- Bond yield changes now drive the sharpest moves in commercial property values, outpacing GDP or inflation shocks.

- Markets with low capitalization rates, such as San Francisco, face the greatest volatility when yields shift.

- Retail properties are especially sensitive to interest-rate fluctuations, while industrial assets react more to demand-driven downturns.

- Investors who track Treasury yield movements may be better positioned to anticipate valuation swings than those focused solely on macroeconomic growth or inflation.

Bond Yields at the Center of CRE Risk

Commercial real estate is proving more sensitive than ever to bond market volatility, per Globe St.

According to Oxford Economics’ September analysis, permanent shifts in long-term US Treasury yields can cause sharper and deeper valuation swings than either a GDP contraction or a jump in consumer prices.

The mechanism is straightforward: as bond yields move, real estate yield spreads compress. In metros with already-low capitalization rates, even small changes in yields translate into magnified shifts in property pricing.

A Ranking of Shock Sensitivities

The Oxford Economics modeling—based on 42 US metros—shows that:

- A 1% GDP contraction reduces capital returns by 1.4% to 2%.

- A 1% rise in consumer inflation trims returns by 0.3% to 1.8%, with retail hit hardest.

- But a 200 bps swing in Treasury yields generates outsized responses, particularly in low-cap-rate markets.

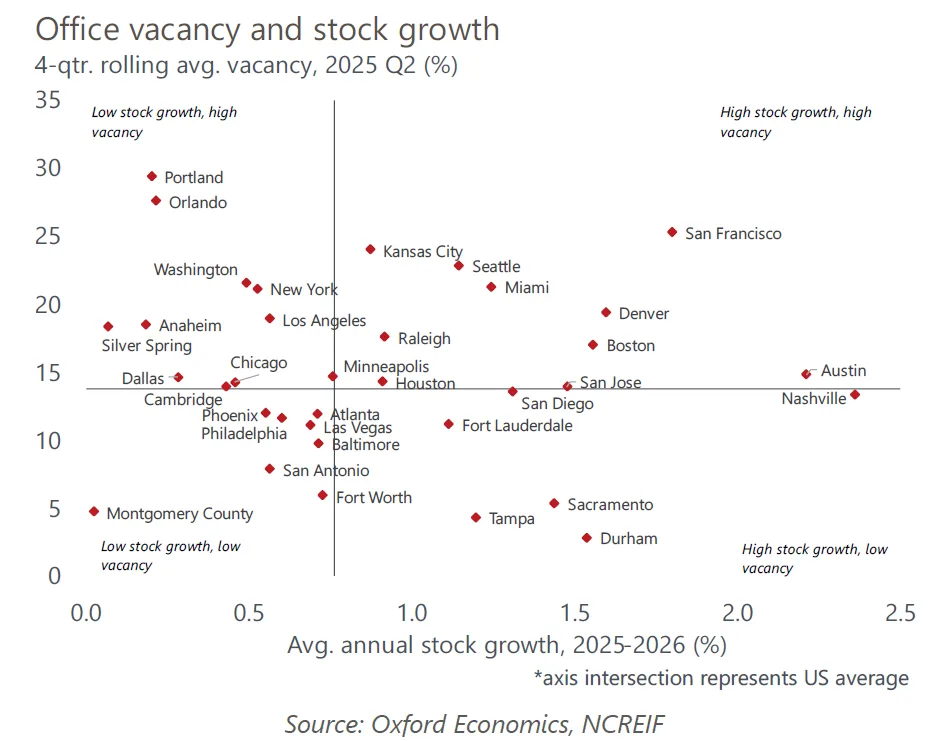

San Francisco stands out as the most exposed metro, where bond yield shifts create capital return elasticities of -9, compared with only -1.4 for inflation and 1.8 for GDP.

Sector Breakdown

Not all property types react equally.

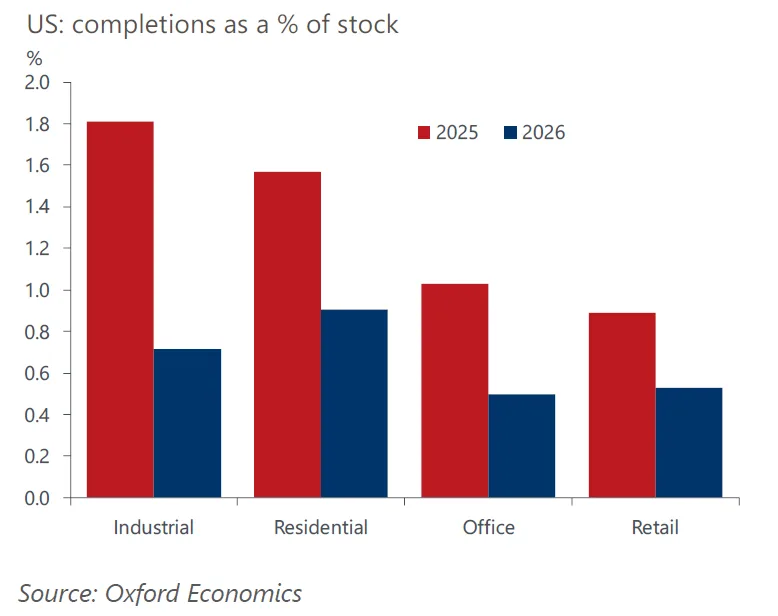

- Retail assets are the most sensitive to interest-rate fluctuations, correcting swiftly—often within a year—after bond market shocks.

- Industrial assets show more resilience to financial shifts but remain vulnerable to GDP-driven demand changes, with effects playing out over several years.

- Residential property values appear least exposed, reinforcing their defensive reputation during broader market turbulence.

Why It Matters

For investors, the takeaway is clear: in today’s environment of fiscal concerns and policy uncertainty, monitoring bond yields is no longer just about financing costs—it is about anticipating valuation shocks across CRE. Discount rates remain the critical link between bond markets and property performance.

As Oxford Economics notes, yield-driven repricing doesn’t fade quickly. Unlike consumer downturns, which may take years to fully reflect in property prices, bond market shocks tend to embed permanently into valuations.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes