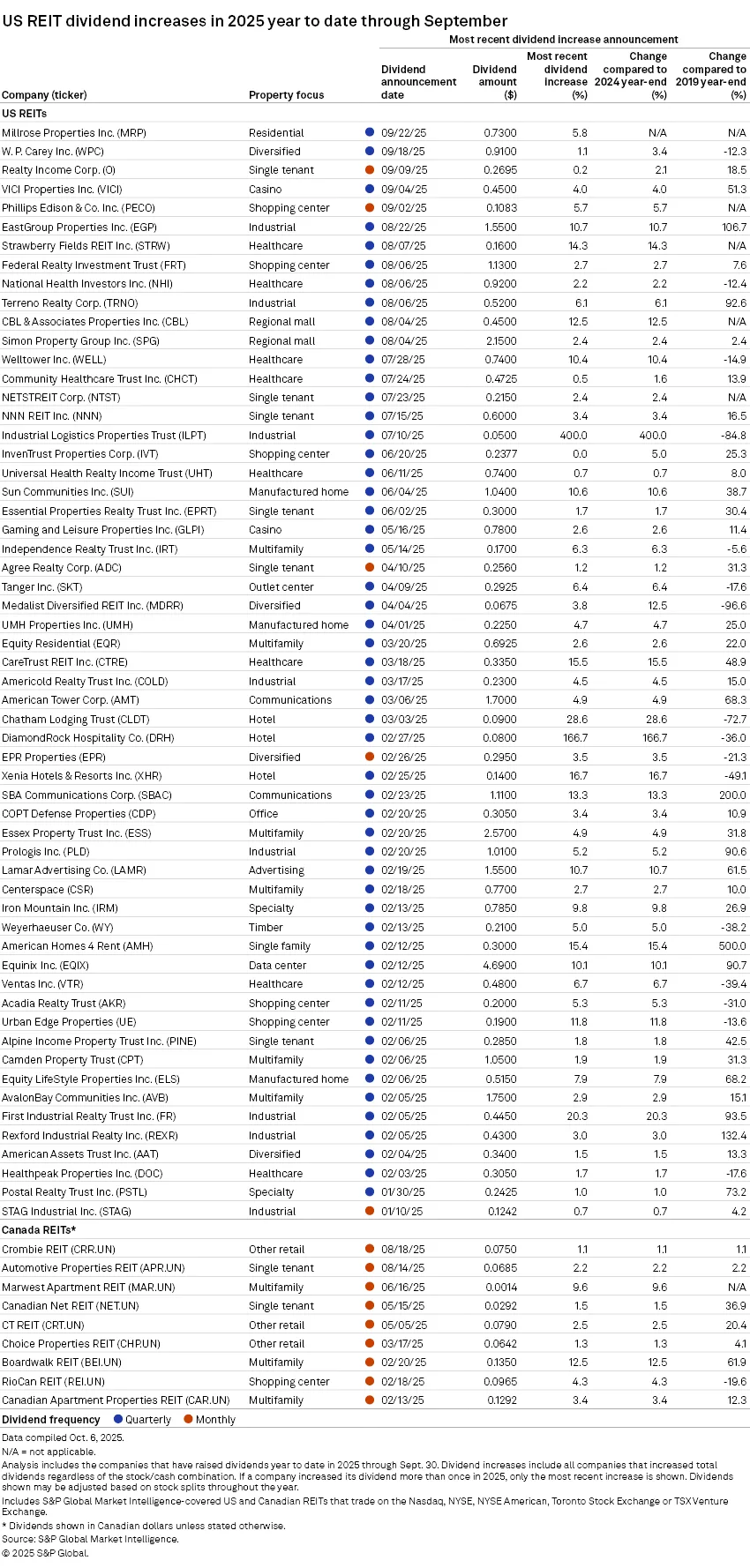

- Five US-listed REITs increased their per-share dividends in September, bringing the 2024 total to 58 REITs, or nearly 37% of the sector.

- Residential REIT Millrose Properties led the group with a 5.8% hike, while diversified REIT W. P. Carey and gaming-focused Vici Properties also boosted payouts.

- Dividend growth has been most concentrated among industrial REITs, where more than 60% of the sector raised payouts year-to-date.

Dividend Momentum Continues

US equity REITs continued to return capital to shareholders in September, with five companies announcing per-share dividend increases, according to S&P Global Market Intelligence.

That brings the number of US REITs that have raised dividends this year to 58 out of the roughly 157 tracked by the firm.

Who Raised and By How Much

Among the notable increases:

- Millrose Properties Inc. (Residential): Announced a new quarterly dividend of $0.73, up 5.8% from its prior payout.

- W. P. Carey Inc. (Diversified): Boosted its quarterly dividend 1.1% to $0.91 per share.

- Vici Properties Inc. (Gaming): Raised its dividend by 4% to $0.45 per share.

- Realty Income Corp. (Net Lease): Increased its monthly dividend by 0.2%.

- Phillips Edison & Co. Inc. (Retail): Lifted its monthly payout 5.7%.

No dividend increases were reported among Canadian REITs in September.

Sector Breakdown

Dividend growth has not been evenly spread. So far in 2024:

- Industrial REITs lead the charge, with 61.5% of the sector increasing payouts.

- Residential and retail REITs followed as the next most active sectors for dividend growth.

- In Canada, just 20.5% of REITs raised dividends year-to-date, with no changes in September.

Why It Matters

Dividend hikes are a key signal of financial health and confidence, particularly for income-focused REIT investors. With interest rate uncertainty still lingering, the ongoing dividend momentum suggests many US REITs are benefiting from strong property performance and resilient cash flows.

What to Watch

As Q4 earnings season approaches, investors will be closely watching for continued dividend hikes, especially in outperforming sectors like industrial and data center REITs. The pace of increases will also help gauge broader market sentiment amid rising operational costs and macroeconomic volatility.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes