- Easing interest rates and reduced development activity are creating conditions for a tentative recovery in Europe’s commercial real estate sector.

- Blackstone and others are targeting logistics, housing, and data centers, pointing to improved cash flow and limited new supply.

- Valuation gaps, competition from alternative assets, and muted transaction volumes suggest the market hasn’t fully turned the corner yet.

A Shift In The Market Mood

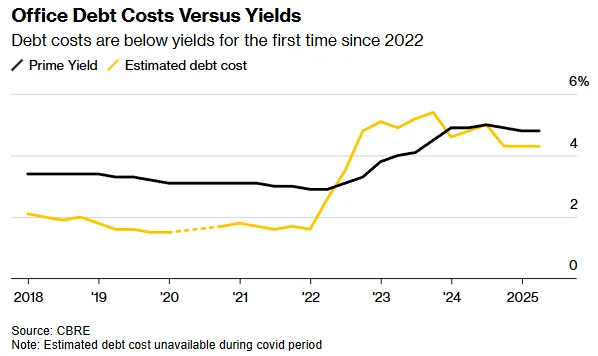

After years of downturn, Europe’s real estate market is seeing renewed interest, reports Bloomberg. Falling interest rates across the eurozone are improving financing conditions. Institutional investors are beginning to return to the market. Office and logistics assets are seeing renewed interest, as borrowing costs have dropped below prime yields in those sectors.

Yet, optimism remains measured. Many attendees at EXPO REAL in Munich — Europe’s largest property conference — shared a common sentiment. The new market cycle will demand more effort, strategic thinking, and realism. It stands in stark contrast to the easy-money era of the 2010s.

Institutional Giants Start To Move

Blackstone has deployed roughly $35B in real estate capital globally over the past year, drawn by constrained supply and rising asset-level income. The firm is leaning into sectors with long-term structural demand, such as rental housing, logistics, and data infrastructure.

“This feels like the right time to reenter,” said global real estate co-head Kathleen McCarthy-Baldwin at a recent Bloomberg event, citing long-term growth themes despite near-term volatility.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Big Deals Are Back — Cautiously

Transaction volume remains below pre-2022 levels, but activity is picking up:

- Blackstone acquired the Trocadéro office complex in Paris for €705M this summer.

- Invesco is exploring a sale of the Capital 8 building in Paris, with bids expected around €1B.

- JPMorgan and GIC are marketing Frankfurt’s Openturm for roughly €900M.

- Brookfield and Blackstone are both considering exits from student housing and rental portfolios, with valuations north of €1B each.

These transactions could serve as benchmarks for asset pricing in a post-boom environment.

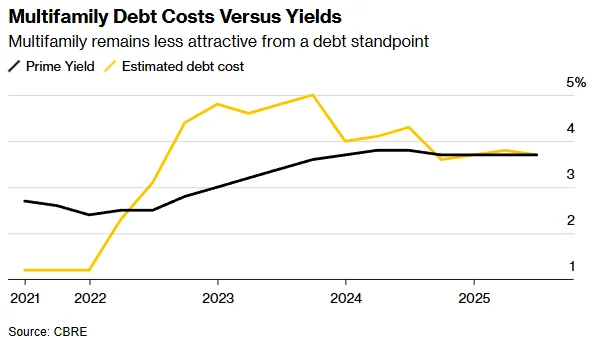

Debt Becomes A Tool Again

With lenders increasingly eager to finance stable asset classes, borrowers are benefiting from more favorable terms. Debt costs have dipped below asset yields in some segments for the first time in years, helping unlock previously stalled deals.

“Lenders are competing again — and that’s shifting pricing power back to borrowers,” said CBRE’s Chris Gow.

Structural Headwinds Persist

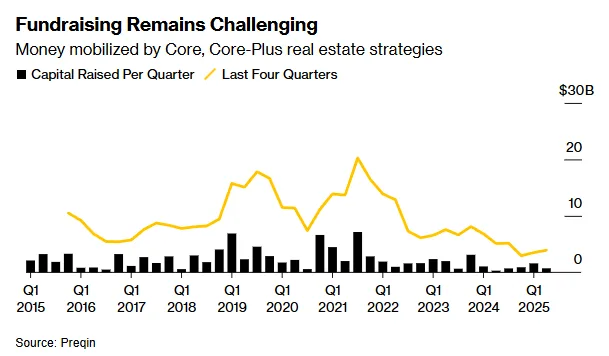

Despite renewed interest, the path to full recovery is uneven. Many owners are reluctant to sell at today’s discounted prices, especially if doing so means accepting losses on legacy debt. Meanwhile, investors now have viable alternatives in private credit and government bonds, which offer appealing yields with lower risk.

“The focus is shifting toward credit and infrastructure ahead of real estate,” said Isabelle Scemama of AXA IM Alts, underscoring the challenge real estate faces in attracting capital.

The Bottom Line: A Smarter, Slower Cycle

A growing number of investors believe the worst of Europe’s real estate downturn is over — but few expect a sharp rebound. Instead, the next phase is likely to reward operators who can unlock value through asset management rather than relying on market momentum.

“The easy wins are gone,” said PIMCO Prime Real Estate’s Annette Kröger. “Now it’s about making smart moves — not just waiting for cap rates to compress.”