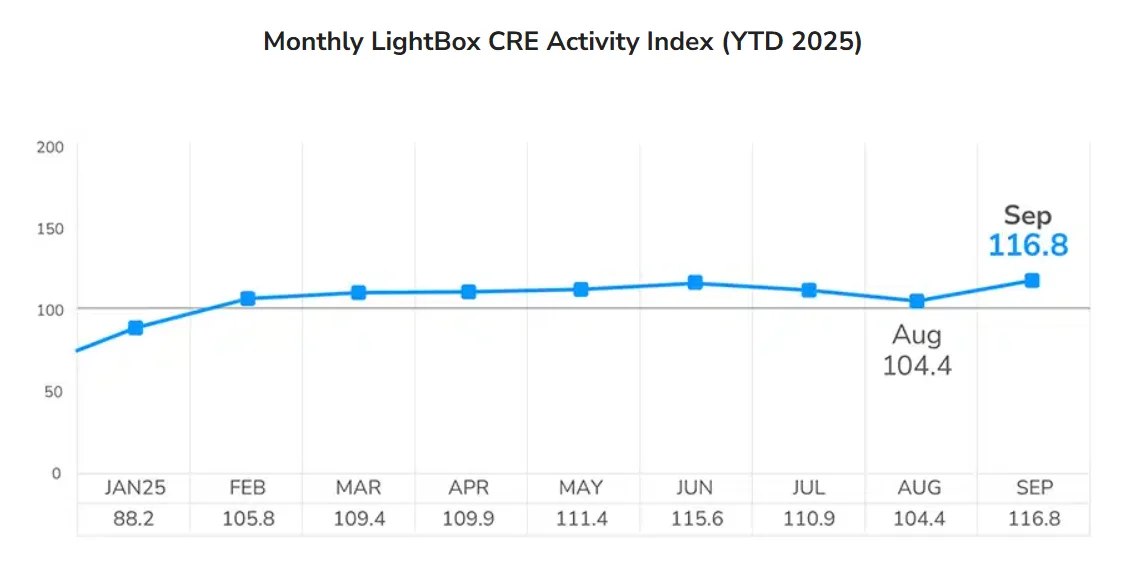

- The LightBox CRE Activity Index rose to 116.8 in September — a 2025 high — driven by a late-quarter surge in listings and steady lending-related activity.

- A 25-basis-point Fed rate cut in September is improving risk appetite, with expectations of further cuts boosting sentiment.

- Q4 deal flow is accelerating, particularly in high-demand segments like industrial, necessity retail, and selective multifamily, though underwriting remains cautious.

September Momentum Reverses Summer Lull

After a mild seasonal slowdown in August, commercial real estate activity snapped back in September, reports LightBox. The LightBox CRE Activity Index climbed to 116.8, the highest level of 2025 so far. The rebound was powered by a 25% month-over-month surge in property listings, supported by resilient levels of Phase I ESA activity and a modest uptick in lender-driven appraisals.

“September’s rebound was both expected and encouraging… The combination of improved liquidity and rising confidence suggests that the August slowdown was a short-term lull, not a trend reversal.”

— Manus Clancy, Head of Data Strategy, LightBox

A Fed Tailwind

September’s 25-basis-point rate cut by the Federal Reserve played a critical role in market sentiment, improving the risk calculus for lenders and buyers alike. More rate cuts are anticipated later this year. As a result, stakeholders are showing renewed appetite for deals. Interest is strongest in segments with durable demand and reliable cash flow.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Q4 Outlook: Selective Optimism

The CRE market is entering Q4 with cautious optimism. Investors are focusing on asset classes like industrial, necessity retail, and stabilized multifamily, while keeping underwriting conservative due to lingering macroeconomic uncertainties.

- Dry powder remains ample, and financing windows are open.

- New loan origination is showing signs of life, supported by narrowing mortgage spreads and improved CMBS activity.

- According to Deloitte, nearly 75% of global investors plan to increase CRE allocations over the next 12–18 months.

Risks To Watch

While momentum is building, potential disruptors remain. These include:

- Weak corporate earnings impacting NOI and leasing demand

- Inflationary pressure from tariff pass-through

- A prolonged government shutdown

- Declining business and consumer sentiment

Still, unless major shocks emerge, CRE appears positioned for a strong and steady close to 2025, with positive signs pointing toward a broader recovery in 2026.