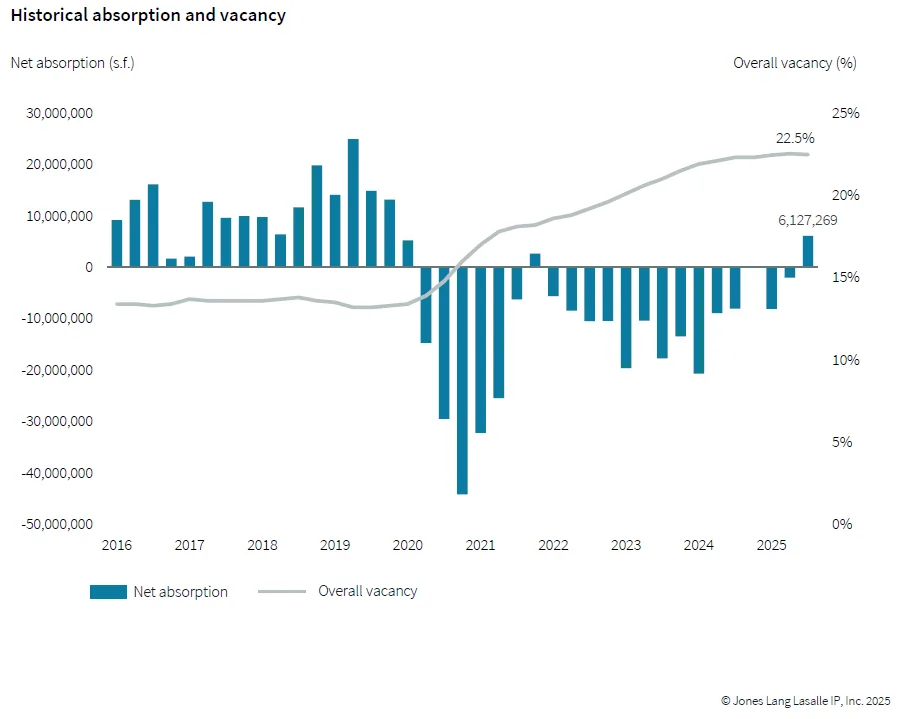

- Office vacancy declined nationally for the first time in over six years, falling to 22.5% in Q3 2025, according to JLL.rn

- New office supply is at historic lows, with only 6M SF under construction—down 84% from 2019.

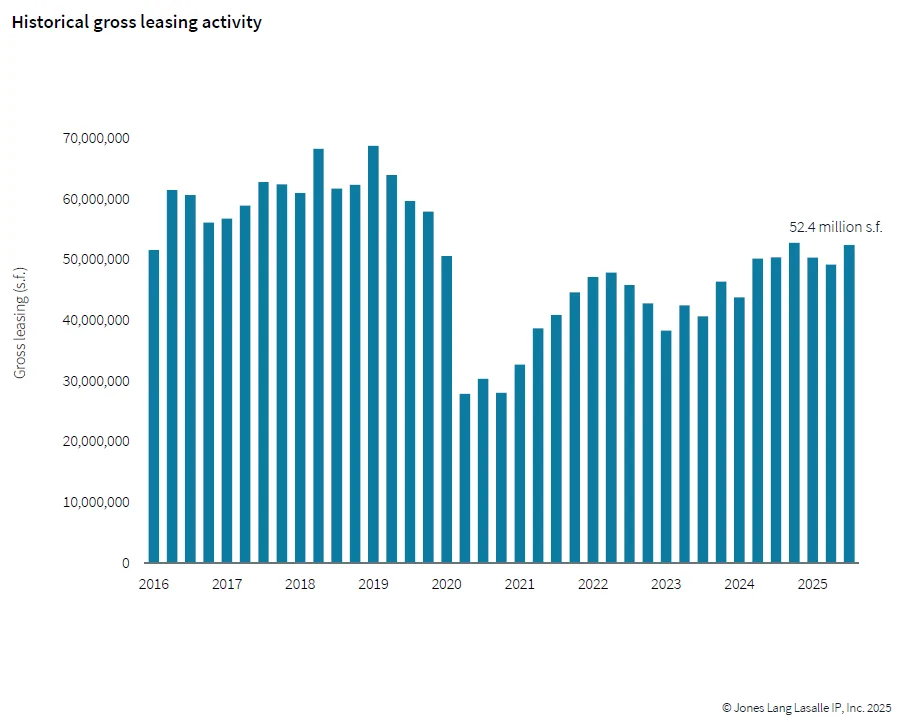

- Leasing activity is recovering, with 52.4M SF leased in Q3, just below post-pandemic highs and 82% of pre-pandemic levels.rn

The Big Picture

After years of rising vacancies and tenant downsizing, the US office sector is finally turning a corner, per Bisnow.

A new report by JLL shows national vacancy has declined for the first time since early 2019, dropping five basis points to 22.5% in Q3 2025.

The catalyst? A sharp slowdown in new construction paired with a rebound in leasing activity, particularly in high-demand urban hubs like Silicon Valley, San Francisco, and Chicago.

Demand Bounces Back

Large-scale leases are making a comeback. Gross leasing volume rose 6.5% quarter-over-quarter to 52.4M SF, with 18 markets now exceeding pre-pandemic leasing volumes. Major deals included Amazon’s 1M SF lease in Puget Sound and Goldman Sachs’ 700K SF commitment in Dallas-Fort Worth.

Although overall leasing is still below pre-pandemic norms, the market saw a significant rebound from the mid-year lull. net absorption hit 6.1M SF in Q3—more than double the previous post-pandemic high.

New Supply Slows to a Trickle

The development pipeline is shrinking fast. Only about 6M SF remains in active construction—compared to more than 50M SF in 2019. Some markets have less than 500,000 SF under construction, and national office inventory even declined in Q3 due to conversions and limited groundbreakings.

High-end Class A buildings are in especially short supply, with vacancy for space built since 2000 falling 104 basis points year-over-year.

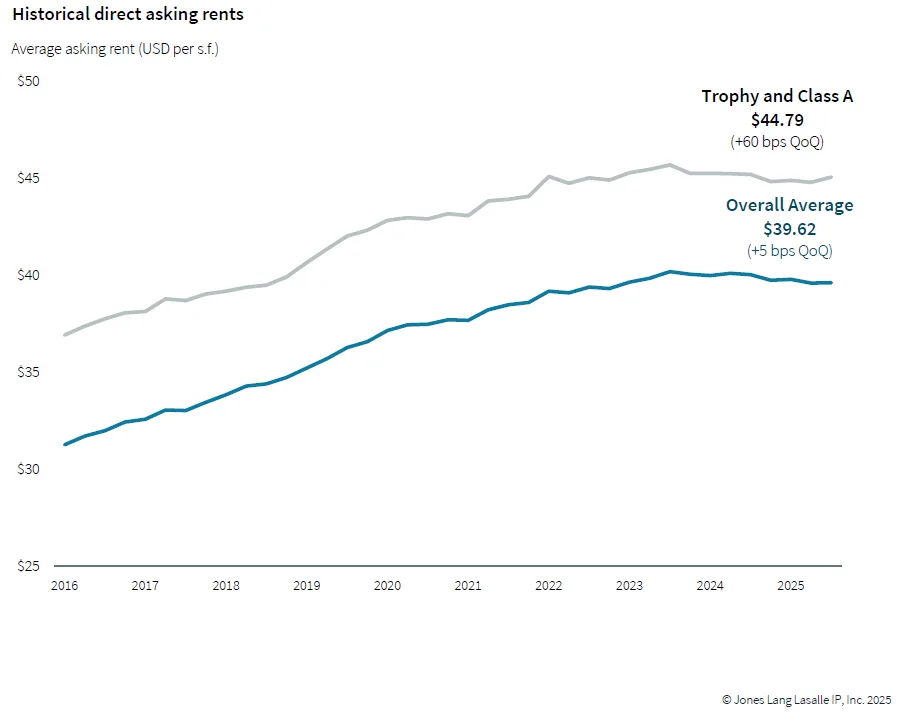

Rents Holding Steady—With Tier 2 Growth

While overall asking rents remained flat, scarcity in Tier 1 space is pushing demand—and pricing—into Tier 2 properties. In cities like Washington, DC, where top-tier space is nearly tapped out, rents in second-generation buildings rose 2.1% in the past year.

Back to the Office (For Real)

Corporate mandates are getting stricter. More than half of Fortune 100 employees now face five-day office requirements, and 97% of major employers have some form of weekly in-office expectation. The average is now four days per week.

A Landlord’s Market?

With record removals of office inventory, a muted development pipeline, and expanding tenant footprints, the market is shifting in landlords’ favor. Trophy-class space is commanding top dollar, and more tenants are competing for limited high-end options.

Barring a dramatic surge in construction, these trends could continue through at least 2027.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes