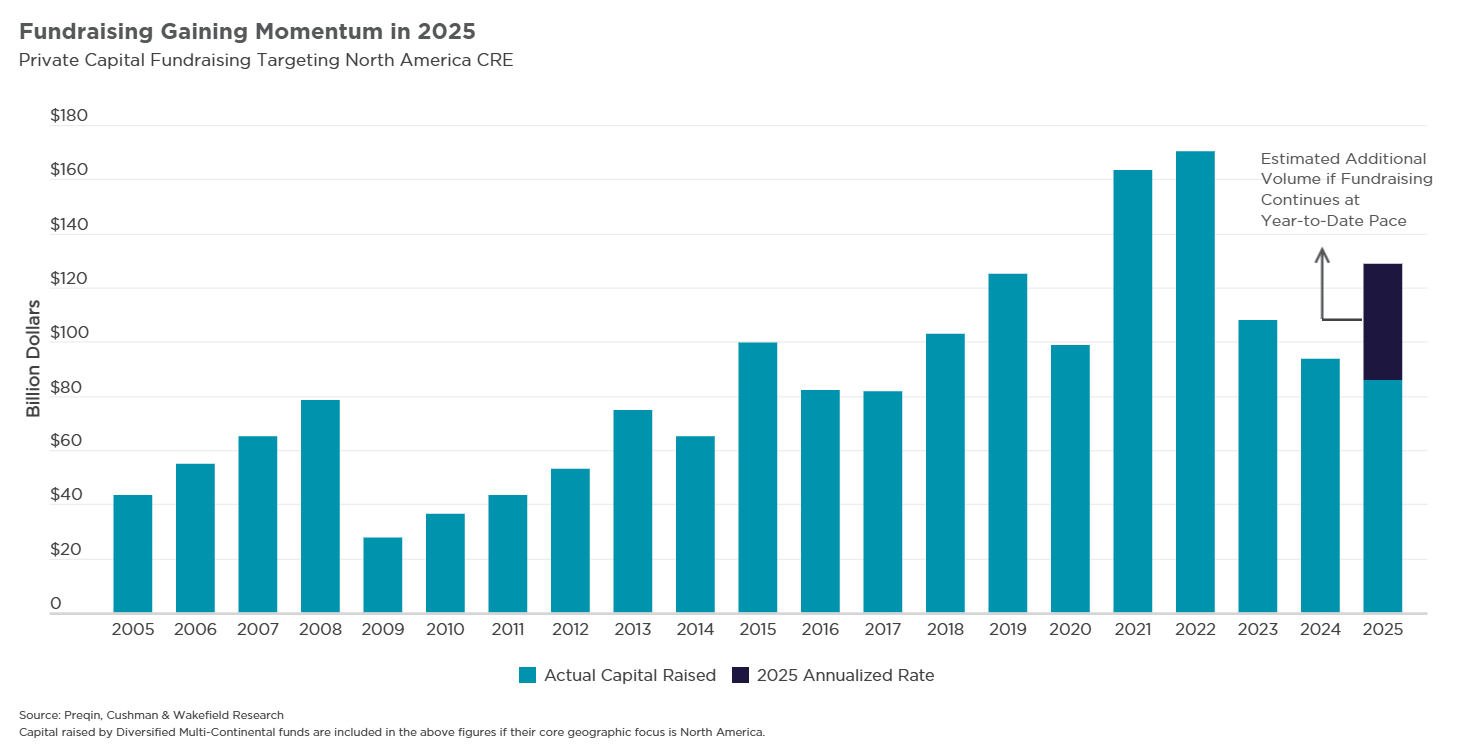

CRE Fundraising on Pace for $129B in 2025

Private funds have already raised $85B this year and are on pace to top $129B by December.

Good morning. Capital raising is making a comeback. Private CRE funds are on track for their strongest year since 2022, with investors shifting back into growth mode.

Today’s issue is brought to you by QC Capital—invest in one of the most resilient and scalable asset classes in CRE.

💻️ Today at 2 PM ET: Unpack the Q3 2025 Fear & Greed Survey with JBREC—get insights on CRE trends, rate cuts, cap rates, and what’s next for Multifamily, Retail, Office & Industrial.

Market Snapshot

|

|

||||

|

|

*Data as of 09/30/2025 market close.

Dry Powder

CRE Fundraising on Pace for $129B in 2025

After two years of stalled activity, equity and debt fundraising in U.S. commercial real estate is roaring back, with 2025 shaping up as one of the strongest years on record.

Capital inflows rebound: Asset managers raised $85B in the first eight months of 2025, putting funds on track to hit $129B by year-end — a 38% increase over 2024. That’s a sharp reversal from the fundraising slump that began in 2023, when totals slid from a $170B peak in 2022 to just under $100B last year.

Mega-funds closing big: Brookfield’s $16B Strategic Real Estate Partners V and Carlyle’s $9B Realty Partners X mark each firm’s largest-ever closes. Blackstone also doubled down, with its $8B Real Estate Debt Strategies V matching the largest debt fund globally.

REITs tiptoe back in: After sitting out most of the rate-hike era, REITs are also easing back into fundraising. Bond issuance has picked up sharply, with $48B in unsecured offerings over the last 12 months—back to pre-pandemic averages. While equity issuance remains modest, it’s trending upward, marking the highest volume in nearly three years.

Why now? Investor sentiment is warming as easing borrowing costs and limited new supply signal recovery. Blackstone’s Jonathan Gray cites these as the foundation for a rebound, though slow price resets and loan extensions are still muting deal flow.

Shifting strategies: According to the 3Q25 Fear and Greed Index, investors remain cautious, with 71% holding exposure flat. Still, sentiment is edging toward expansion, and 41% expect to increase exposure over the next six months. Debt funds are especially hot, already pulling in $20B this year, with investors positioning for looming maturities.

➥ THE TAKEAWAY

Betting forward: Private capital is signaling confidence that CRE’s reset is finally underway. Expect more dry powder to flow toward debt and opportunistic plays, with investors betting that today’s slow market will open the door to tomorrow’s deals.

TOGETHER WITH QC CAPITAL

Discover the Power of Passive Flex Space Investing

Looking for an investment that delivers stability and long-term growth?

QC Capital’s Flex Space Fund is designed for accredited investors seeking passive income and strategic upside.

✅ 8% Preferred Return – Consistent income backed by fully leased assets.

✅ Hands-Off Investing – Zero operational responsibility through NNN leases.

✅ Projected 2x+ Equity Multiple – Growth potential over a 3–5 year hold period.

✅ Exposure to a Fast-Growing Asset Class – Flex space is in high demand nationwide.

This isn’t just about passive income, it’s about investing in one of the most resilient and scalable asset classes in commercial real estate.

Round 2 Commit Date Deadline: October 31st. Spots are first come, first serve.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Get your free guide: $7T in retail capital is flowing into alternatives by 2032 — and real estate is high on the list. So why are most mid-sized GPs still chasing institutions? (sponsored)

-

Soft season: Record vacancies and surging supply are pushing U.S. rents down for the second straight month, with the national median now at $1,394.

-

License lapse: The Appraisal Institute’s top reviewer lost his license in 2018, raising doubts about the certification's integrity.

-

Landlord spillover: Unsold homes are turning into rentals, cooling single-family rent growth and pressuring big landlords.

-

Bubble trouble: UBS warns rising debt and policy shifts may fuel housing bubbles, with Miami and L.A. showing inflated home values far outpacing rent growth.

-

Write-off risk: The return of 100% bonus depreciation is supercharging 1031 exchanges with big tax breaks—but also steep exit liabilities.

🏘️ MULTIFAMILY

-

Shifting priorities: HUD is scaling back enforcement, shifting focus from neighborhood-wide lending patterns to individual discrimination cases.

-

Funding advance: Mayor Eric Adams is advancing $1.8B to fast-track affordable housing projects under new federal tax credit rules.

-

Foreclosure wave: Veritas Investments, once SF’s largest private landlord, faces foreclosure on 66 buildings after defaulting on over $652M in loans.

-

Riverfront raise: Newgard Group and Two Roads scored $513M in financing for Miami’s One Brickell Riverfront, a two-tower residential project now over 50% complete.

-

Distress rising: Houston apartment sales are rebounding, but Class-C assets remain deeply troubled as foreclosures mount and prices plunge.

🏭 Industrial

-

Energy shift: Prologis says energy reliability, AI, and regionalization are driving a major supply chain reset as companies prioritize resilience over cost.

-

Midwest move: Investcorp sold a $365M, 3.5M SF Midwest industrial portfolio but signaled it’s still bullish on the sector.

-

Data drag: AI-driven data center demand is booming, but rising costs, power constraints, long lead times, and mounting community pushback are creating serious development risks.

-

Next frontier: Related Midwest and CRG struck a $58M land deal with Blue Owl to launch a multi-billion-dollar quantum computing campus on Chicago’s South Side.

-

Nearshoring boom: U.S.-Mexico border markets are becoming vital logistics hubs as nearshoring, trade realignment, and rising AI manufacturing demand fuel a new era of industrial expansion.

🏬 RETAIL

-

Runway deal: Hines acquired the mixed-use Runway Playa Vista for $428M, betting on long-term retail and multifamily strength.

-

Leasing lag: Retail lease deals are slowing not just due to costs or market shifts, but also from poor coordination.

-

Bank spread: Investor appetite remains strongest for Chase-leased assets, as higher cap rates and pricing pressure hit Bank of America and Wells Fargo properties.

-

Retail optimism: Retail real estate is becoming the asset class of choice as capital returns, bid sheets grow, and transaction volume climbs heading into 2025.

-

Gateway rebound: Investors are flooding back into California retail, boosting bids, compressing cap rates, and fueling new projects.

🏢 OFFICE

-

Tower turnaround: Developers Mike Hoque and Mike Ablon are seeking $98M in public support for a $350M overhaul of Dallas’ tallest tower.

-

Silicon stake: Apple’s latest $365M Sunnyvale office purchase pushes its Silicon Valley spending spree close to $1B.

-

Tier down: With top-tier office space tightening in Chicago, tenants are shifting into renovated Tier 2 buildings, especially in the West Loop.

-

Guggenheim grows: The firm expanded its Midtown lease to 360K SF at 330 Madison, filling the building and signaling renewed momentum in Manhattan’s office market.

-

Discount deal: The Conrad N. Hilton Foundation sold its half-leased Westlake Village HQ to Oaks Christian School for $25M, half what it paid in 2018.

🏨 HOSPITALITY

-

Access economy: Private social clubs are expanding in midsize cities, catering to affluent newcomers seeking exclusivity and community.

-

Tourism play: Fort Bend is planning a $235M hotel and convention center to boost Rosenberg as a regional event destination.

A MESSAGE FROM CRETECH

CREtech New York: Where Business Gets Done

Join us October 21 – 22, 2025, in the real estate capital of the world for the industry’s flagship innovation event.

Over two action-packed days, connect with leading owners, developers, investors, and technology innovators shaping the future of the built world. With hosted meetings, world-class speakers, and a groundbreaking expo hall, CREtech New York delivers unmatched opportunities to build relationships and drive real business outcomes.

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

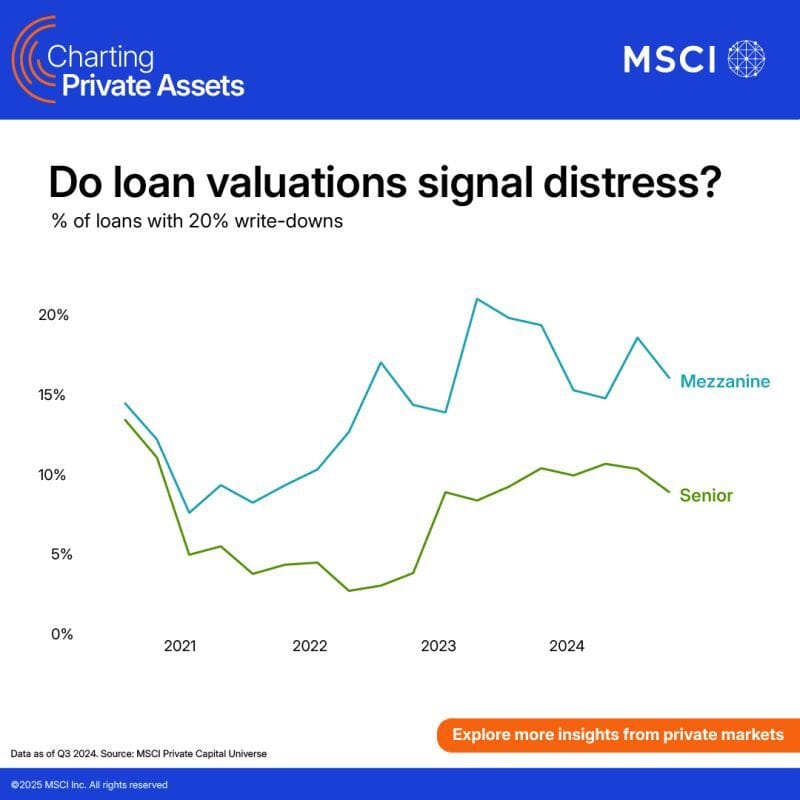

📈 CHART OF THE DAY

Loan valuations suggest rising stress in private credit, with distress rates tripling since 2022 and deeper write-downs hitting both senior and mezzanine debt.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |