- Clarion Partners enters senior housing with plans to invest up to $1B annually, starting with a newly built Virginia property.

- Demand is surging as the 80+ population grows and new construction lags, pushing occupancy rates above 90% nationwide.

- Institutional capital is targeting high-end communities, while older and mid-tier properties struggle with performance and refinancing.

- Senior housing is emerging as a long-term growth sector, driven by demographic trends and a growing preference for amenity-rich living.

Clarion Makes Senior Housing Debut

Clarion Partners is a real estate investment manager with $73B in assets. The firm has made its first move into senior living, and that’s just the beginning, reports Bisnow. The New York-based firm recently acquired a newly built 103-unit property in Mechanicsville, Virginia. It plans to invest up to $1B annually in the sector over the next several years.

The property, called Sancerre at Atlee Station, hit 90% occupancy within a year of opening and is operated by Experience Senior Living, a subsidiary of NexCore Group. Clarion intends to maintain this partnership model going forward, favoring established operators over in-house management.

Tailwinds From Demographics And Supply Constraints

Investor interest in senior housing is climbing quickly—and for good reason. The US population aged 80 and older is expected to grow steadily through the mid-2030s. At the same time, construction of new senior housing has slowed significantly since the pandemic.

According to Walker & Dunlop, inventory growth in the sector has stayed below 2% for three consecutive years, even as demand builds. Occupancy rates are already rebounding, with Q3 sector-wide occupancy topping 90% for the first time since 2019.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Premium Assets In High Demand

Clarion’s strategy is clear: target newer, high-quality properties designed with amenities that appeal to affluent older adults and their families. Robinson describes these facilities as “hospitality-driven.” She likens them to college dorms, with full dining programs, community spaces, and even on-site bars.

“Happy hour,” she noted, is a top-rated activity among residents.

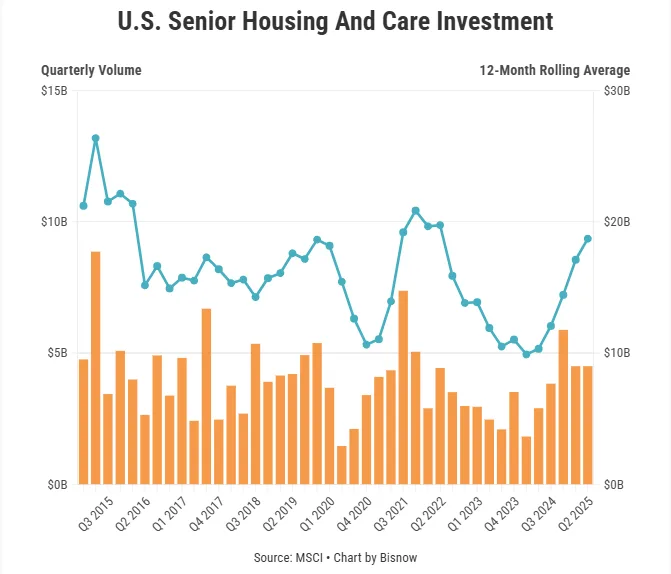

This premium segment is drawing the lion’s share of capital. Investment volume for senior housing hit $18.7B over the past 12 months, the highest level in three years, according to MSCI. Most of that capital is flowing toward institutional-grade assets, often triggering competitive bidding.

Middle Market Remains A Puzzle

While investors are crowding the top of the market, older and mid-tier communities are struggling. Stagnant lease rates, staffing challenges, and operational inefficiencies have left many of these assets underperforming. Some are being sold at steep discounts—or repurposed altogether.

“There’s been talk for years about cracking the middle-market code,” said Kevin Guisti of Walker & Dunlop. “But the economics just haven’t worked.”

Clarion, for now, is steering clear of that segment unless a strong operator can deliver premium-level service to a more cost-conscious customer base.

Outlook: Long-Term Commitment

With its new focus on senior living, Clarion is tapping into one of the most durable growth stories in real estate. Baby boomers are aging into the market in large numbers, and the relative lack of new supply gives investors like Clarion a long runway.

“We see this as a high-conviction, long-term opportunity,” said Robinson. “There’s strong demand, limited competition at the high end, and a clear need for better, more modern options for older adults.”

Expect more deals ahead—as Clarion and others continue to scale up in one of real estate’s most demographically driven asset classes.