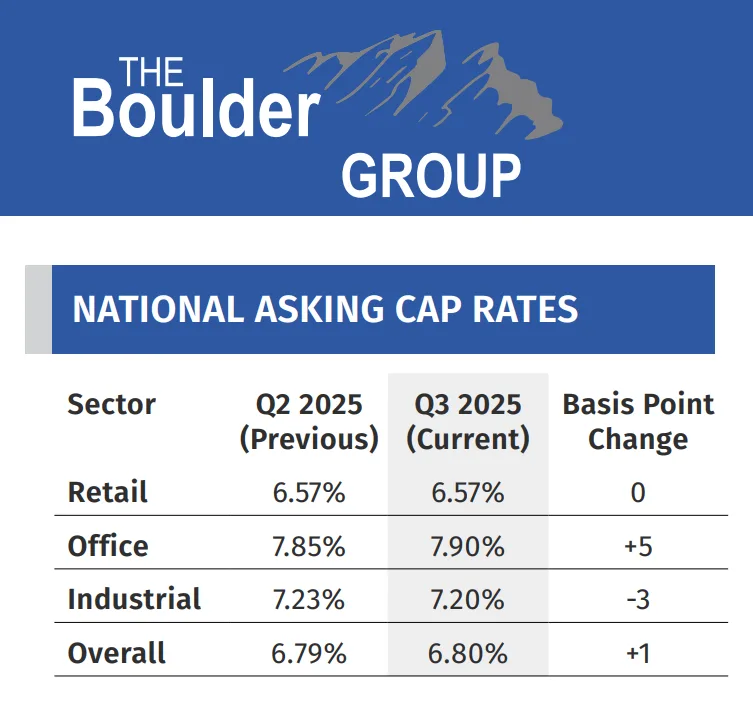

- Cap rates in net lease assets remained largely flat, with retail at 6.57%, industrial compressing slightly to 7.20%, and office rising to 7.90%.

- Inventory levels shifted marginally, with overall supply down 0.5%—a sign of stabilization amid capital market adjustments.

- Investor demand remains resilient, driven by institutional capital, even as borrowing costs continue to influence deal activity.

Market Stays Balanced

The net lease sector continues to show resilience as cap rates across most property types held steady in the third quarter, per GlobeSt.

The national average cap rate in the single-tenant space ticked up just one basis point to 6.80%, underscoring the market’s ongoing stability. Retail stayed flat at 6.57%, office rose to 7.90% (+5 bps), and industrial saw a slight compression to 7.20% (-3 bps).

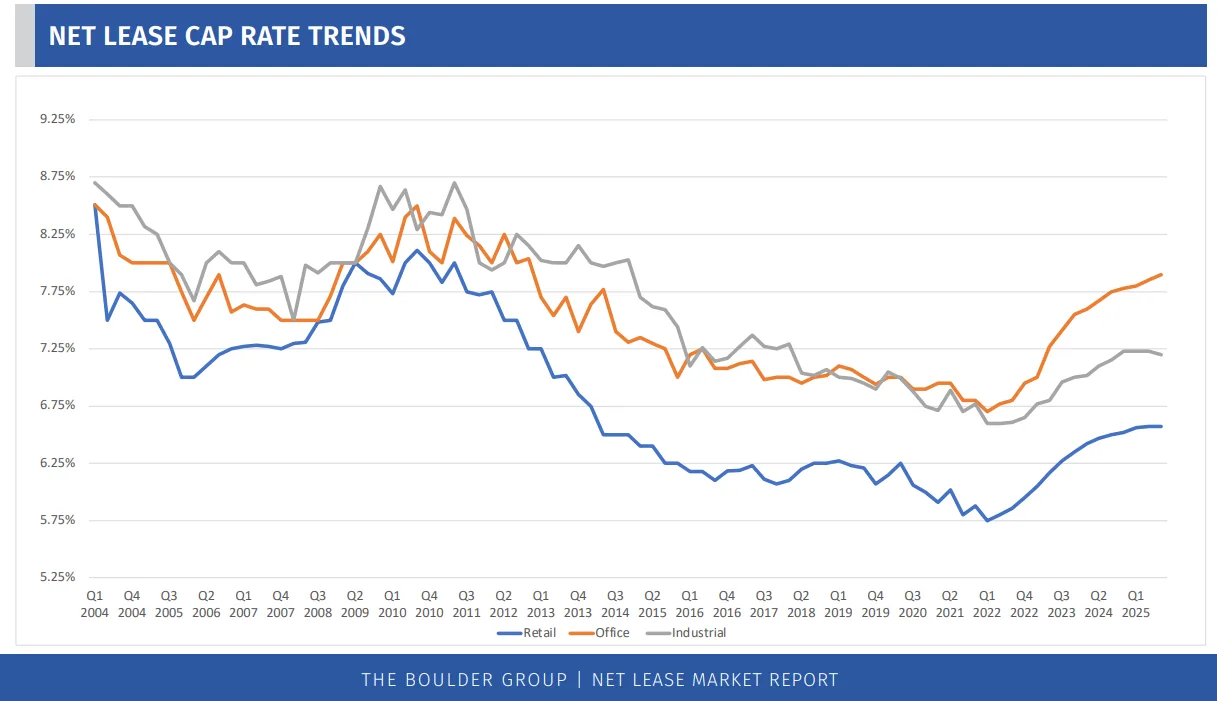

The Federal Reserve’s 25-basis-point rate cut earlier this year brought its target range down to 4.00%-4.25%, contributing to more predictable capital markets. However, cap rates did not immediately follow suit, highlighting that supply-demand dynamics—not interest rates alone—are the main pricing drivers in this sector.

Supply Shifts Slightly

Overall inventory declined modestly by 0.5% during the quarter, with retail and office supply decreasing 1.4% and 1.1%, respectively. In contrast, industrial property listings increased 6%, likely reflecting heightened disposition activity as owners look to capitalize on sustained tenant demand.

The slight realignment in supply has led to tighter bid-ask spreads. Retail properties now see a median spread of 29 bps between asking and closed cap rates, while industrial stands at 30 bps—indicating stronger price consensus between buyers and sellers.

Investor Appetite Holds

Despite higher capital costs, institutional interest in net lease remains strong. Transaction volume has yet to match pre-pandemic peaks, but improved price discovery is fueling optimism for increased deal flow over the next 12 months.

Two additional Fed meetings remain in 2025, and future rate movements could either enhance or hinder deal velocity depending on the cost of capital. Still, historical trends suggest cap rates may lag interest rate changes.

Sector Snapshots

Select Q3 transactions highlight continued cross-sector activity. Industrial trades included:

- General Mills in Georgia: $75M at a 6.10% cap on a 5-year lease.

- Vanderlande Industries: $34M at 5.69%, also with five years remaining.

Retail deals included:

- Lowe’s in Massachusetts: $32.6M at a 6.76% cap.

- Dick’s Sporting Goods in Ohio: $19.1M at 6.60% with a 10-year term.

Quick service restaurants (QSR) continue to command premium pricing, with Chick-fil-A ground leases averaging just 4.55% in Q3—a reflection of long-term leases and strong credit tenants.

By The Numbers

Lease duration remains a primary pricing driver. Properties with 16–20 years remaining average a cap rate of 5.65%, while those with less than five years trade closer to 8.00%.

In the drug store segment, Walgreens cap rates rose to 7.90% (+15 bps), while Family Dollar locations in the dollar store category climbed to 8.40% (+10 bps), signaling modest softening in tenant credit perception or location quality.

Looking Ahead

With fundamentals stabilizing and investor interest holding strong, the net lease market appears well-positioned heading into Q4. All eyes will be on the Fed’s remaining 2025 meetings as potential rate adjustments could shift the landscape for buyers and sellers alike.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes