- CoStar upgrades 2026 forecast to 10M SF of positive office absorption, reversing earlier negative projections.

- National office vacancy dropped for the first time since 2019, signaling early signs of office recovery.

- Rent growth outlook improves, now expected to reach 1% by end of 2026 and 1.5% in 2027.

- Long-term challenges persist, with vacancy projected to remain above 13.5% through 2030.

A Surprising Turnaround

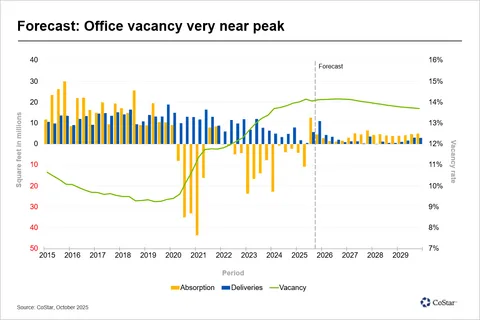

The US office sector is showing early signs of a rebound, according to CoStar’s latest projections, reports Bisnow. After years of softening demand and rising vacancies, the outlook is finally shifting. The analytics firm now expects 10M SF of positive net absorption in 2026. This marks a significant reversal from its earlier projection of a 4M SF decline.

This revised outlook follows a rare drop in national office vacancies in Q3 2025—the first since before the pandemic—with a modest 5 basis point dip to 22.5%, according to data from JLL.

Improved Rent Outlook

CoStar also boosted its rental growth forecast, now projecting a 1% increase by the end of 2026 and 1.5% growth by late 2027. This marks a shift from the firm’s prior expectation that office rents would grow less than 1% annually through 2027.

Phil Mobley, CoStar’s National Director of Office Analytics, attributed the changes to the strongest occupancy gains seen since before 2020.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Challenges Still Loom

Despite the brighter near-term outlook, structural challenges remain. CoStar expects vacancy to stay above 13.5% through the end of the decade, well above pre-pandemic norms and higher than the Great Recession peak.

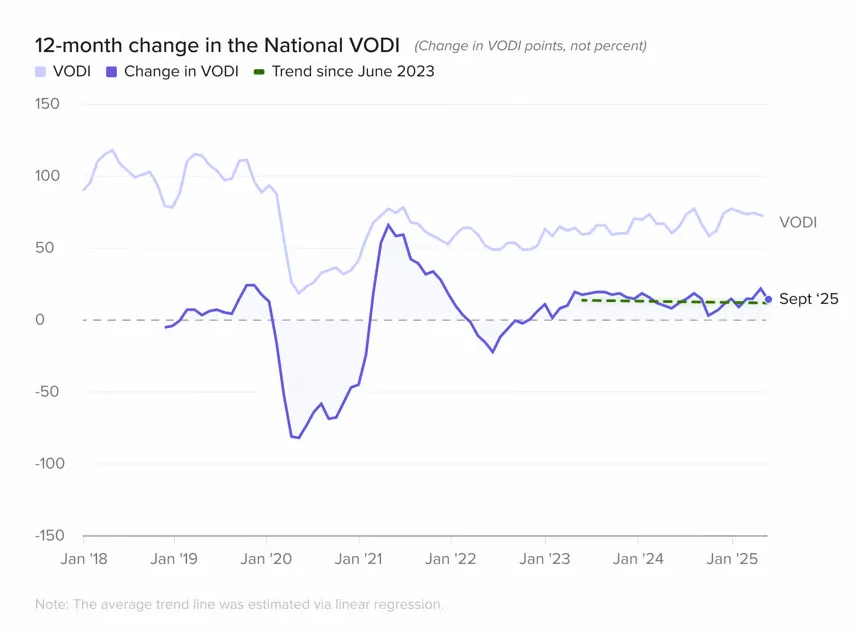

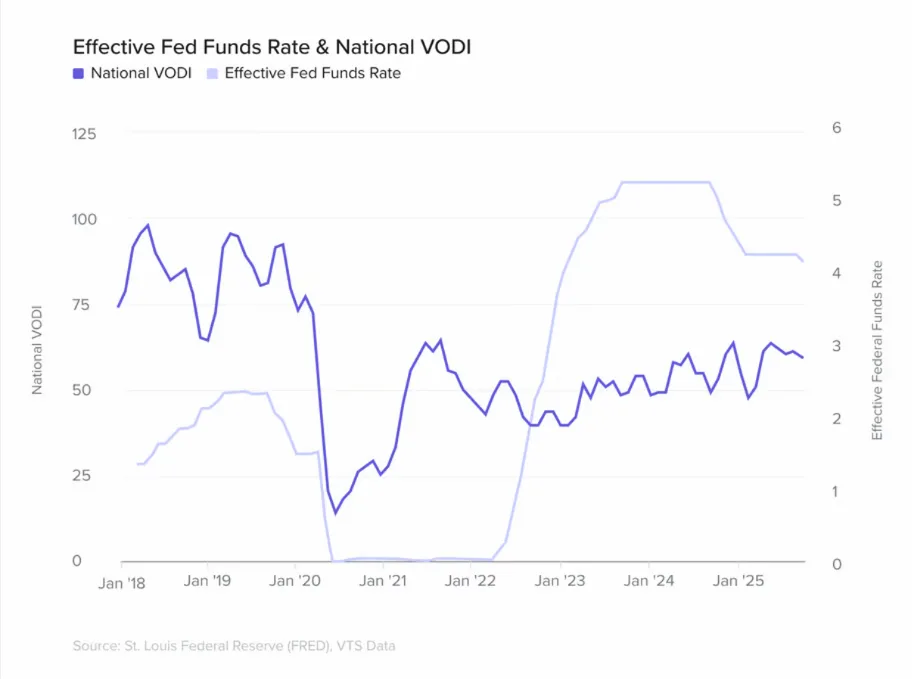

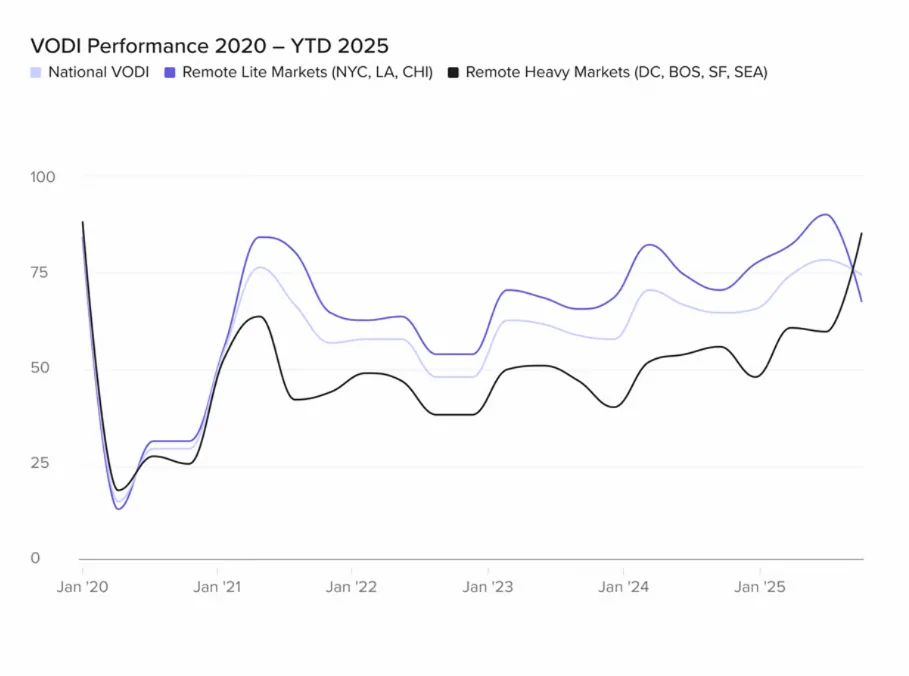

Office demand rose 16% year-over-year in Q3, but a 4% quarterly dip suggests the recovery remains uneven, per VTS.

Economic concerns are tempering optimism, including rising unemployment, which reached 4.3% in August. Ongoing trade policy uncertainty and the federal government shutdown that began October 1 are also weighing on sentiment. Additionally, planned layoffs from large employers like Amazon and UPS could further impact leasing activity.

What’s Next

While the sector appears to have turned a corner, industry leaders are approaching the recovery with cautious optimism. The economic environment remains uncertain, and workplace strategies continue to shift. As a result, a full office market recovery could take years, even as early signs turn more positive.