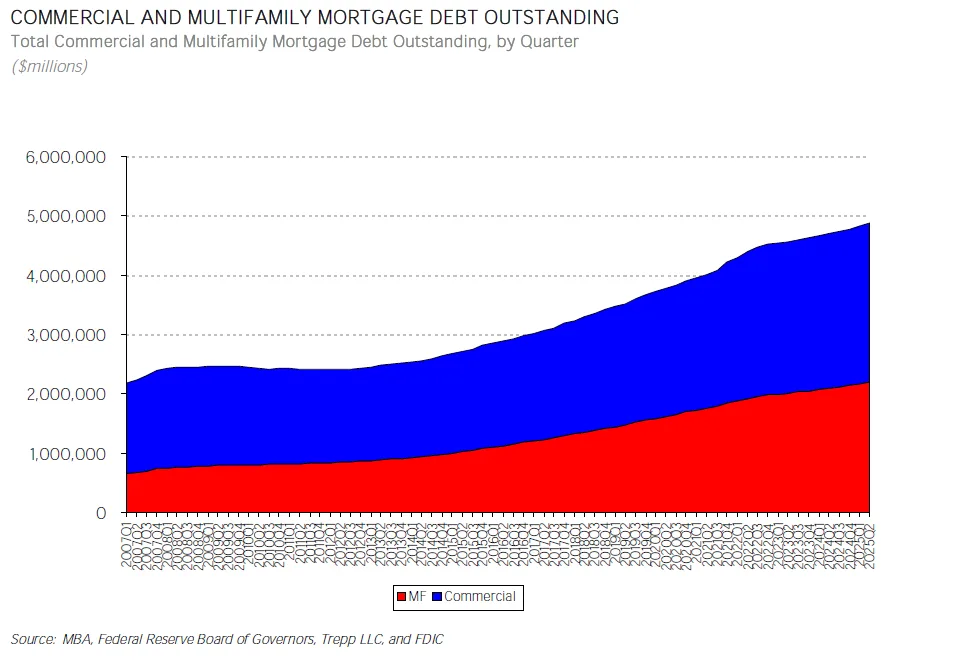

- Total commercial/multifamily mortgage debt outstanding reached $4.88T, up $47.1B (1.0%) from Q1 2025.

- Multifamily mortgage debt alone increased by $27.7B (1.3%) to $2.19T.

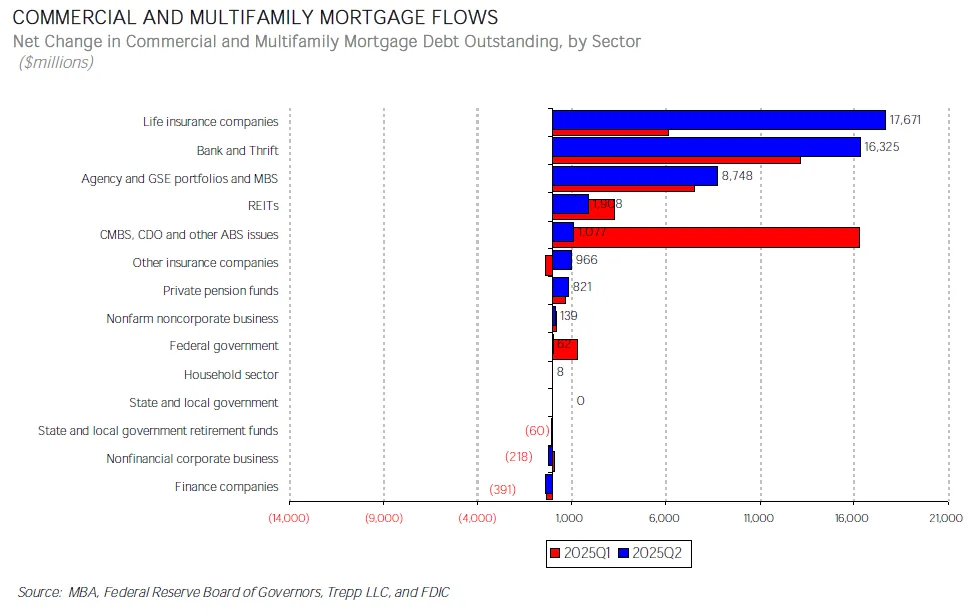

- Life insurance companies led dollar gains across both categories, increasing their holdings of multifamily debt by 5.8% and commercial/multifamily debt by 2.4%.

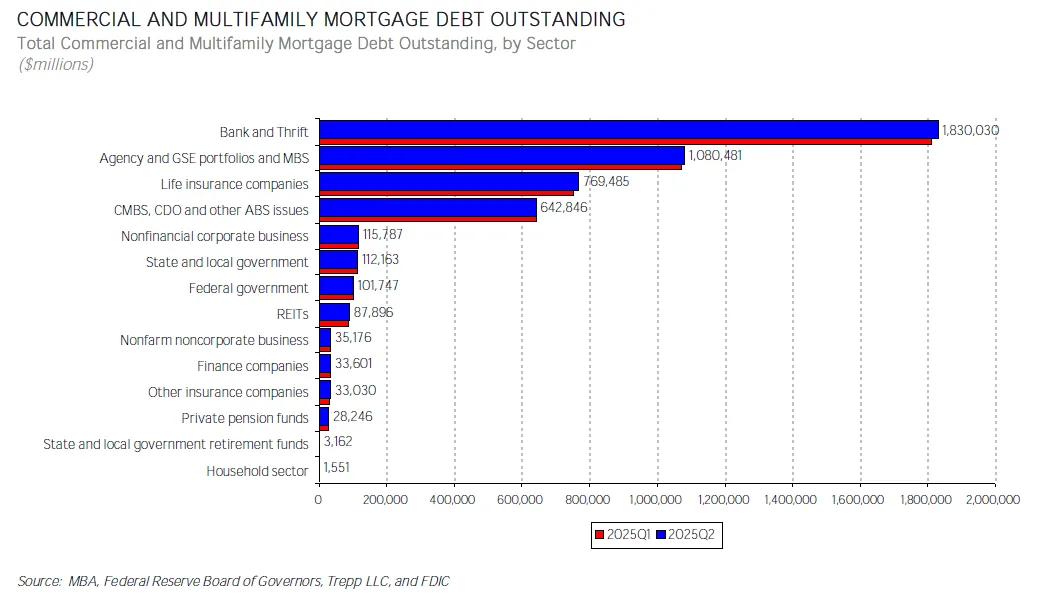

- Banks remain the top holders of commercial/multifamily mortgages, with $1.83T in debt on their books.

Mortgage Market Sees Steady Growth

The total amount of mortgage debt backed by commercial and multifamily real estate grew moderately in Q2 2025, according to the Mortgage Bankers Association. The increase was driven by gains across nearly all major investor groups. It reflects cautious but continued confidence in the income-producing property market.

“Every major capital source added to its holdings, but growth varied,” said Reggie Booker, MBA’s Associate VP of Commercial Research.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Multifamily Loans Still A Growth Engine

Multifamily mortgages saw stronger quarterly growth than the broader market, rising 1.3% to $2.19T. Government-sponsored entities (GSEs) like Fannie Mae and Freddie Mac continue to dominate this sector, holding 49% of outstanding multifamily debt.

Life insurance companies increased their multifamily holdings by $14.2B (5.8%), the largest percentage gain among investor types, while banks added $5.5B (0.9%).

By The Numbers

As of Q2 2025:

- Commercial banks and thrifts hold the largest share: $1.83T (38% of total).

- Agency and GSE portfolios and MBS: $1.08T (22%).

- Life insurance companies: $769B (16%).

- CMBS, CDOs, and other ABS: $643B (13%).

In multifamily specifically:

- Agency/GSE MBS: $1.08T (49%).

- Banks and thrifts: $645B (29%).

- Life insurers: $256B (12%).

Winners And Losers

Life insurers were the biggest winners this quarter, adding $17.7B in commercial/multifamily debt and gaining the largest share of the increase (37.6%).

Private pension funds saw the largest percentage increase at 3.0%. State and local government retirement funds reduced their holdings by 1.9%. Nonfinancial corporate businesses cut their multifamily exposure by 15.5%, marking the steepest decline across the board.

Why It Matters

Even modest quarterly gains like this underscore the resilience of the commercial and multifamily mortgage markets. Despite macroeconomic uncertainty, investor confidence remains firm, especially among traditional institutional holders like life insurers and banks.