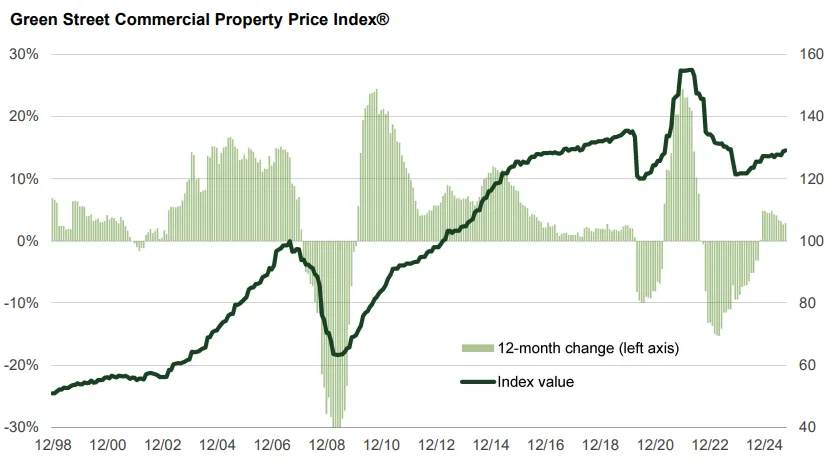

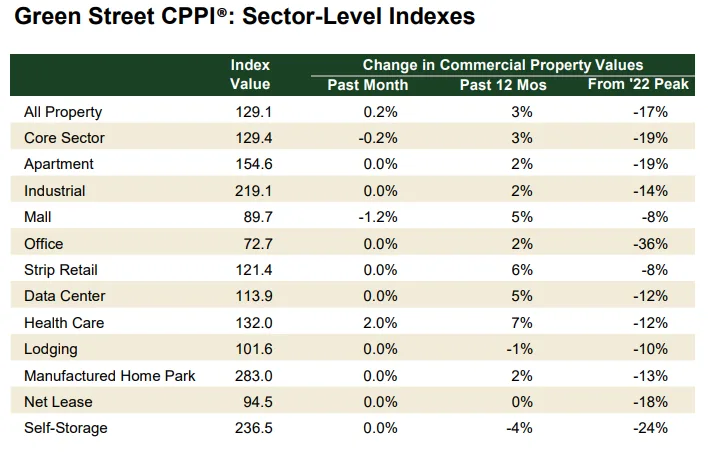

- Green Street’s all-property Commercial Property Price Index® increased 0.2% in September, marking a 2.9% rise year-over-year.

- Transaction volumes have recovered, and pricing remains stable, with Green Street signaling a higher likelihood of gradual price increases ahead.

- The index reflects timely, high-quality property valuations, offering investors and stakeholders a leading indicator of market direction.

A Slow But Steady Climb

According to Green Street’s all-property Commercial Property Price Index®, values showed modest growth last month, edging up by 0.2% in September, and up 2.9% over the past year.

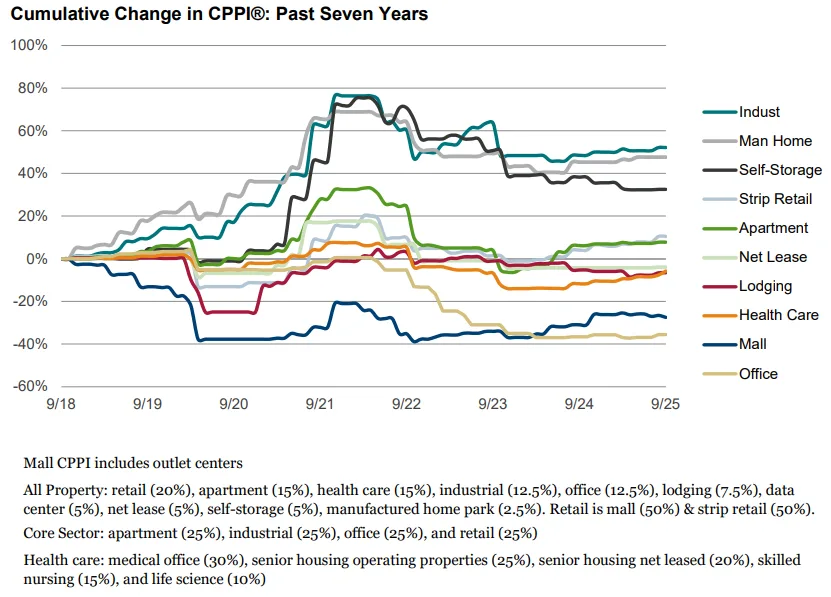

The results highlight a period of relative calm in the US commercial real estate market following several years of volatility.

“Transaction volumes have recovered nicely, and pricing has been steady, with not too much pressure one way or the other,” said Peter Rothemund, Co-Head of Strategic Research at Green Street. “It’s more likely that prices go up from here than go down, but don’t expect large moves.”

A Closer Look at the Index

Green Street’s Commercial Property Price Index® (CPPI) is a leading gauge of real-time US commercial property values, distinguishing itself from other indexes by focusing on:

- Timeliness: Released just days after month-end, the index reflects current market conditions rather than lagging appraisal-based data.

- Institutional Quality: It tracks properties typically held by publicly traded REITs, providing insight into top-tier commercial assets.

- Aggregate Value: Modeled similarly to stock indexes like the S&P 500, it emphasizes total market value rather than average transaction prices.

Why It Matters

For investors and market participants, Green Street’s CPPI offers an early look into pricing trends for institutional-grade real estate. The recent increase suggests that while the market isn’t seeing dramatic swings, it is gradually regaining its footing.

The Outlook

While pricing stability has returned, Green Street is tempering expectations for dramatic gains. With volume improving and fundamentals holding, the industry may see incremental appreciation — but without the volatility or exuberance seen in prior cycles.

Stay tuned: As interest rates, capital markets, and broader economic signals evolve, Green Street’s index will continue serving as a real-time barometer of institutional real estate pricing in the US.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes