- US industrial vacancy rose slightly to 7.4%, marking the smallest quarterly increase since late 2022 and signaling a potential stabilization ahead.

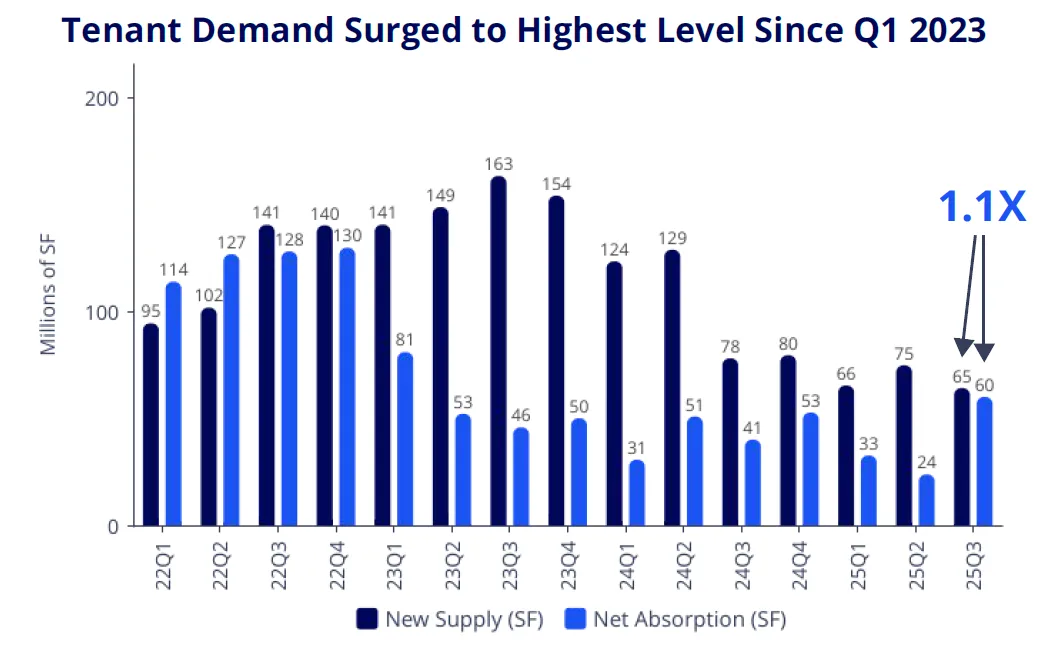

- Net absorption hit 60M SF, the strongest quarterly total since Q1 2023, reflecting rebounding tenant demand in core markets like Phoenix and Indianapolis.

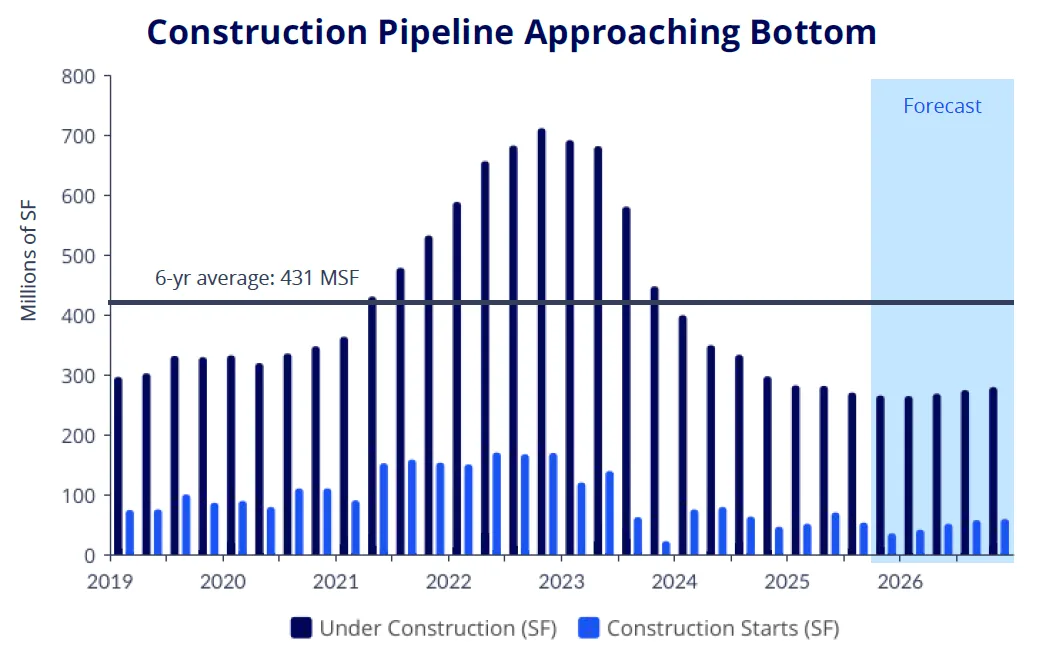

- New construction starts slowed significantly, with 270M SF underway—down 62% from the 2022 peak—pointing to a more balanced pipeline moving forward.

Vacancy Rate Plateaus After Rapid Rise

In Q3 2025, industrial vacancy rose 4 bps to 7.4%, nearing its cyclical peak, reports Colliers. That’s a stark contrast to previous quarters and reflects improving balance between supply and demand. The Northeast saw the sharpest year-over-year increase, climbing 146 bps to 8%, while the Midwest remains the tightest region at 5.5%.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Demand Surges Across Key Markets

Net absorption jumped to 60M SF, a 148% increase from last quarter and the highest quarterly total in over two years. Phoenix (7.9M SF) and Indianapolis (7.4M SF) led the way, thanks to big-box leases and build-to-suit projects. Other high-performing metros include New York City, Dallas-Fort Worth, and Greenville-Spartanburg.

New Construction Hits Multi-Year Low

New supply in Q3 totaled 65M SF, the lowest since Q1 2019, reflecting a significant pullback from the construction boom that peaked in 2022. With 270M SF currently under construction, activity is down more than 60% from its peak and expected to bottom out in the coming quarters.

Despite the slowdown, construction remains active in select metros. Dallas-Fort Worth tops the list with 31.3M SF underway, followed by Houston (21.8M SF) and Atlanta (13.5M SF), signaling that development is shifting toward demand-driven markets.

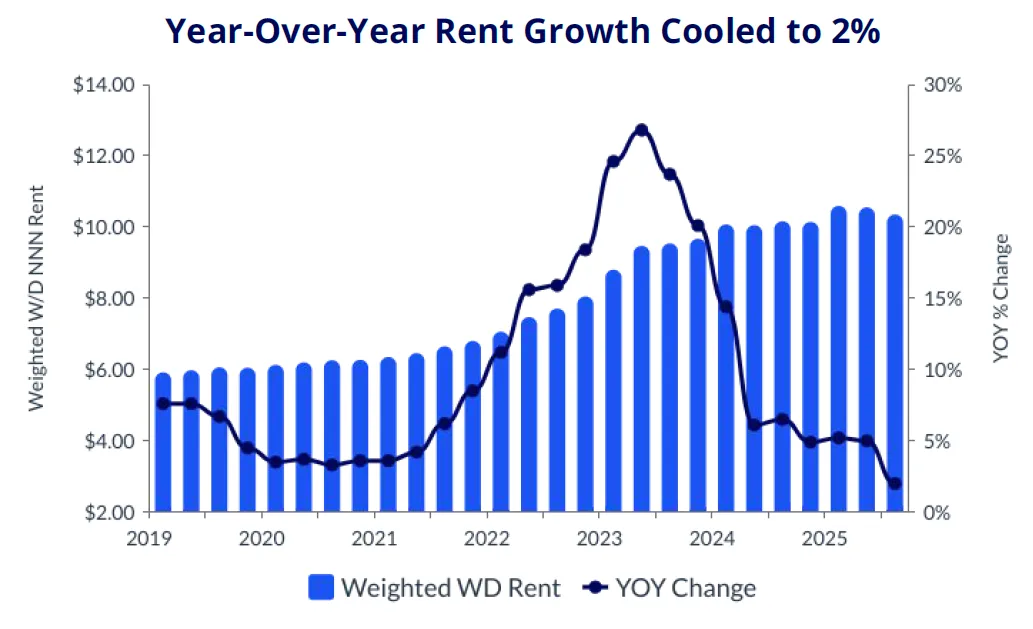

Rent Growth Moderates After Pandemic Surge

After double-digit annual growth in 2022 and 2023, warehouse/distribution asking rents rose just 2% YOY, reaching $10.35/SF nationally. Some high-cost markets like Greater Los Angeles ($14.87/SF) and New York City Metro ($16.78/SF) remain elevated. However, growth has cooled across the board, aligning with historical norms.

Why It Matters

The Q3 data points to a more mature phase in the current industrial cycle. As construction slows and vacancy stabilizes, tenants are regaining leverage while developers become more selective. Markets with sustained demand and tighter fundamentals are emerging as key growth hubs.

What’s Next

With fewer speculative builds and demand bouncing back, the industrial sector is poised for steadier performance in 2026. Watch for new project announcements in low-vacancy metros and continued rent normalization as the market shifts from post-pandemic highs to long-term fundamentals.