- US rents declined 2.1% year-over-year in September 2025, marking the 26th consecutive month of annual rent drops.

- Rental affordability improved nationwide, with the typical rent-to-income ratio falling to 23.4% from 24.9% a year ago.

- Miami remained the least affordable market, while Austin became the most affordable, with renters spending just 16.5% of income on rent.

- Southern and Western metros led in affordability gains, driven by growing rental supply and moderating demand.

National Trends: Rent Declines Continue

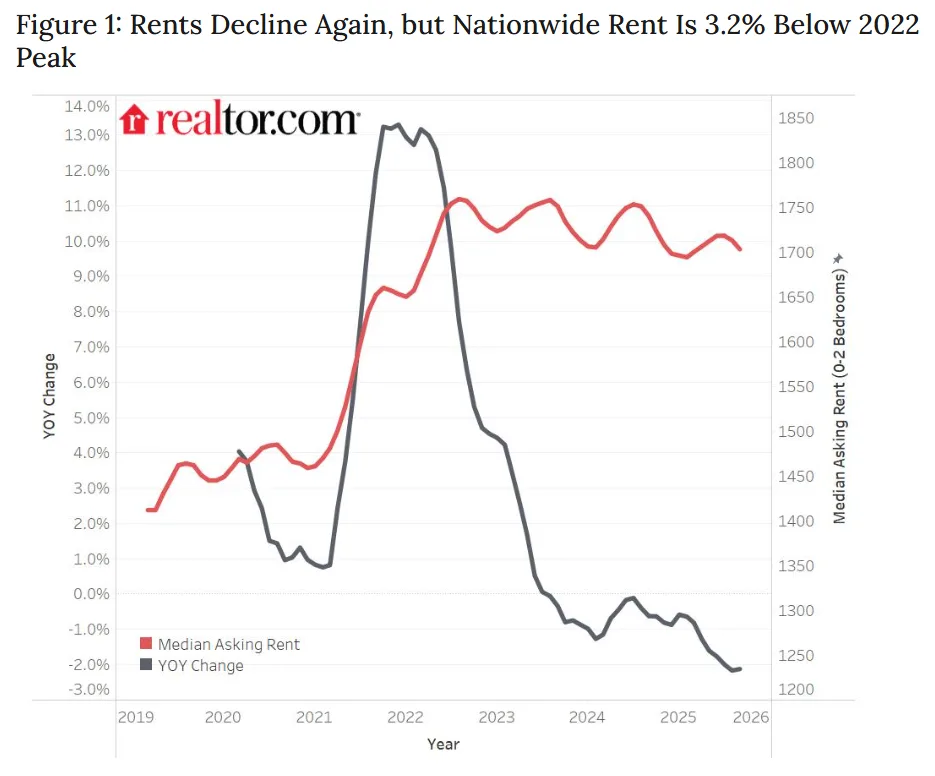

September marked the 26th straight month of year-over-year rent declines for 0–2 bedroom units, reports Realtor. The national median rent stood at $1,703—down $36 from a year ago and $56 below its August 2022 peak. Despite the drop, rent levels remain $241 (16.5%) higher than they were pre-pandemic in 2019.

This is the second consecutive month of month-over-month declines in 2025, signaling the start of the typical fall slowdown in the rental market. So far this year, rents have increased just 0.4% year-to-date—well below the 1.9% growth recorded over the same period in 2024.

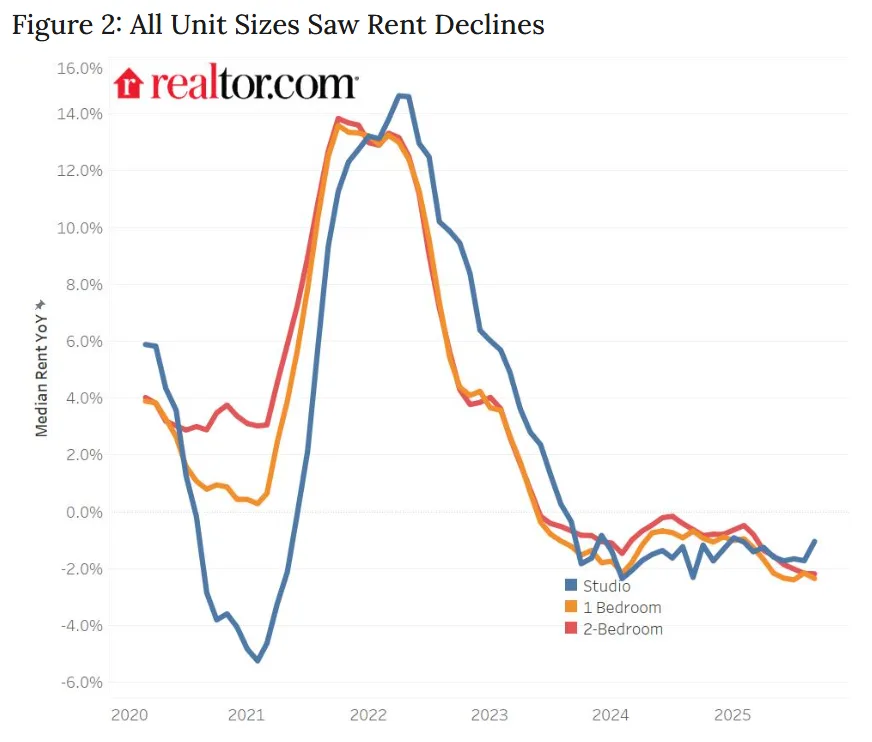

Rents Declined Across All Unit Sizes

All rental unit sizes experienced price declines in September 2025:

- Studios had a median rent of $1,426, down 1.0% year-over-year and 3.7% below their October 2022 peak. Still, studio rents are 12.5% higher than in 2019.

- One-bedroom units rented for a median of $1,582, a 2.3% annual drop and 4.7% below the August 2022 peak. Compared to 2019, rents are up 14.6%.

- Two-bedroom units saw the steepest long-term growth, with a median rent of $1,885—down 2.2% year-over-year but 18.3% higher than six years ago.

Rental Affordability Is Improving

Nationwide, renters spent 23.4% of the typical household income on rent in September 2025, down from 24.9% in September 2024. This marks a notable improvement in rental affordability, helped by modest rent declines and income growth.

However, affordability still varies significantly by metro area. Five of the top 50 US metros had renters spending more than 30% of their income on rent—officially considered “cost-burdened” by HUD standards.

Miami remained the least affordable market, with the typical renter household spending 37.1% of its income on rent. That’s still an improvement from 40.4% a year ago. However, rents in Miami remain high—roughly 1.2 times more than what’s considered affordable based on local incomes.

Los Angeles followed closely, with renters allocating 37.0% of their income to rent, while in New York, the share was 36.7%. Boston and San Diego rounded out the top five. Renters in both cities spent over 31% of their income on housing, despite year-over-year improvements.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Austin Is Now the Most Affordable Rental Market

Austin, TX overtook Oklahoma City as the most affordable major rental market in the country. In September 2025, Austin renters with a typical household income spent just 16.5% of their income on rent—down from 19.3% a year earlier.

This means Austin renters are paying only about 55% of the maximum affordable rent for their income. As a result, they have significantly more financial breathing room.

Other highly affordable rental markets included Oklahoma City, OK (16.9%), Raleigh, NC (18.0%), Columbus, OH (18.1%), and Minneapolis, MN (18.7%). These metros combine lower rents with relatively strong income levels.

Southern And Western Markets Lead In Affordability Gains

Markets in the South and West showed the biggest improvements in rental affordability. This was largely driven by an increase in new rental supply, which has helped to bring down prices. According to Realtor.com, the South is expected to see the largest increase in rental housing stock in 2025, with 1.5% growth by fall.

Jacksonville, FL led the nation in improved affordability, with renters now spending 21.5% of income on rent—down 3.5 percentage points from 2024. San Diego, CA saw a similar drop, falling 3.4 percentage points to a 31.5% rent-to-income ratio.

Other major improvements were recorded in Miami, FL (-3.3 percentage points), Denver, CO (-3.2), Austin, TX (-2.8), and Phoenix, AZ (-2.7). These shifts suggest the effects of new rental inventory are starting to materialize in many high-demand metros.

One Market Bucked The Trend

Kansas City, MO-KS stood out as the only metro among the top 50 to see worsening affordability. Renters there spent 20.9% of their income on rent in September 2025—up 0.6 percentage points from a year earlier. While still under the 30% threshold, the increase points to potential future affordability pressures in the market.

Bottom Line

Rents continued to cool nationwide in September 2025, providing relief to renters in nearly all major US markets. The combination of softening demand and rising supply has pushed rents down for over two years straight. While cost burdens remain high in places like Miami, Los Angeles, and New York, affordability has improved notably—even in these expensive markets.

If these trends continue, 2025 may close out as one of the most renter-friendly years in recent memory.