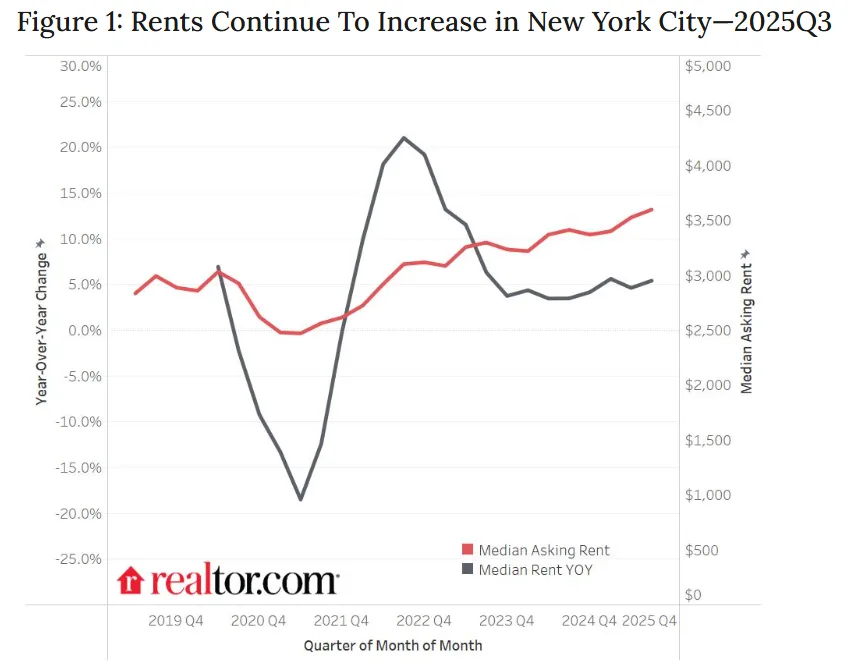

- New York City’s median rent reached $3,599 in Q3 2025, up 5.4% year-over-year, with smaller apartments (0–2 beds) driving the most growth.

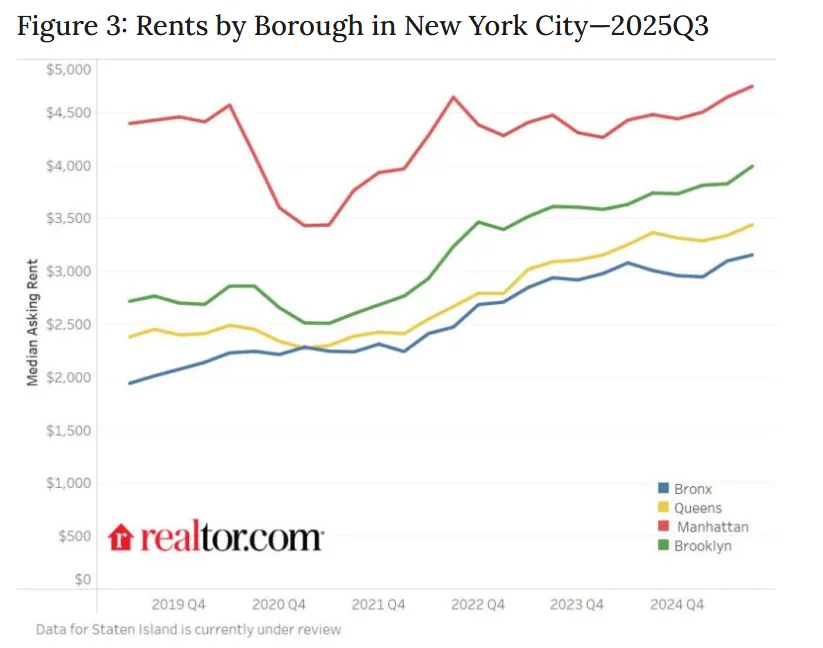

- Rents rose across all boroughs, led by Brooklyn (+6.8%), followed by Manhattan (+6.0%), the Bronx (+4.9%), and Queens (+2.2%).

- With a monthly rent budget equivalent to each borough’s median, NYC renters could afford homes valued between $400K and $690K in markets like Yonkers, NJ suburbs, and even some out-of-state cities.

- Top relocation destinations for NYC renters include Yonkers, Toms River, Philadelphia, and Orlando, all offering the potential for homeownership at current NYC rent levels.

NYC Rent Growth Continues In Q3 2025

New York City’s rental market continued to climb in Q3 2025, reports Realtor. The median asking rent reached $3,599, marking a $185 increase compared to the same quarter in 2024. Rents dropped during the pandemic, but have since rebounded. They are now more than 20% above pre-COVID levels. As a result, many renters are being priced out or rethinking their long-term plans in the city.

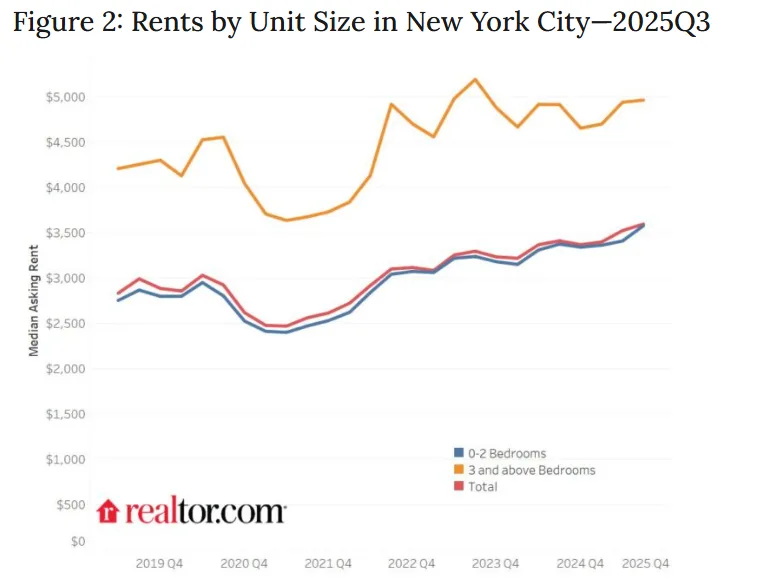

Smaller units saw the most notable gains. Apartments with 0 to 2 bedrooms rose 6.0% year-over-year to $3,581—an increase of $203—while larger 3+ bedroom units saw a smaller gain of just 1.0%, rising to $4,968.

All Boroughs See Rent Increases

Each of the city’s boroughs experienced rent growth. Brooklyn posted the sharpest annual increase, with its median rent climbing 6.8% to $3,992. Manhattan followed with a 6.0% rise, pushing the median to $4,747. The Bronx saw rents grow 4.9% year-over-year to $3,155, while Queens registered the most modest gain of 2.2%, reaching $3,439.

To afford the median rent in these boroughs under the 30% income rule, renters need a high annual household income. In Brooklyn, that means about $159,680. In Manhattan, it jumps to $189,880. Renters in the Bronx would need around $126,204, while those in Queens would need $137,560.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Where NYC Budgets Stretch Further

So, what could a renter afford if they redirected that monthly rent into a mortgage payment?

Assuming a 20% down payment, a 30-year fixed mortgage rate of 6.35%, and factoring in taxes and insurance, NYC renters could afford homes priced between roughly $400K and $690K. The exact amount depends on their borough and the market they’re targeting.

Among nearby destinations, Yonkers, NY stands out as a strong option for renters from all four boroughs. Its median home listing price is $421K. A renter paying Bronx-level rent ($3,155) could afford a home around $442K. Someone paying Manhattan-level rent ($4,747) could afford up to $666K in Yonkers.

In Toms River, NJ, the median home price is $455K. Renters from the Bronx could afford a home around $437K, while those with a Manhattan-level budget could go up to about $657K. Brick and Freehold, NJ have higher median home prices at $546K and $614K, respectively. Even so, they remain affordable for renters from Brooklyn, Manhattan, and Queens.

In Jersey City, the median home price is $685K. Renters from the Bronx could afford around $405K, which is well below that amount. Manhattan renters could afford up to $609,600, but that’s still short of the typical listing price.

National Markets With Potential

For renters open to relocating farther, many US markets offer better affordability. Philadelphia, PA, for example, had a median listing price of just $286K in Q3 2025. That’s well below what NYC renters could afford—even Bronx renters could stretch to homes priced around $451K, and Manhattan renters could go up to $678,500.

Pittsburgh, PA also offered significant value, with a median price of $276K. Renters from Brooklyn and Queens could afford homes in the $550K range, while Manhattan renters could reach up to $653,700.

In the South, Orlando, FL and Myrtle Beach, SC provide warm climates and manageable prices. With Orlando’s median home listing at $391K, Bronx renters could afford roughly $429,500 in home value, while Manhattan renters could go up to $646,300. In Myrtle Beach, the median home price is just $289K. Renters from all NYC boroughs could afford well above that amount. For example, Manhattan renters could stretch their budget to nearly $695K.

Only Naples, FL proved out of reach for most NYC renters. With a median listing price of $694K and elevated insurance costs, even a Manhattan-level rent budget translates to just $613,500—insufficient to afford a typical home there.

Why It Matters

With affordability tightening across NYC, these numbers offer a dose of reality—and opportunity. For renters paying $3K–$4,700 per month, the path to homeownership might simply lie outside city limits.

Whether it’s nearby cities like Yonkers and Jersey City or out-of-state options like Philadelphia and Orlando, NYC rent-level budgets can now cover mortgage payments. In many growing markets, renters have the financial power to buy instead of lease.

What’s Next

As election season adds uncertainty to local housing policies, many NYC renters may increasingly explore alternatives. Given that rents are now over 20% higher than pre-pandemic levels, the appeal of buying elsewhere continues to grow.

Keep an eye on out-migration trends—especially toward more affordable metro areas. And if rent keeps climbing into 2026, expect more renters to become buyers—just not in New York City.