- The multifamily sector is showing renewed strength as housing supply stabilizes and valuations return to growth, reversing a two-year decline.

- Recent federal interest rate cuts and legislative incentives — including restored bonus depreciation and expanded tax credits — are fueling renewed investor interest.

- While broader macroeconomic uncertainty lingers, improved financing conditions and capital availability point to a rebound in deal flow through 2026.

Turning The Corner

After grappling with a significant recalibration, the US multifamily real estate sector is entering the final stretch of 2025 with renewed momentum. Investor confidence is returning, as reported by Arbor. A mix of monetary policy easing, improved asset pricing, and policy-driven tailwinds is fueling the rebound. These factors are also enhancing after-tax returns, making multifamily investments more attractive.

The Federal Reserve’s September rate cut marked the first in its current cycle. Additional reductions are expected, totaling 50 basis points by year-end. Another 75 basis points in cuts are projected for 2026. These cuts are already having a noticeable impact, reviving transaction activity previously stalled by high capital costs.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Stabilizing Fundamentals

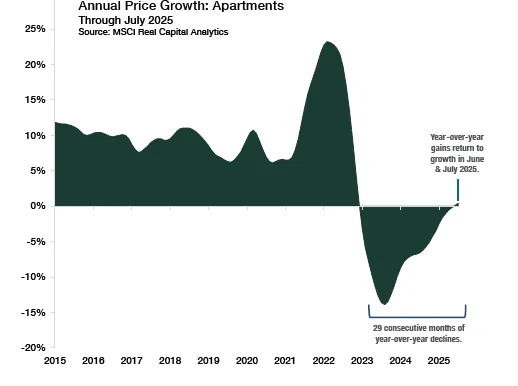

Multifamily valuations had declined roughly 19% since 2022, or over 26% when adjusted for inflation. By mid-2025, they finally returned to positive territory. This marked the end of 29 consecutive months of year-over-year losses.

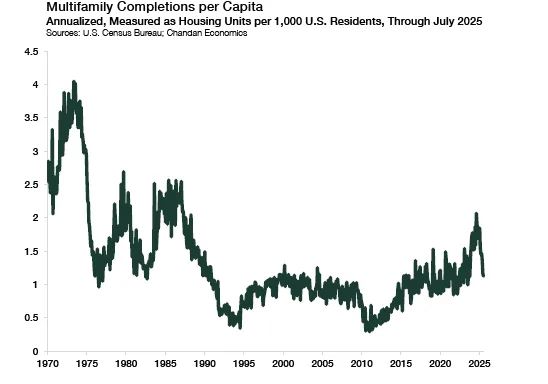

Key to this turnaround is the easing of oversupply. As of July, the rate of new multifamily completions dropped to 1.1 units per 1K US residents — nearly half the pace seen a year prior and now aligned with pre-pandemic averages. This slowdown in deliveries, combined with steady absorption, has pushed rents upward in 70% of US metro markets.

Policy Boosts And Investor Sentiment

Federal incentives are further fueling optimism. The recently passed One Big Beautiful Bill Act restored 100% bonus depreciation. It also expanded key tax credits, including the 9% Low-Income Housing Tax Credit. Additionally, it made the Opportunity Zone Program permanent. These measures enhance the viability of deals that previously may not have penciled.

Investor sentiment is catching up. According to the Real Estate Roundtable, more industry leaders now expect capital availability and property pricing to improve over the next 12 months.

What’s Next

Despite lingering concerns around tariffs, labor market softness, and weak consumer spending, multifamily’s recovery looks increasingly durable. Interest rates are falling, capital markets are loosening, and construction activity is becoming more balanced. Together, these trends set the stage for a healthy uptick in deal volume through 2026.

The sector’s long-term fundamentals are once again aligning — and the investment window may be opening wider than it has in years.