Institutions Trim Real Estate Allocations for First Time Since 2013

As infrastructure and private credit gain favor, some investors are rethinking—but not abandoning—their real estate strategies.

Good morning. Institutional investors are dialing back real estate allocations for the first time in over a decade, signaling a subtle shift in strategy. Rising competition from infrastructure and private credit is reshaping portfolio priorities.

Today’s issue is brought to you by 1031 Crowdfunding—helping investors access institutional-quality real estate through tax-advantaged vehicles.

🖥️ Webinar: Reserve your spot to uncover how AI is helping real estate teams work smarter, automate routine tasks, and stand out in their roles.

Market Snapshot

|

|

||||

|

|

*Data as of 10/09/2025 market close.

Allocation Shift

Institutions Trim Real Estate Allocations for First Time Since 2013

Real estate’s long-standing dominance in institutional portfolios is facing new headwinds from emerging asset classes.

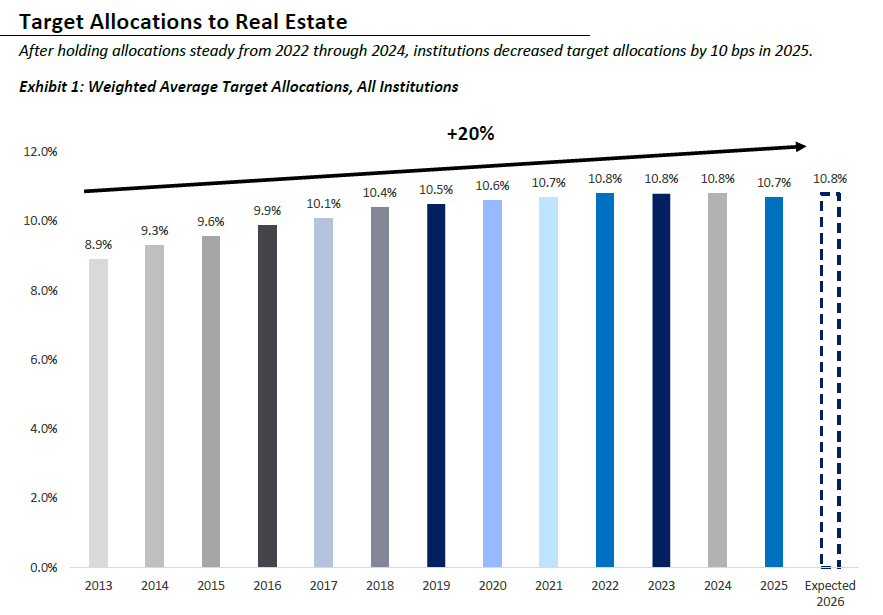

Allocations edge down: For the first time since the Real Estate Allocations Monitor began in 2013, institutional investors have reduced their average real estate target—from 10.8% (steady since 2022) to 10.7% in 2025. The modest 10 bps dip signals cooling sentiment amid continued market volatility.

Competition heats up: Private credit and infrastructure are drawing institutional dollars away from real estate. Infrastructure allocations hit 5.9% in 2025, up 80 basis points since 2023, driven by strong 2024 returns averaging 9.6%, and nearly a quarter of institutions plan to invest more.

Patterns vary: Real estate remains a core part of portfolios globally, but exposure levels differ. In APAC, a robust 92% of institutions maintain real estate holdings, followed by 81% in EMEA and 58% in the Americas. Globally, 68% of surveyed institutions still count property in their real asset mix.

Bucking the trend: While some funds pulled back, others doubled down. New York’s Common Retirement Fund raised its allocation from 9% to 12%, and Ohio’s teachers’ fund went from 8% to 10%. Meanwhile, Maryland, Oklahoma, and North Dakota trimmed targets by 1–2 points.

Bright skies ahead: Despite the dip, the outlook isn’t bearish. Projections suggest allocations will tick back up to 10.8% in 2026. The report underscores that real estate remains a stabilizing force in portfolios—especially as transaction volume and valuation clarity return.

➥ THE TAKEAWAY

Short-term setback: This year’s allocation dip reflects short-term caution, not a strategic retreat. As capital pivots temporarily toward high-yield alternatives like infrastructure, real estate’s role as a portfolio anchor remains intact—and poised to rebound.

TOGETHER WITH 1031 CROWDFUNDING

Now is the Time to Tap into Senior Housing Demand

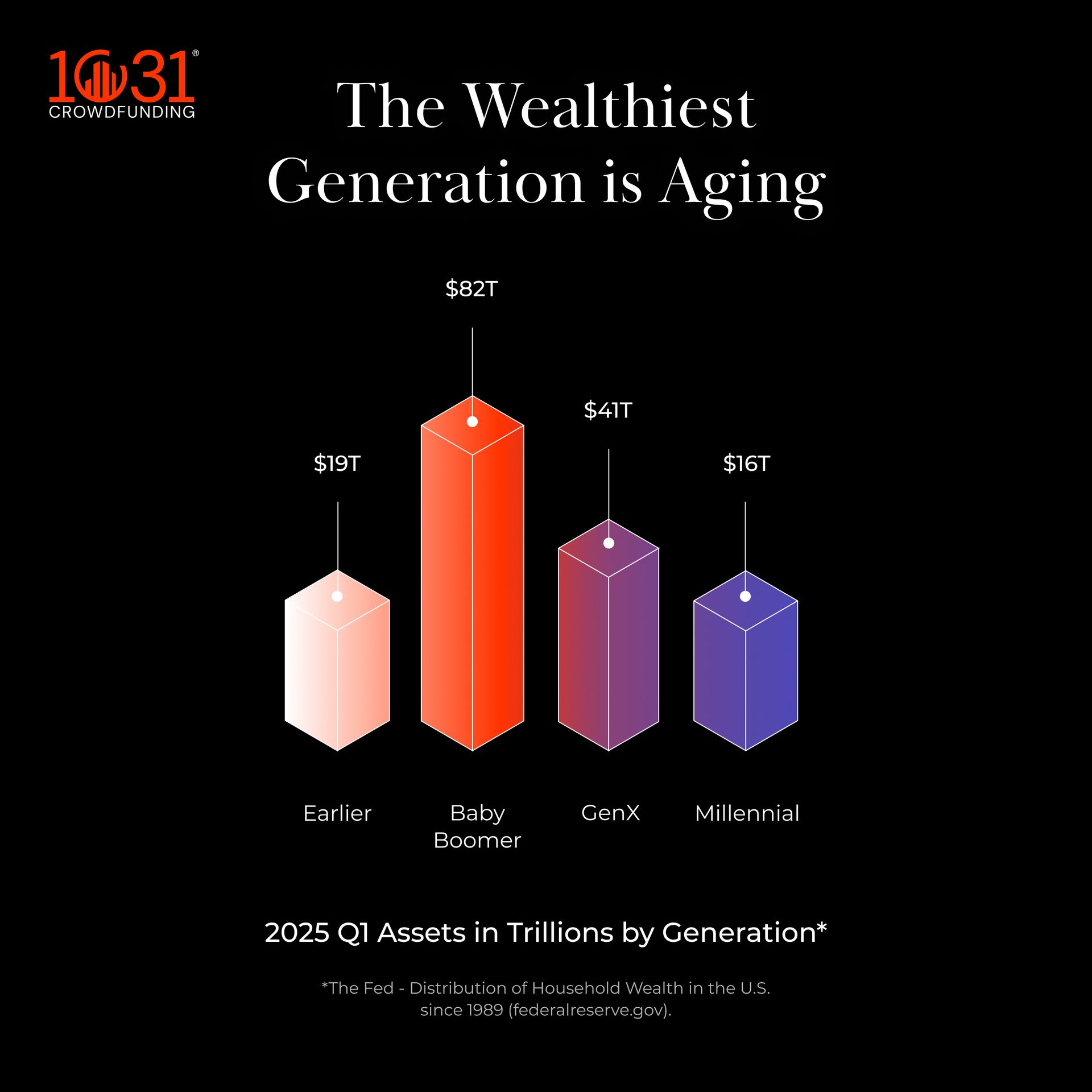

Senior housing has gained traction with institutional investors as the Baby Boomer generation, the wealthiest generation in U.S. history, ages into higher levels of care. This demographic shift is fueling unprecedented demand for assisted living and memory care communities.

Why invest in Senior Housing?

-

10,000 Americans turn 80 every day starting this year

-

+50% increase in demand for Americans ages 65+ who require nursing home care by 2030

-

Senior housing stands out as a sector built on necessity and backed by enduring demand

At 1031 Crowdfunding, we help investors access senior housing opportunities through tax-advantaged vehicles. We provide exposure to professionally managed portfolios while eliminating the challenges of direct property ownership.

Register for free to view our diverse selection of senior housing investments today.

*Disclaimer: Investments offered by Capulent LLC, member FINRA/SIPC. This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Stronger property businesses: Re-Leased’s new assessment shows landlords and owners where their property operations can improve, helping reduce risk and increase margins. Get tailored recommendations in minutes. Take the free quiz. (sponsored)

-

Capital conviction: EQT plans to invest $250B in U.S. assets over five years, doubling down despite market uncertainty.

-

Valuation gap: As private real estate appraisals lag market realities, REITs are gaining an edge by offering investors transparent, market-aligned valuations.

-

Required reading: Upgrade your bookshelf with this curated lineup of top CRE books on everything from investing and development to brokerage and proptech.

-

Staying hot: Sunbelt metros like Myrtle Beach, Houston, and Dallas are leading U.S. population growth through 2031.

-

Private debt: With banks pulling back from CRE lending, private capital is stepping in aggressively—offering faster deals, flexible terms, and tighter pricing.

-

Chain reaction: CRE is adopting blockchain to tokenize assets, automate contracts, and modernize financing with AI.

🏘️ MULTIFAMILY

-

Slow climb: On-time payments at mom-and-pop rentals ticked up to 83.5% in October, signaling slow but steady improvement.

-

High marks: Core Spaces and Wexford have broken ground on a 30-story, nearly 2,000-bed student housing tower in downtown Tempe.

-

Lease loyalty: Renewals are outpacing new leases in both volume and rent growth, helping operators preserve margins in a cooling market.

-

Patience is key: Institutional investors are optimistic as stabilizing rates and supply slowdowns open the door for disciplined, data-driven plays in select markets.

-

Care capital: Greystone’s $451.6M healthcare CLO shows rising investor confidence in senior housing, driven by tight supply and long-term care demand.

-

Apple aid: Backed by Apple and partners, a new $200M fund aims to fast-track 7,400 affordable homes in the Bay Area.

🏭 Industrial

-

Cleared for expansion: Embraer is investing $70M to expand maintenance ops at Fort Worth’s AllianceTexas, boosting U.S. capacity and positioning closer to key airline clients.

-

Defense deals: The Army is enlisting private equity to help fund $150B in infrastructure upgrades using underutilized assets.

-

Storage strategy: Truist Bank has issued a $100M refinance loan for a 19-asset industrial outdoor storage portfolio spanning seven states.

-

Industrial strength: CIP Real Estate and Almanac Realty Investors secured an $820M refinance for a 42-property shallow-bay industrial portfolio across six markets.

-

Digging deeper: Cleveland-Cliffs is exploring rare earth mining at Midwest sites while riding a rebound in auto steel demand.

🏬 RETAIL

-

Public pantry: Mayoral candidate Zohran Mamdani's plan for city-run grocery stores is sparking debate over food access and free-market fairness.

-

Going west: Five Below is launching eight Pacific Northwest stores in November as part of a 150-store expansion this year.

-

Space swap: Major store exits are opening prime Manhattan space, sparking a leasing surge from brands like IKEA and Pop Mart.

-

Design drive: Hyundai’s Genesis brand has opened its first U.S. design studio in El Segundo, tapping into L.A.’s booming tech corridor.

-

Back to basics: National Development bought the Watertown Mall for $100M, shelving prior lab conversion plans to keep it operating as a traditional shopping center.

🏢 OFFICE

-

Mixed bag: Miami’s office market is showing strength in low vacancies and steady construction, even as sales volume plunged nearly 18% year-over-year.

-

Concentrated growth: Office completions dropped 35% nationwide in H1 2025, but 10 metros accounted for more than half of the new supply.

-

Power move: JPMorgan Chase has opened its $4B HQ at 270 Park Avenue—$1B over budget and a bold bet on Midtown’s office future.

-

Hat trick: Harwood International faces its third office foreclosure this year, now risking its original Harwood No. 1 building in Uptown Dallas.

-

Going vertical: Developers are breaking ground on new Manhattan office towers as premium rents soar and major tenants lock in space early.

🏨 HOSPITALITY

-

Kelce capital: Travis Kelce is joining activist investor Jana Partners in a $200M push to revamp Six Flags.

-

Credit stability: Despite a dip in credit ratings, restaurant borrowers are still meeting debt payments, reflecting steady post-pandemic performance.

-

Hotel handoff: Ben-Josef Group has acquired the leasehold of Manhattan’s luxury Chatwal Hotel for $53.2M following debt default and a murky ownership trail.

A MESSAGE FROM SHARPLAUNCH

CRE Marketing Strategies Backed by Real Data

SharpLaunch’s 2025 Industry Report reveals what actually drives results: 92% of listing traffic comes from email and direct visits, and rich content boosts engagement by 57%.

If you’re not optimizing subject lines, property depth, and mobile experience—you’re behind.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

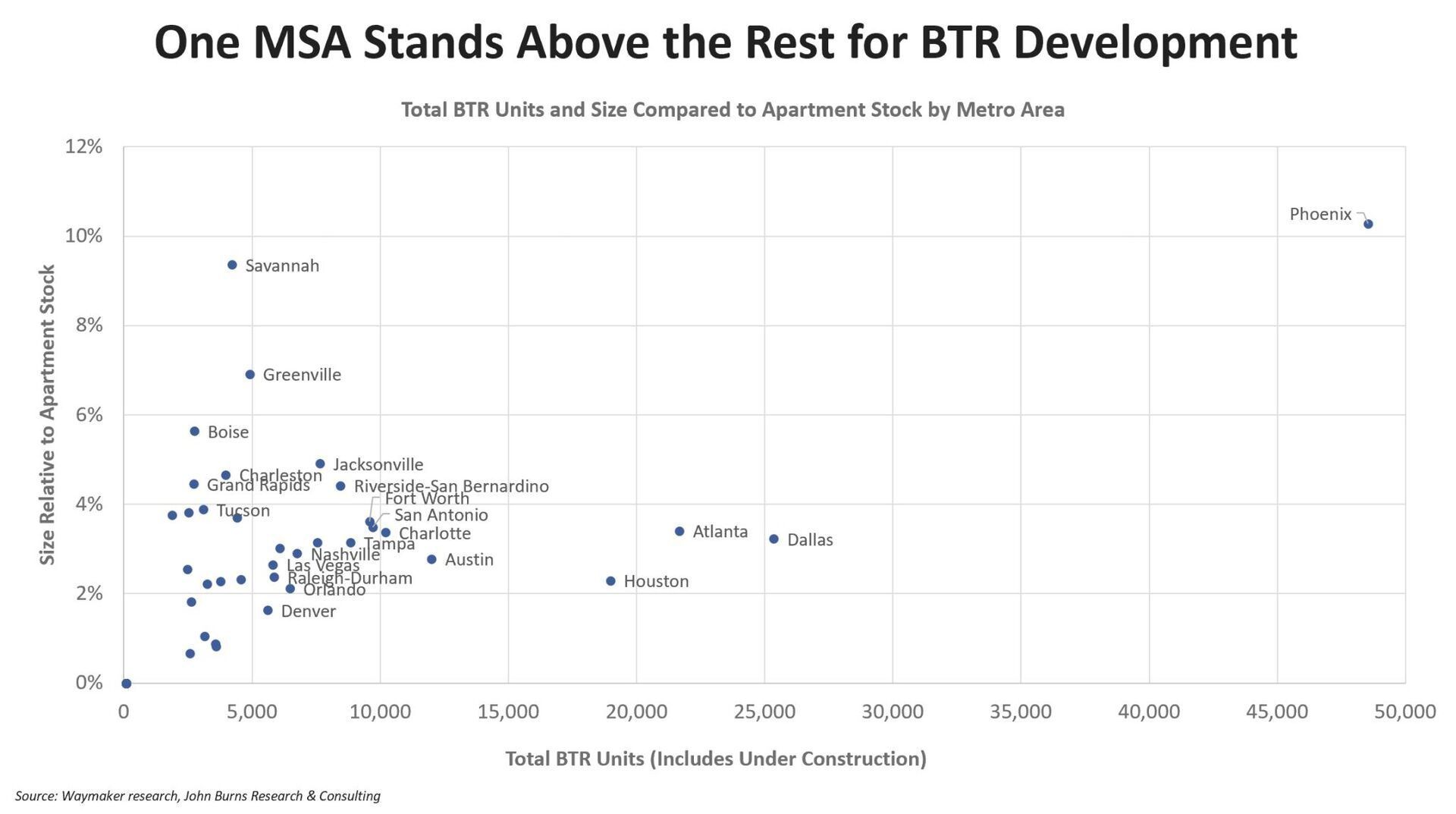

While Phoenix has already built a massive BTR presence—now exceeding 10% of its apartment stock—nearly all other major metros remain in the very early stages of BTR development, with inventory still under 4% despite strong long-term demographic demand.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |