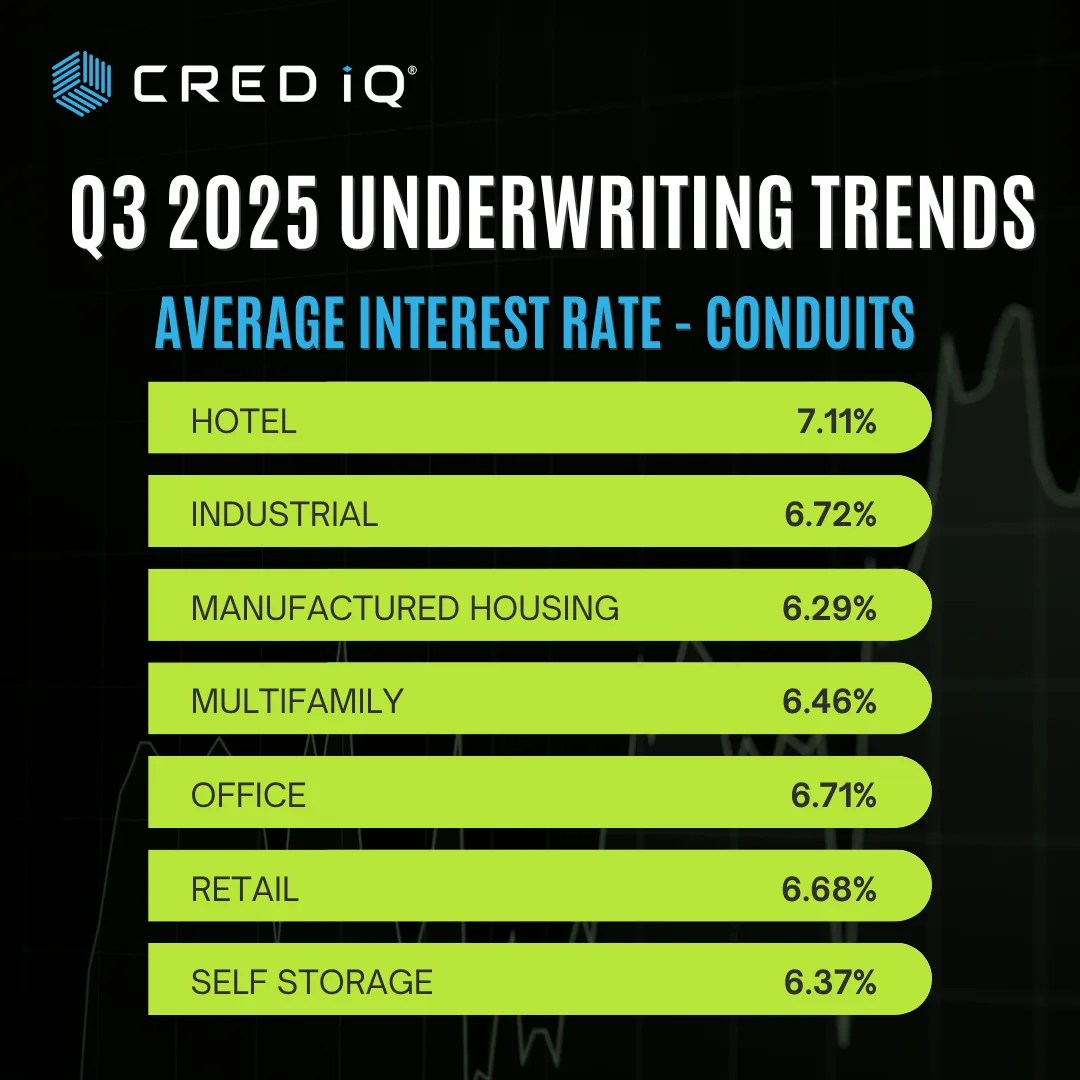

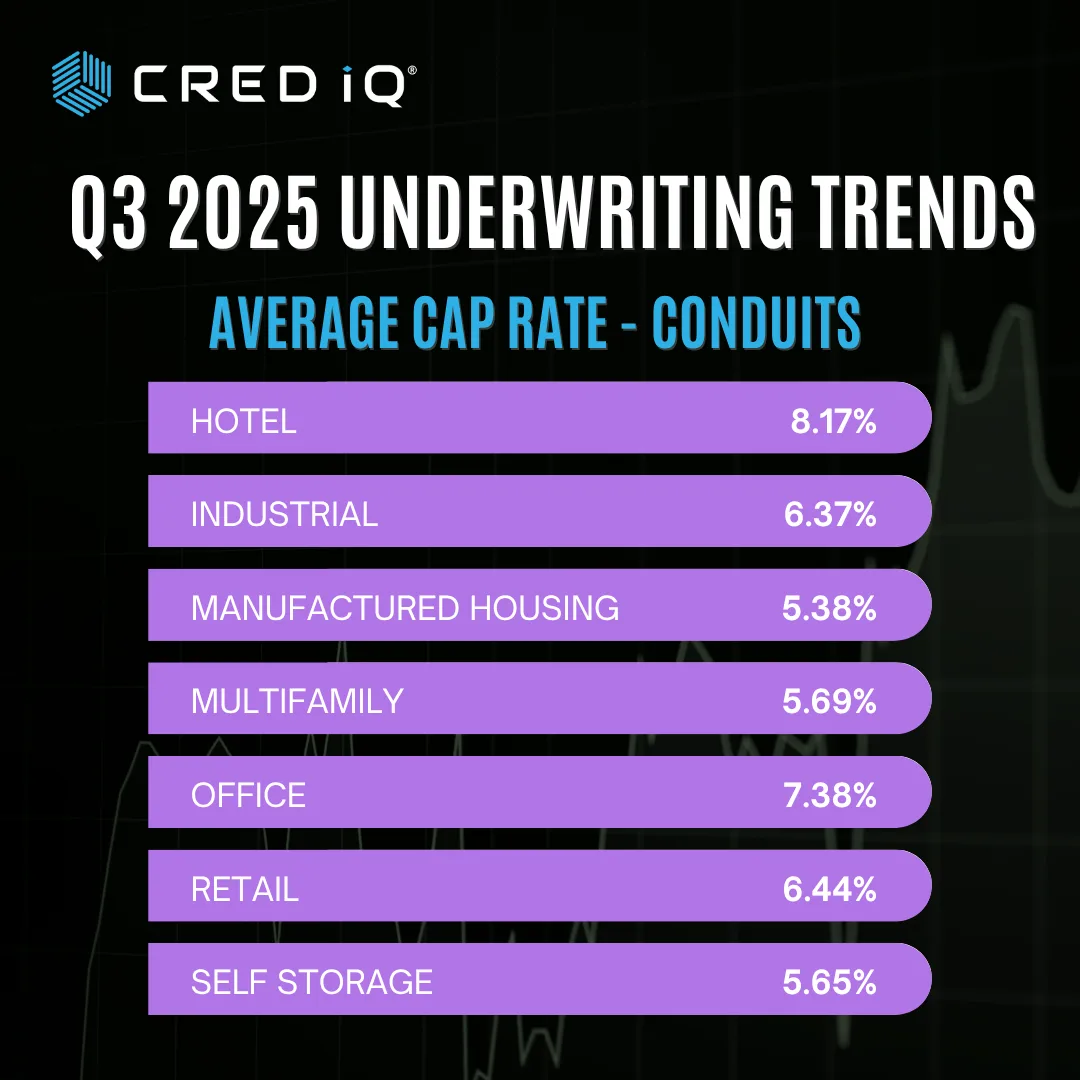

Across all property types, the average interest rate stood at 6.57%, while the average cap rate was 6.34%. This resulted in a narrow 23-basis-point spread. Although modest, this gap raises concerns about income coverage, especially in sectors with soft fundamentals.

Moreover, the data suggests that elevated borrowing costs continue to weigh on transaction viability and asset pricing.

How Property Types Stack Up

Hospitality stood out in Q3 with the widest spread between cap rates and interest rates, offering a strong 106-basis-point cushion. This reflects growing investor confidence in the sector’s recovery potential. In contrast, industrial saw the tightest margin—just 35 basis points—as high demand continues but leaves little room for rate volatility. Multifamily performed close to the market average, yet rising construction costs and affordability pressures are starting to weigh on returns.

Meanwhile, self storage remained a steady performer, posting the lowest interest rates alongside stable cap rates, signaling continued investor interest in its low-maintenance appeal. Office properties, though showing a moderate spread, remain clouded by hybrid work uncertainty, which continues to challenge leasing fundamentals. Finally, retail experienced a narrow margin, but any expansion in cap rates could unlock value for opportunistic buyers as the sector finds its footing.

Looking Ahead

As interest rates stay elevated, margins will likely stay compressed. Therefore, sectors with thin spreads may face valuation and refinancing challenges. Conversely, properties with wider cap rate buffers—like hospitality—may offer better protection.

Going forward, investors should monitor cap rate movement closely. Widening spreads in underperforming sectors could signal better entry points in a market that is becoming more selective and fundamentals-driven.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes