Single-Asset Sales Surge as Investors Favor Logistics, Retail, and Multifamily

Deals over $100M are surging in logistics, retail, and multifamily, while office and portfolio sales remain stuck in neutral.

Good morning. Investors are back in action—but their money’s more selective than ever. A flood of capital is fueling record-breaking single-asset deals in multifamily, logistics, and retail, even as the broader CRE market struggles to regain pre-pandemic momentum.

Today’s issue is brought to you by Avalon Risk Management—protect your property, cuts risks, and maximizes ROI.

Market Snapshot

|

|

||||

|

|

*Data as of 10/09/2025 market close.

Mega Deals

Single-Asset Sales Surge as Investors Favor Logistics, Retail, and Multifamily

Big money is back—just not everywhere—as investors chase high-value, single-asset plays across select sectors while shunning riskier portfolios.

Deal volume diverges: Cushman & Wakefield reports that single-asset deals topping $100M in logistics, retail, and multifamily hit record highs in Q2, reversing several years of declines. Even so, total U.S. commercial property sales remain roughly 20% below 2019 levels, weighed down by sluggish office and portfolio activity.

Sectors in the spotlight: The sharpest rebound is in sectors with fresh, high-quality assets. Newly built apartments and industrial facilities are fetching premium prices as investors chase stable income and strong fundamentals. Even retail is seeing major single-asset investment despite little new construction—a sign of shifting confidence in well-located centers.

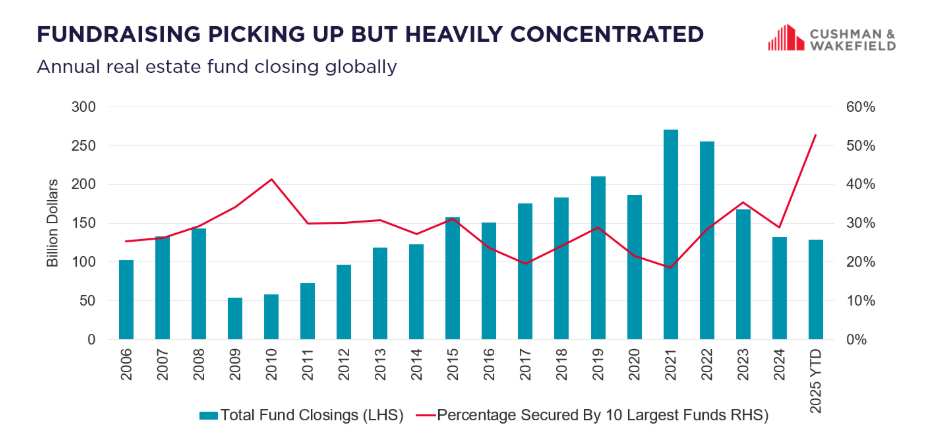

Follow the money: More than half of this year’s real estate fundraising is concentrated among just ten managers—a record high. Armed with billions in dry powder, they’re targeting fewer, larger deals in resilient sectors. Their cautious strategy is fueling single-asset sales while leaving bulk portfolio trades on pause.

Office slips from the top: Before the pandemic, office properties led all big-ticket deals. No longer. Office transactions over $100M totaled just $14B in the past year—well below the $40–$50B typical pre-2020. Multifamily now leads institutional investment, followed by industrial and select retail assets.

➥ THE TAKEAWAY

Looking ahead: Cushman & Wakefield expects balance to return as leasing picks up and risk appetite improves. When it does, sidelined capital could quickly revive portfolio-level deals. For now, investors are sticking with top-tier, single assets that offer stability in a shaky market.

TOGETHER WITH AVALON RISK MANAGEMENT

Get access to the insurance everyone wants but few can get.

Avalon Risk Management is changing commercial property insurance. Forget generic policies and outdated models that cost more.

With real-time data and pricing that beats the competition, Avalon protects your property, cuts risks, and maximizes ROI.

Exclusively available through Arcstone Insurance Advisors, Avalon delivers faster claims, lower premiums, and a team that works relentlessly for your bottom line.

Why settle for the status quo when you can have smarter coverage that works harder for your properties?

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Unlock hidden income: HAH Parking is a modern software suite designed to maximize revenue with no upfront costs. CRE pros earn 50% gross profits for 12 months per referred parking lot. Apply Today. (sponsored)

-

Loan stability: Bank-held CRE loans remained steady in Q2, with higher originations and low delinquencies.

-

Ripple effect: The federal shutdown is squeezing D.C. businesses as lost foot traffic and spending cuts hit restaurants, retailers, and hotels near government offices.

-

Growth move: Newmark acquired Dallas-based RealFoundations to grow its global management services arm.

-

Rate debate: Economist Peter Linneman expects three Fed rate cuts this year, citing politics and down payment barriers as key drags on housing demand.

-

Rule reversal: The Labor Department plans to revoke the Biden-era contractor rule, reverting to looser standards that could again reshape worker classifications in CRE.

-

City within: Lennar and The Easton Group unveiled plans for City Park at West Kendall, a $2B, 990-acre “15-minute city.”

🏘️ MULTIFAMILY

-

Adaptive ambition: Developers will convert a Midtown South office building near Penn Station into 107 studio apartments as part of a $70M redevelopment project.

-

Lending lift: Mortgage credit availability rose 0.4% in September—the highest in four months—as adjustable-rate mortgage offerings expanded and eligibility standards loosened slightly.

-

Harbor haul: Harbor Group International bought a four-property, 1,817-unit multifamily portfolio across New England for $356M.

-

Market hold: Manhattan rents held at $4,550 in September, up 8% YoY amid tight supply and high mortgage rates.

-

Loan lifeline: Veritas is negotiating to restructure $652M in debt on 66 San Francisco properties to avoid foreclosure on 1,566 apartments.

🏭 Industrial

-

North star: McKinney has surged as DFW’s hottest industrial hub, fueled by sky-high rents and rapid development around its expanding airport.

-

Size matters: Smaller tenants and regional manufacturers are now driving U.S. industrial leasing as large users stay on the sidelines.

-

Refi of the day: Investcorp secured a $1B refinancing led by Morgan Stanley for a 14M SF U.S. industrial portfolio.

-

Freight focus: Realterm and J.P. Morgan Asset Management acquired seven industrial outdoor storage sites to expand their presence in key U.S. freight corridors.

Warehouse upgrade: Industrial demand is shifting toward modern, high-tech warehouses as automation, reshoring, and AI outgrow the nation’s aging stock.

🏬 RETAIL

-

Retail rotation: SuperFresh topped NYC’s September retail leases as Soho and Midtown drew new deals from Lululemon, Abercrombie & Fitch, and Sephora.

-

Brooklyn boost: Brooklyn retail rents held steady or rose across most corridors in 2025, led by strong leasing and sales in Dumbo, Downtown, and Williamsburg.

-

Burger battle: Mooyah Burgers plans new openings despite rising costs and a crowded fast-casual market.

-

Bankruptcy grab: Sun Holdings, one of the nation’s largest restaurant franchisees, acquired Bar Louie’s 39 locations out of bankruptcy.

-

Site strategy: Walmart will demolish Pittsburgh’s Monroeville Mall to build a new mixed-use retail hub.

🏢 OFFICE

-

Office outlook: The office market is stabilizing unevenly, with rents up 4.7% year-over-year and more than half of leases set to roll by 2030.

-

REIT rebellion: Oksenholt Capital urged shareholders to reject City Office REIT’s “lowball” Elliott deal, demanding new leadership and a U.S.-focused turnaround.

-

Billionaire buy: Zara founder Amancio Ortega made South Florida’s biggest office deal of 2025, purchasing Miami’s 1111 Brickell Avenue tower for $274M.

-

Miami magnet: Miami’s office market continues to outperform peers, with visitation at 75.8%, well above the national average.

-

Loop revival: New buyers snapping up discounted Chicago office buildings are breathing life into leasing, even as vacancy hovers near record highs.

-

Contractor comeback: A $29B Navy funding surge is drawing defense contractors to D.C.’s Navy Yard, boosting office demand near federal hubs.

-

Lab crunch: AI’s rise is reshaping biotech real estate, with JLL projecting nearly 19M SF of U.S. lab space to be repurposed by 2030.

🏨 HOSPITALITY

-

Travel trouble: Hotel stocks sank 4.1% in September, their biggest drop since March, as weak demand hit investor confidence.

-

Strategic unwind: Braemar Hotels & Resorts is offloading The Clancy in San Francisco for $115M as part of a broader plan to sell its entire luxury portfolio.

-

Margin pressure: Hoteliers face weak performance and economic uncertainty, turning to AI as a key tool to cut costs and modernize operations.

A MESSAGE FROM AGORA

Webinar: The AI Shortcuts Every CRE Professional Should Know

Discover how top CRE pros are using AI to save hours, automate reporting, and stand out at work.

Whether you’re managing assets, raising capital, or just looking to get ahead in your career, this webinar will give you the AI shortcuts to work smarter and make yourself indispensable.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

📈 CHART OF THE DAY

September saw strong returns in global equities and natural resources, but inflation-protected bonds and real estate underperformed the broader rally.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |