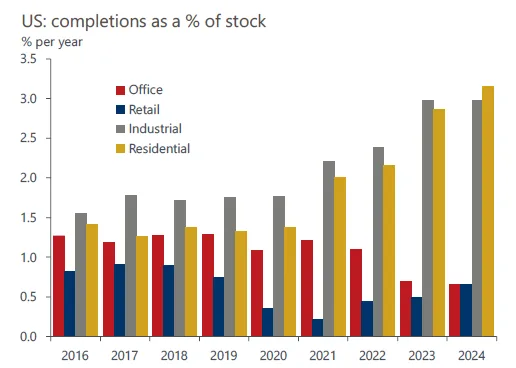

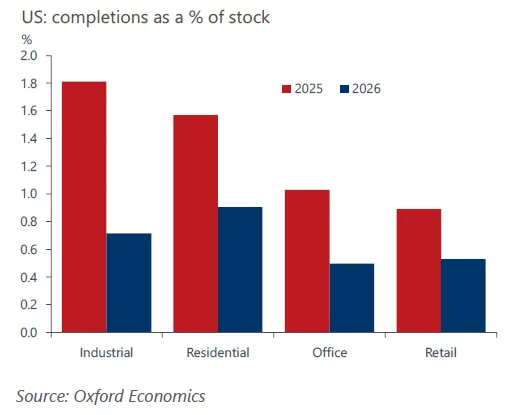

- Commercial real estate (CRE) inventory growth is expected to slow across most US metros over the next five years, following a period of supply-heavy development in industrial and residential sectors.

- Despite slowing construction, near-term supply surges in metros like Las Vegas, Austin, and Miami could pressure vacancy rates and rents across multiple property types.

- Office markets such as Boston and San Francisco face continued headwinds from elevated vacancy rates, tech job losses, and an oversupply of life science space.

A National Slowdown, But Not For Everyone

Commercial real estate growth is entering a cooling phase, as reported by Oxford Economics. After a wave of completions dominated by industrial and residential projects, the pace of new supply is expected to decline. This slowdown will impact nearly all sectors, with office and retail facing the sharpest drop.

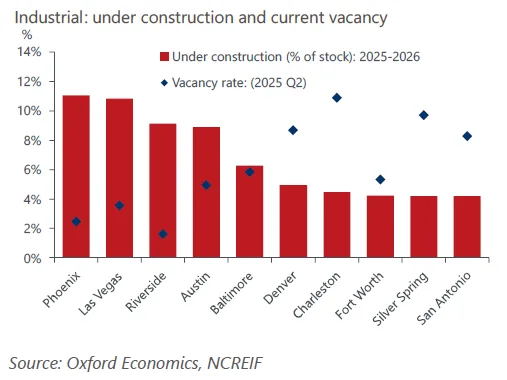

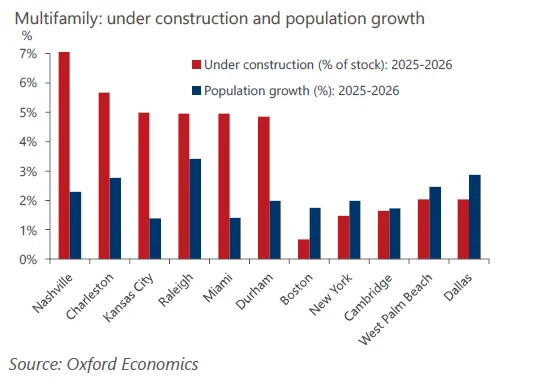

Still, several metros are expected to buck the trend. Industrial pipelines remain robust in cities like Phoenix, Austin, and Riverside. Meanwhile, multifamily development is surging in Nashville, Raleigh, and Miami. In some cases, this growth is outpacing job and population gains.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Where The Risks Lie

Industrial: Despite a projected slowdown, the industrial sector will remain the most active in terms of completions. National vacancy rates rose from a recent low of 1.5% to 4.1% in Q2 2025. Some metros with strong pipelines—Las Vegas, Charleston, and Fort Worth—are already experiencing vacancy rates more than double the national average.

Office: The office sector faces the harshest fundamentals. New supply is arriving just as occupiers reevaluate their space needs amid ongoing hybrid work and rising AI adoption. Boston and San Francisco, in particular, are dealing with excessive life science supply—where vacancy rates have reached 33.9% and 29.3%, respectively.

Residential: The multifamily pipeline is active in Sunbelt markets, with Nashville, Charleston, and Miami leading in deliveries. Yet demographic and employment slowdowns may extend lease-up times and pressure rents in the near term, despite strong long-term demand forecasts.

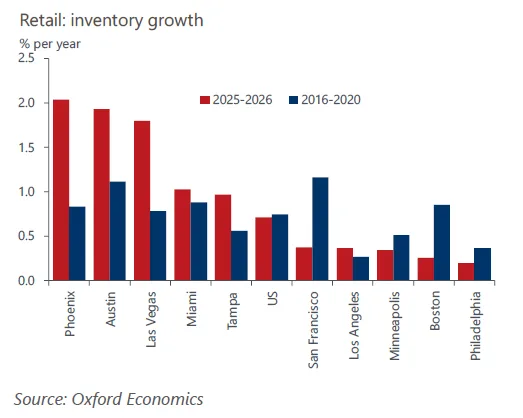

Retail: Retail remains the slowest-growing sector, with average national inventory growth below 0.5% annually. However, pandemic-era population shifts are driving pockets of new development in metros like Austin, Tampa, and Phoenix, where growth rates exceed national averages.

The Big Picture

While supply pipelines are moderating, imbalances between new inventory and underlying demand persist. This is especially true in fast-developing metros with softening labor markets and slowing population growth. On the upside, high barriers to new construction, elevated costs, and restrictive policies are helping to rein in overbuilding in coastal cities like Boston and New York, where vacancy pressures are lighter.

Why It Matters

The report underscores a growing divergence in metro-level CRE dynamics. Developers and investors alike will need to watch for localized oversupply in specific sectors—especially in office and multifamily. Meanwhile, the industrial sector, though still active, may soon test the limits of tenant demand.