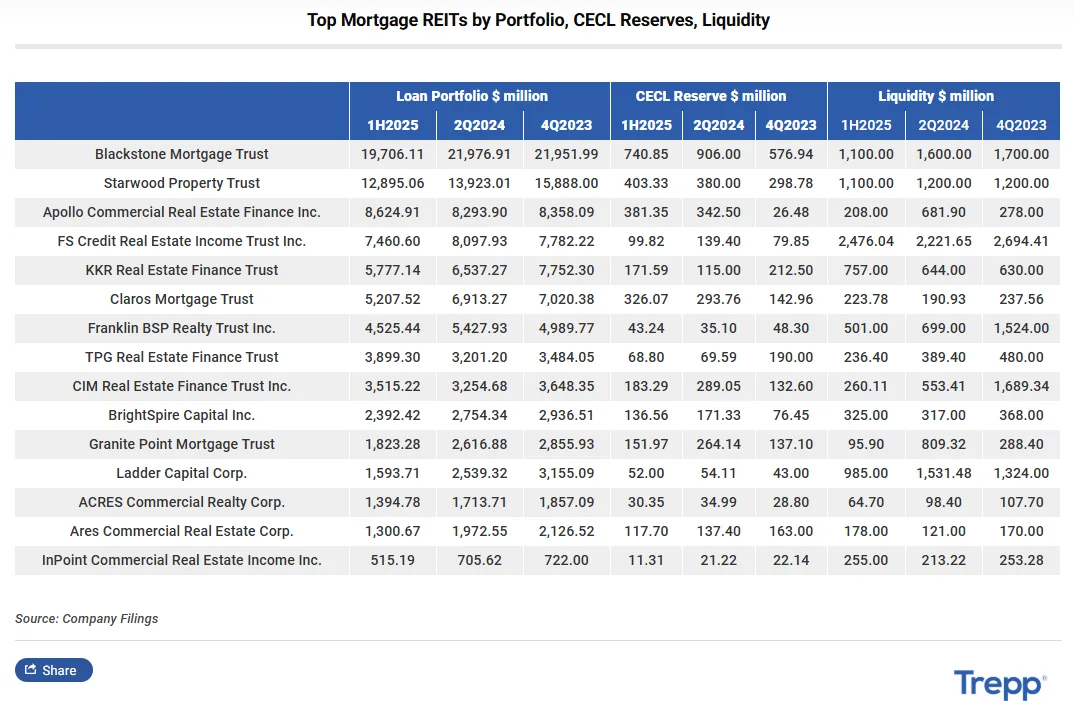

- The loan portfolios of 16 major mortgage REITs dropped by more than 18% since Q4 2022, totaling $80.6B as of Q2 2025.

- REITs shifted from loan origination to asset management due to rising rates and increasing risks, particularly in the office sector.

- Blackstone Mortgage Trust alone saw its loan book shrink by over 26% from its 2022 peak, though lending activity has recently picked up.

A Lending Pullback

Mortgage REITs, particularly those focused on transitional commercial real estate, have downsized significantly in the face of rising interest rates and increased risk in property markets, according to Trepp.

Collectively, the 16 major non-traded and publicly traded REITs saw their loan books contract from their 2022 highs to $80.6B in Q2 2025—a reduction of more than 18%.

From Origination to Management

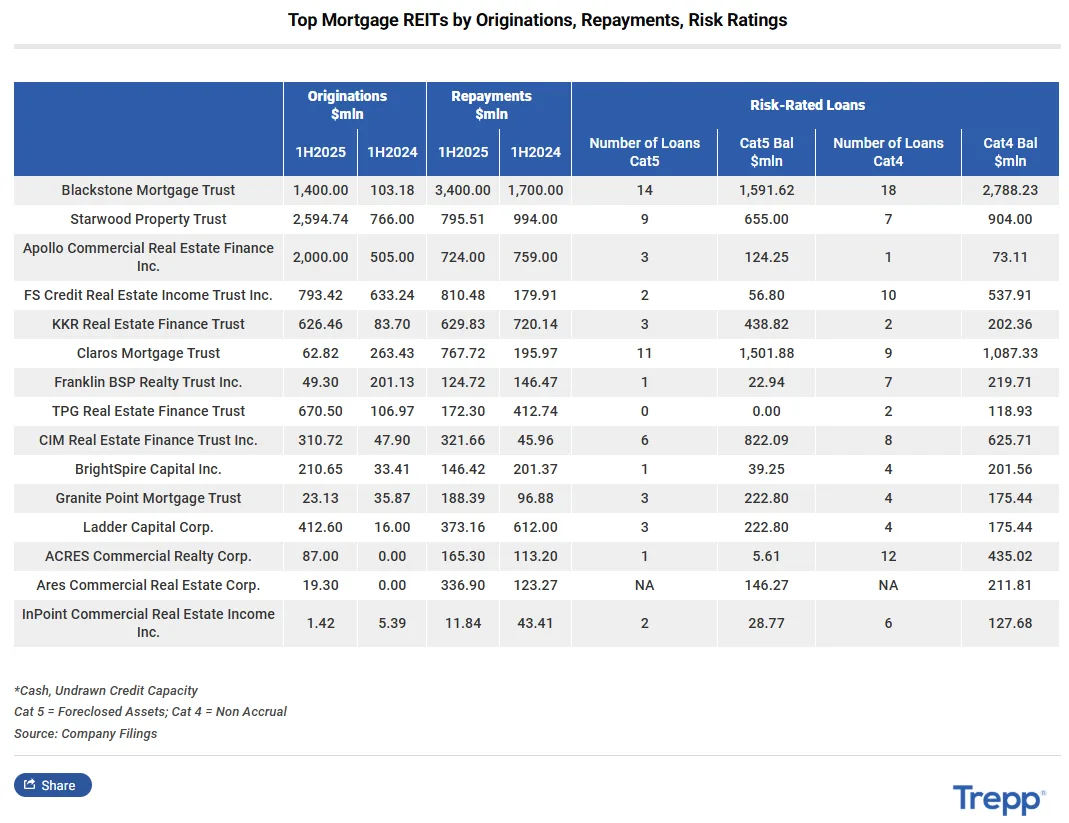

Origination volume has slowed sharply since 2021, when nearly $50B in loans were issued. That number fell to $31B in 2022, and even less in 2023 as higher borrowing costs put stress on borrowers. In response, REITs shifted their focus to asset management and loan workouts, many halting new originations entirely.

Credit Quality in Focus

By mid-2023, risk-rated loans in categories 4 and 5 (i.e., distressed or near non-performing) topped $10B across these firms. In line with post-GFC accounting standards, REITs have beefed up their CECL reserves to account for expected lifetime losses.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Case In Point – Blackstone Mortgage Trust

Blackstone, the largest player in the space, has reduced its loan book by over 26% since its $26.8B peak in 2022. It currently holds $19.7B in loans, representing 24.4% of the entire mortgage REIT sector. Still, Blackstone has recently ramped up activity—originating $1.4B in loans in H1 2025 (up from just $103M in H1 2024)—while receiving $3.4B in repayments.

Sector Rotation Underway

Blackstone and other REITs are strategically lowering their exposure to the office sector. Blackstone’s office exposure dropped from 41% in mid-2022 to 28% today, while its multifamily allocation rose to 27% and industrial to 18%. In some cases, partnerships—such as Blackstone’s with M&T Realty Capital—are providing borrowers a path to agency takeouts via Fannie Mae and Freddie Mac programs.

The Big Picture

Amid ongoing uncertainty in commercial real estate, especially in the office sector, mortgage REITs are playing defense. Liquidity is up, portfolios are leaner, and capital is being redeployed to more stable property types. While lending is slowly resuming, risk management remains a top priority.