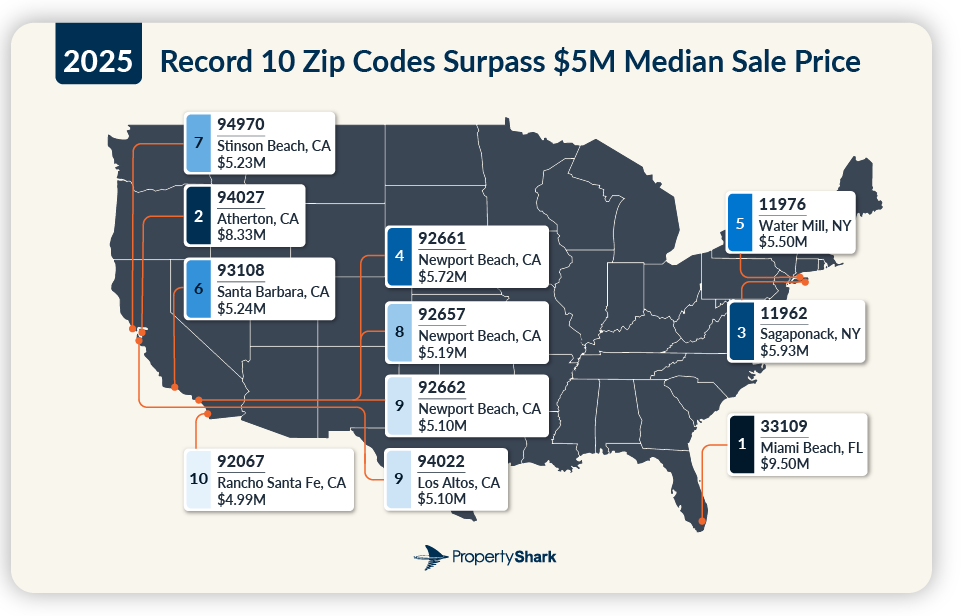

- Miami Beach’s Fisher Island (33109) ranked as the most expensive US zip code in 2025 with a $9.5M median sale price — a 65% year-over-year surge.

- Atherton, CA (94027) dropped to #2, while Sagaponack, NY (11962) retained the top spot in New York at #3 with a $5.9M median.

- California remained dominant, with 61 of the top 100 zips and eight of the top 10.

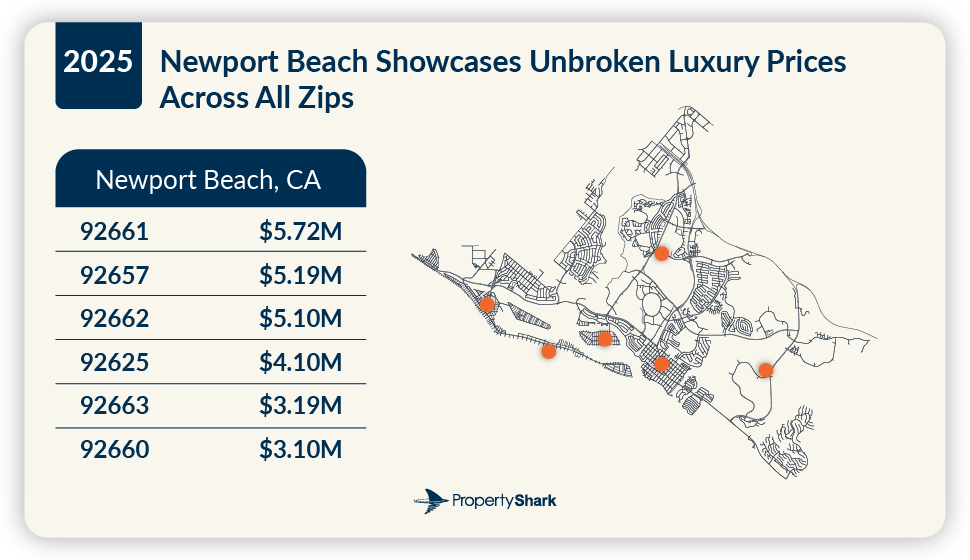

- Newport Beach became the most expensive city overall, with all six of its zips ranked in the top 100.

Florida Moves to the Top

Fisher Island’s 33109 zip code soared to the top of the national rankings with a record $9.5M median home sale price, per PropertyShark’s report.

This marks Florida’s first #1 finish and a significant 65% price increase from 2024, driven by high-end condo sales. The most expensive deal on the private island reached $23.7M. It’s the first time in the report’s 10-year history that a zip outside California or New York has taken the top spot.

California Still Dominates, But…

While Atherton (94027) fell to #2 with an $8.33M median, California still claims the majority of the list with 61 of the 100 priciest zips. Newport Beach emerged as the country’s most expensive city overall, placing all six of its residential zip codes in the top 100 — including three in the top 10. Newport’s 92661, 92657, and 92662 all posted medians above $5M.

Los Angeles followed closely, tying with Greenwich, CT as the second-most represented city with four zips each. However, Greater LA’s footprint has shifted, with some areas like Pacific Palisades seeing declines due to early-2025 wildfires.

Bay Area Retreats as San Jose Holds Ground

Although the Bay Area still contributed 32 zips — the most of any metro — its influence has waned significantly from its pre-pandemic peak of 55 in 2019. San Francisco now has only one zip in the top 100 (94123), while suburban areas like Los Altos (94022 and 94024) continue to see gains.

New York’s Slide

New York’s presence was the weakest in a decade, with only 15 zips making the list — and just three from NYC. TriBeCa’s 10013 led the city with a $3.7M median, but the state’s luxury market was anchored once again by the Hamptons, which contributed nine Suffolk County zips, including Sagaponack (#3) and Water Mill (#5).

Meanwhile, Connecticut overtook Massachusetts in the New England rankings for the first time, led by four Greenwich zips. Notably, New Hampshire’s New Castle surpassed Boston’s Back Bay as the region’s priciest zip.

Luxury Grows Beyond the Coasts

Florida wasn’t alone in making gains. Georgia’s Sea Island (31561) reached #15 with a $4.2M median, while South Carolina’s Sullivan’s Island (29482) and Maryland’s Gibson Island (21056) also posted medians above $3M.

In the West, Paradise Valley, Arizona (85253) hit a record $3.5M median, while two Lake Tahoe communities in Nevada made rare appearances. Washington’s Medina (98039) held steady above $4M, driven by continued demand from tech executives.

Why It Matters

This year’s reshuffling highlights a broader trend: the decentralization of luxury housing, with buyers increasingly seeking privacy, space, and tax-friendly climates outside traditional strongholds. Branded residences, limited supply, and migration patterns continue to fuel price growth in affluent enclaves from Florida to Connecticut and Arizona to Hawaii.

What’s Next

As the ultra-luxury market evolves, expect further geographic diversification. The number of zips with median prices above $5M doubled from last year, signaling deepening demand at the high end. With Florida and the South Atlantic region on the rise, the luxury housing narrative is no longer solely a California-New York story.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes