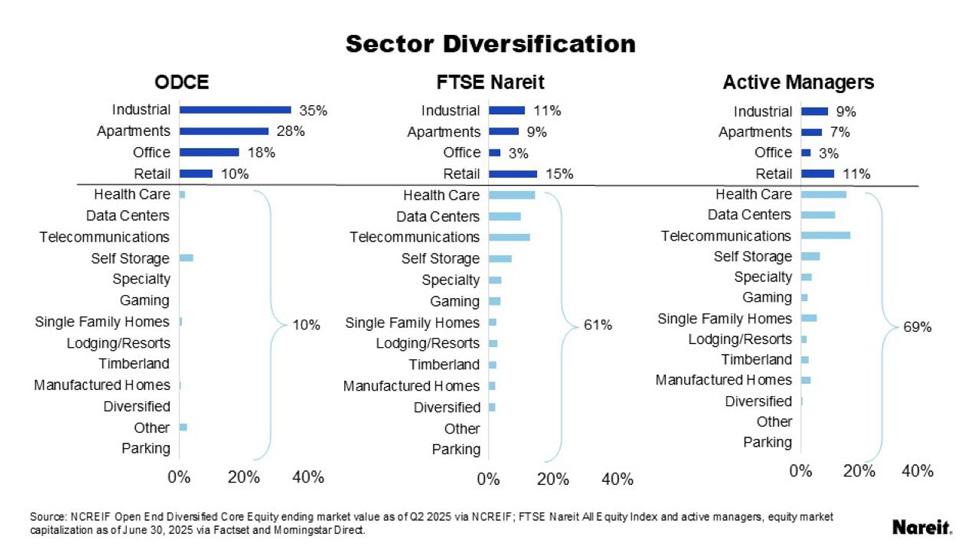

- Private real estate stays traditional, with 90% of ODCE fund allocations in core sectors like office, retail, industrial, and apartments.

- REIT managers diversify, shifting heavily into non-traditional sectors such as telecommunications and reducing exposure to office and retail.

- rnrnIndustrial leads growth, with ODCE tripling its allocation since 2015, while public REITs pulled back in 2025 after earlier gains.rn

A Clear Divide

New analysis comparing NCREIF’s ODCE funds with actively managed REIT portfolios highlights a significant divergence in sector investment approaches over the past decade, per Nareit.

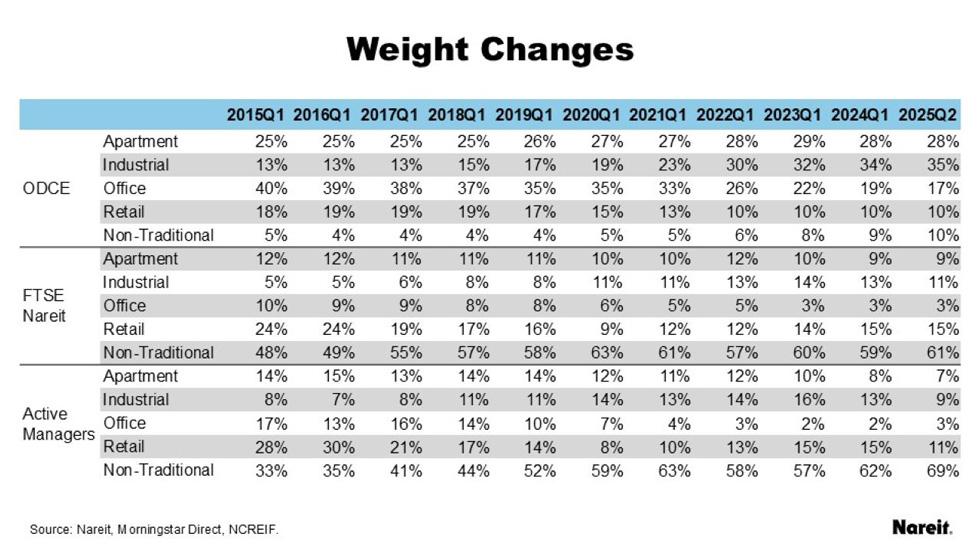

While both private and public real estate investors are trimming exposure to traditional sectors, private vehicles remain anchored in them—especially in office and industrial—while public REITs shift capital into alternative property types.

Breaking Down the Allocations: Office

ODCE funds began the period in 2015 with a 40% allocation to office but have since cut that to 17%. Despite the reduction, it remains a key holding. In contrast, REIT index allocations dropped by 70%, and active managers reduced theirs by over 80%, reflecting growing aversion to the sector.

Apartments

While ODCE slightly increased apartment allocations from 25% to 28% over the decade, active managers halved theirs—from 14% in 2015 to 7% in 2025. The REIT index followed a similar downward trend, dropping to 9% in 2025.

Industrial

This sector was a bright spot across the board during the pandemic. ODCE nearly tripled its share from 13% to 35%. Active managers saw growth early on but reversed course in 2025, dropping industrial allocations down to 9%, still above FTSE Nareit levels.

Retail

ODCE retail exposure shrank from 18% to 10% over the decade, in contrast with REITs, where retail regained favor post-COVID. Active manager allocations, which dipped as low as 8% in 2021, rebounded to 11% by mid-2025.

Public Embraces the New Frontier

The clearest distinction lies in the non-traditional sectors. While ODCE only grew its allocation to these sectors from 5% to 10% over ten years, active REIT managers pushed theirs to 69% in 2025. The REIT index also leaned heavily in this direction, reaching 61%.

Top non-traditional holdings among active managers include telecommunications and data centers, reflecting shifts in tenant demand, tech-driven asset classes, and economic resilience.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It Matters

The divergence reflects more than just risk tolerance—it signals differing liquidity needs, investment horizons, and strategic flexibility. While ODCE funds remain more stable and concentrated in legacy assets, public REIT managers are chasing growth and adaptability.

This gap in allocations may widen further as market conditions evolve, regulatory frameworks shift, and investor preferences lean toward resilience and innovation.

What’s Next

As property market dynamics continue to shift—especially in the face of remote work, inflation pressures, and interest rate uncertainty—expect public real estate strategies to keep leaning into diversification. Meanwhile, private real estate may eventually need to revisit its traditional allocations to remain competitive with more nimble, publicly traded peers.