- CMBS issuance totaled $30.68B in Q3, bringing year-to-date volume to $90.85B, putting 2025 on pace for the highest annual issuance since 2007.

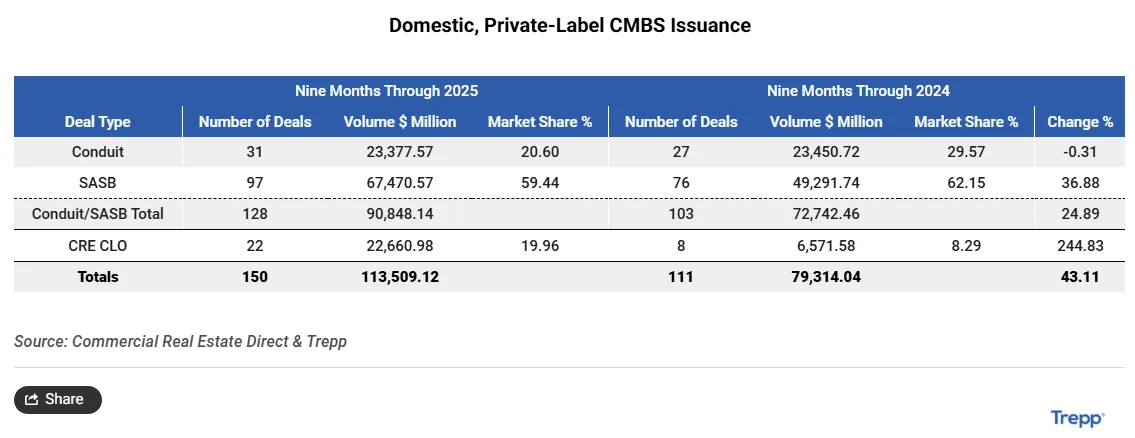

- Single-asset, single-borrower (SASB) deals accounted for over two-thirds of total issuance so far this year, with 97 deals totaling $67.47B.

- Investor demand remains strong despite economic headwinds, helping keep spreads in the low-80s basis points after spring volatility.

- Office assets backed over a quarter of SASB deals this year, while conduit lenders have begun shifting away from retail and into apartments and offices.

Issuance Momentum Builds

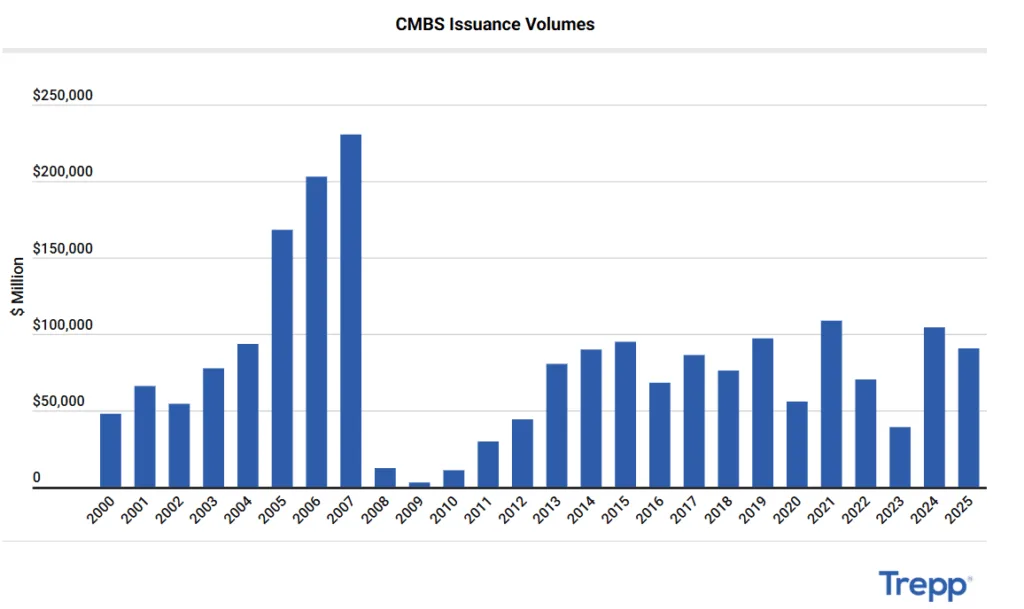

The US CMBS market posted another strong quarter, with $30.68B in private-label issuance during Q3 2025, per Trepp.

That pushed year-to-date totals to $90.85B, a 25% jump compared to the same period in 2024, and puts the market on track to exceed $121B by year’s end. If realized, it would be the largest annual total since 2007, when issuance peaked at $230.5B before the Global Financial Crisis.

cmbs issuance volumes” class=”wp-image-210585″ style=”width:733px;height:auto”/>

cmbs issuance volumes” class=”wp-image-210585″ style=”width:733px;height:auto”/>SASB Transactions Lead the Way

Single-asset, single-borrower (SASB) deals remained the driving force behind this year’s activity. These large, tailored transactions accounted for $67.47B across 97 deals through September, a 35% increase from last year. Twenty of those deals were north of $1B, including the $2.65B Hudson Yards Mortgage Trust transaction backed by The Spiral, a 66-story office tower in Manhattan.

Office properties have been central to SASB issuance, comprising 27% of total volume, followed by industrial at nearly 19%.

Conduit Issuance Flat

Conduit deals, by contrast, held relatively steady. Q3 saw $7.18B across 10 transactions, bringing the 2025 total to $23.38B, on par with 2024. Notably, lenders have favored shorter-term structures, with five-year loans comprising 70% of conduit issuance.

Credit quality has held up: year-to-date conduit loans posted a 56.6% average loan-to-value ratio, with average DSCR at 1.8x and debt yield at 12.65%.

Sector Shifts in Collateral

Lenders have increasingly favored multifamily properties, which made up nearly 24% of conduit collateral, up from under 19% last year. The office is also making a comeback, rising to 15% of conduit deals from 13% in 2024. Retail, however, has seen a sharp drop to just 18% of issuance from over 34% last year.

Strong Investor Demand Keeps Market Liquid

CMBS spreads experienced a brief widening in early spring due to macroeconomic concerns, including tariffs. However, spreads for benchmark conduit bonds have since recovered, tightening to the high-70s to low-80s basis points over swaps, signaling continued demand from investors.

Leading Firms

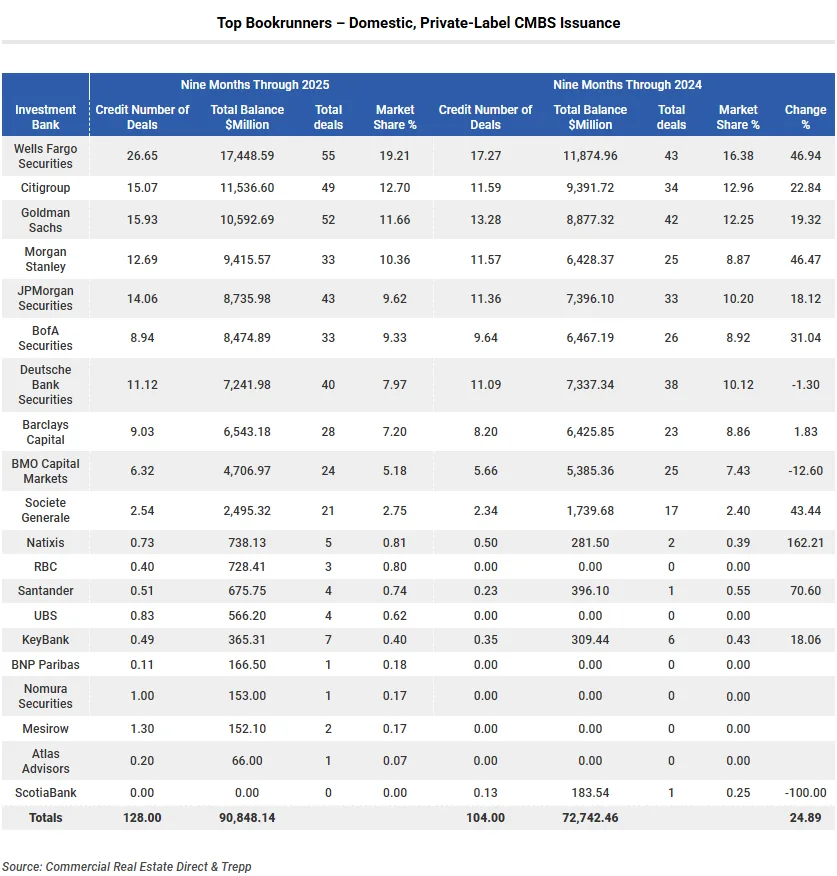

Wells Fargo retained its position as the top bookrunner in 2025 with a 19.2% market share, followed by Citigroup (12.7%) and Goldman Sachs (11.66%). The same trio led among loan contributors as well. The pool of active lenders expanded slightly to 26 firms this year, compared to 24 in 2024.

Why It Matters

CMBS issuance has proven resilient in 2025, thanks in large part to the strength of the SASB market and ongoing demand from bond investors. The shift in lender preferences, away from retail and toward multifamily and office, underscores how sector sentiment is evolving in a post-pandemic, high-rate environment.

What’s Next

With momentum strong and credit metrics holding, the CMBS market could close out the year on a high note, potentially surpassing the $121B mark. Watch for continued SASB dominance and greater activity in office and multifamily sectors as investors seek yield and stability.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes