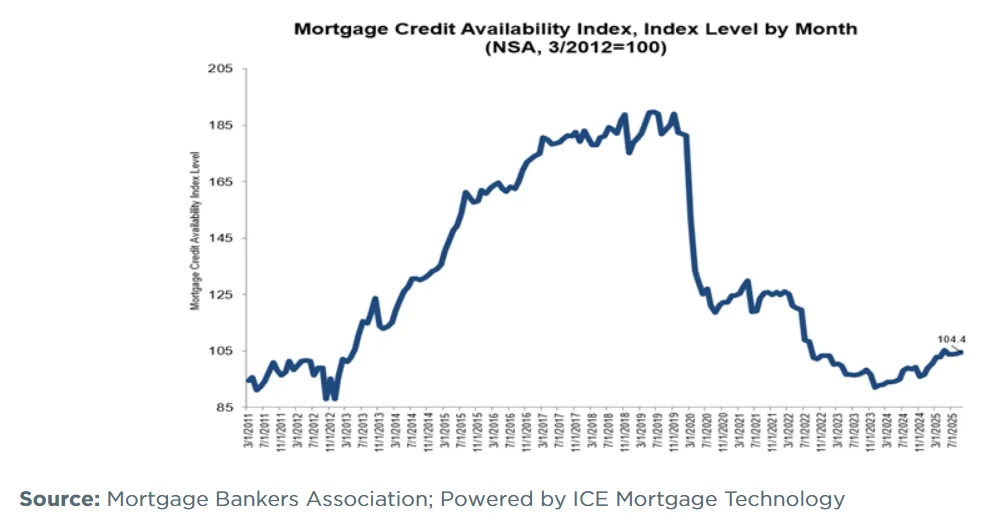

- Mortgage credit access improved in September, with the MCAI rising 0.4% to 104.4.

- The increase was led by a broader selection of adjustable-rate mortgages and expanded eligibility guidelines.

- Government-backed loans saw the largest credit loosening, while jumbo loan options contracted slightly.

- Conforming loan programs gained traction, up 0.7% for the month.

Credit Access Hits Four-Month High

Mortgage credit availability increased in September, reports Mortgage Bankers Association (MBA). The Mortgage Credit Availability Index (MCAI) posted a 0.4% monthly gain, reaching its highest level since May.

The improvement reflects broader offerings of adjustable-rate mortgage (ARM) products and looser underwriting standards tied to those loans. ARM demand has been climbing in recent months. Rates on these loans continue to undercut fixed-rate options by a notable margin. According to MBA analysts, the average difference is around 80 basis points.

Segment Breakdown: Government Leads The Way

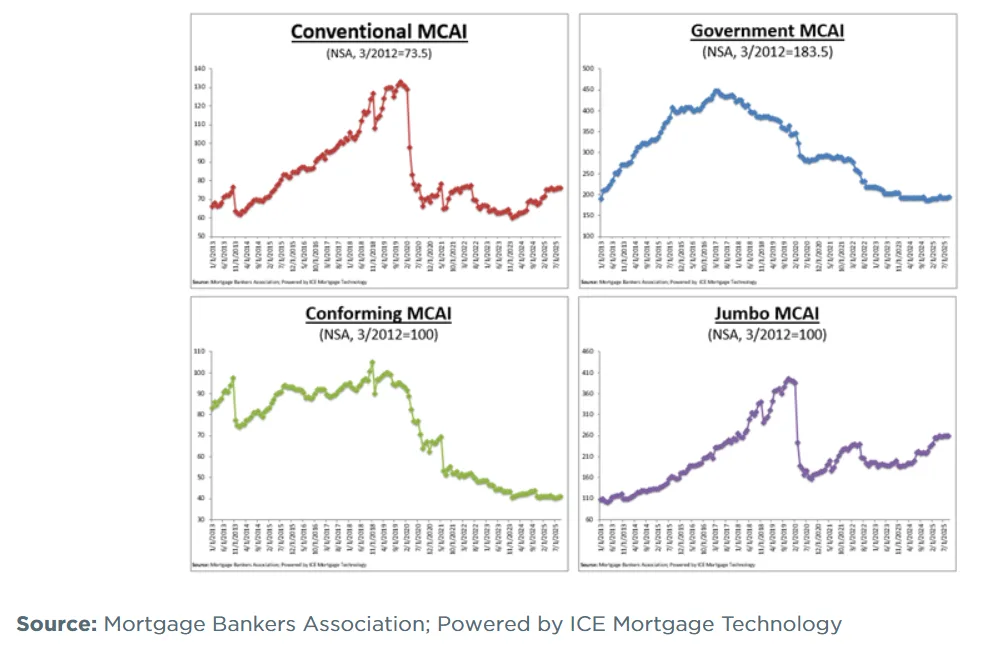

Credit conditions diverged across different loan types:

- Government programs (FHA, VA, USDA) posted the largest increase at +0.8%, pointing to expanded accessibility for lower-down-payment and first-time buyers.

- Conventional lending moved only slightly, up 0.1%, with contrasting activity within its components:

- Conforming loan availability increased 0.7%.

- Jumbo loan availability dipped 0.1%, indicating continued caution in the high-balance loan segment.

- Conforming loan availability increased 0.7%.

The MCAI and its subindices serve as a gauge of lending risk and borrower eligibility. An uptick typically signals that lenders are offering more loan options or easing standards to qualify.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Cautious Optimism In Lending

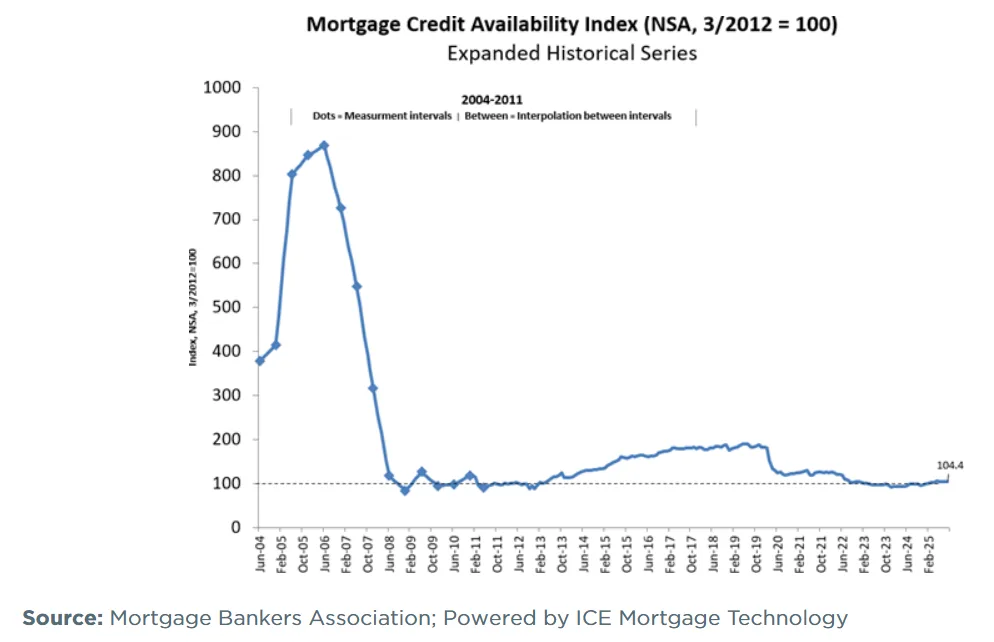

Although the credit landscape improved slightly, overall availability remains relatively tight by historical standards. The MCAI was benchmarked to 100 in 2012. Throughout much of 2025, it has hovered within a narrow range. This stability reflects lender hesitancy amid ongoing economic uncertainty and interest rate volatility.

Joel Kan, MBA’s Deputy Chief Economist, noted that ARMs are becoming more prominent. This is due to their lower rate structure and banks’ sensitivity to short-term funding costs. As long as interest rates remain elevated, ARM offerings could continue to expand.

Looking Ahead

Credit conditions could ease further in coming months if demand for ARMs persists and macroeconomic signals support a more dovish Fed stance. However, high home prices and affordability challenges continue to limit buyer activity. These factors could keep lenders cautious, even as competition increases.

Expect mortgage credit trends to remain closely tied to interest rate dynamics and investor appetite for loan risk through year-end.