In this live recap, Alex Thomas (Senior Research Manager, John Burns Research & Consulting) and Chris Nebenzahl (VP of Rental Research, JBREC) walk through the latest Fear & Greed Survey—run with CRE Daily and sponsored by InvestNext.

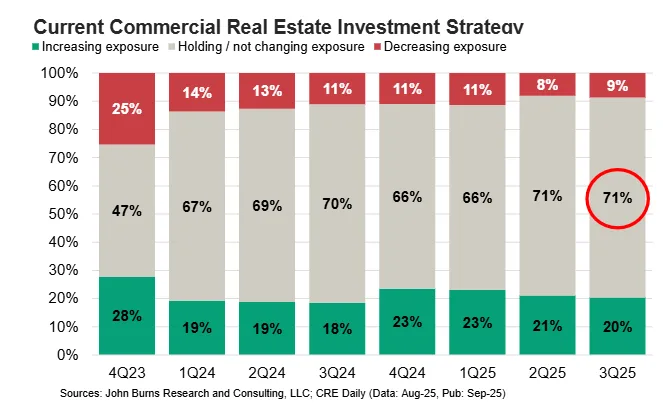

The headline: caution persists. The composite Fear & Greed Index registered 56 on a 0–100 scale (50 = stagnant; 70–90 = healthy), effectively flat for the past year and a half. A record 71% of respondents are “holding tight,” underscoring historically muted transaction appetite despite green shoots in select sectors.

Download the Full Survey Results

The 26-page survey chartbook provides deeper insights and visuals into investor sentiment, capital trends, and the evolving CRE landscape. Download the complete report for a sector-by-sector breakdown and exclusive investor commentary.

"*" indicates required fields

By downloading, you agree to our Terms and Privacy Policy. You will also start receiving CRE Dailys free newsletter. You can unsubscribe anytime.

Where Sentiment Sits Now

The index’s steadiness masks subtle improvements under the surface. Access to capital remains the rate-limiting factor, with more investors still reporting tighter conditions than easier ones; however, the direction of travel is positive, especially in retail and industrial where conditions are edging toward neutral. With most investors neither adding nor trimming exposure, activity is likely to stay subdued until either long-term rates fall meaningfully or pricing adjusts.

Pricing and Deployment Math

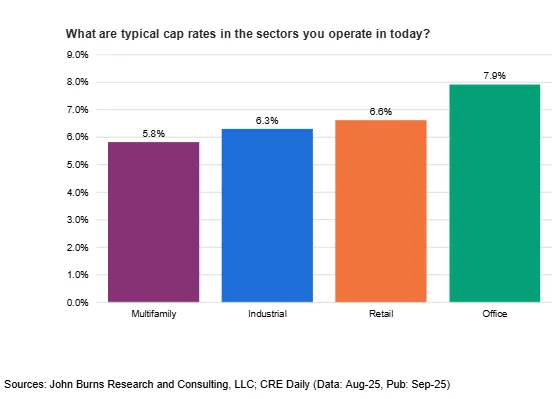

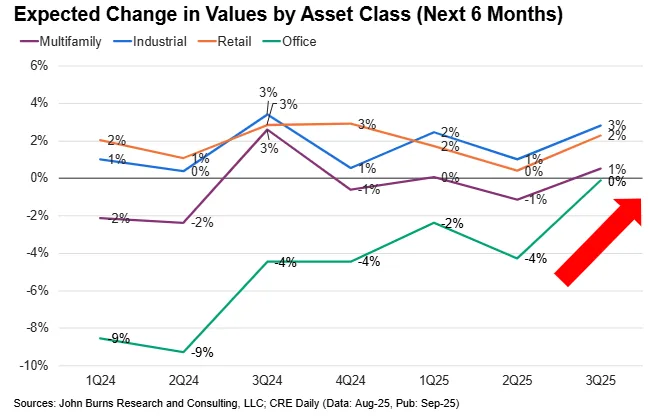

Typical cap rates came in around 6–7% across multifamily, industrial, and retail, and closer to 8% for office. When asked what it would take to “aggressively deploy,” investors pointed to roughly 100 basis points higher than today’s cap rates—implying a 10–15% price reset. Few expect that reset over the next six months, which aligns with stable near-term value expectations: industrial up roughly 3%, retail up 2%, multifamily up 1%, and office flat—the first non-negative office read since the survey began.

Sector Picture

Multifamily shows the clearest path to improvement. Renter-household formation is robust and the monthly ownership premium remains near double the cost of renting, keeping renters in place longer.

Deliveries are past peak and starts are falling, while absorptions continue to outpace starts, a combination that should compress vacancy through 2026–2027. Near-term rent growth stays subdued due to lease-up concessions, but pricing power returns as that pipeline burns off.

Industrial remains the cycle’s steadiest performer. Investor expectations lead other sectors, and earlier trade-policy nerves have moderated into watchful optimism.

Retail sentiment cooled quarter-over-quarter, reflecting concerns around goods inflation, tariffs, and a softer labor read. Operators are focused on margin protection while awaiting clearer macro signals.

Office is still the weakest, but no longer deteriorating at the sector level. A flat six-month value outlook suggests a tentative bottom, with performance hinging on quality and location; trophy assets continue to separate from commodity space.

Rates, Curves, and Who Benefits

Investors say another 100 bps of Fed cuts would most directly help multifamily, given its heavier reliance on short-term, SOFR-linked debt. After a year of shifting expectations, the forward curve now implies roughly 75–100 bps of additional cuts by the end of next year. Unless those moves translate into sustainably lower long-term borrowing costs, the broader market is likely to remain in “wait and see” mode.

What to Watch

The near-term hinge is capital access. If the improving trend reaches neutral and holds, deal flow should thaw first in industrial and stabilized, higher-quality multifamily, followed by selective office trades where distress or story-driven upside exists. For now, investors are positioning for a slow handoff from price discovery to activity—patient on entry, selective on risk, and focused on 2026–2027 as fundamentals normalize in housing-adjacent sectors.

The slides from the webinar are below.