- CRE loan spreads stayed stable for the week ending September 12, 2025, as markets anticipate a possible Fed rate cut.

- CRE loan spreads stayed stable for the week ending September 12, 2025, as markets anticipate a possible Fed rate cut.

- CRE loan spreads stayed stable for the week ending September 12, 2025, as markets anticipate a possible Fed rate cut.

Stable Spreads Reflect Market Confidence

With the Federal Reserve widely expected to cut interest rates by 25 basis points at its September 2025 meeting, commercial real estate lenders appear largely unfazed. According to Trepp’s weekly spread survey, spreads across low loan-to-value (LTV) loans were steady last week—signaling that lenders are still comfortable taking on lower-risk CRE deals, even amid economic uncertainty.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

A Closer Look at the Data

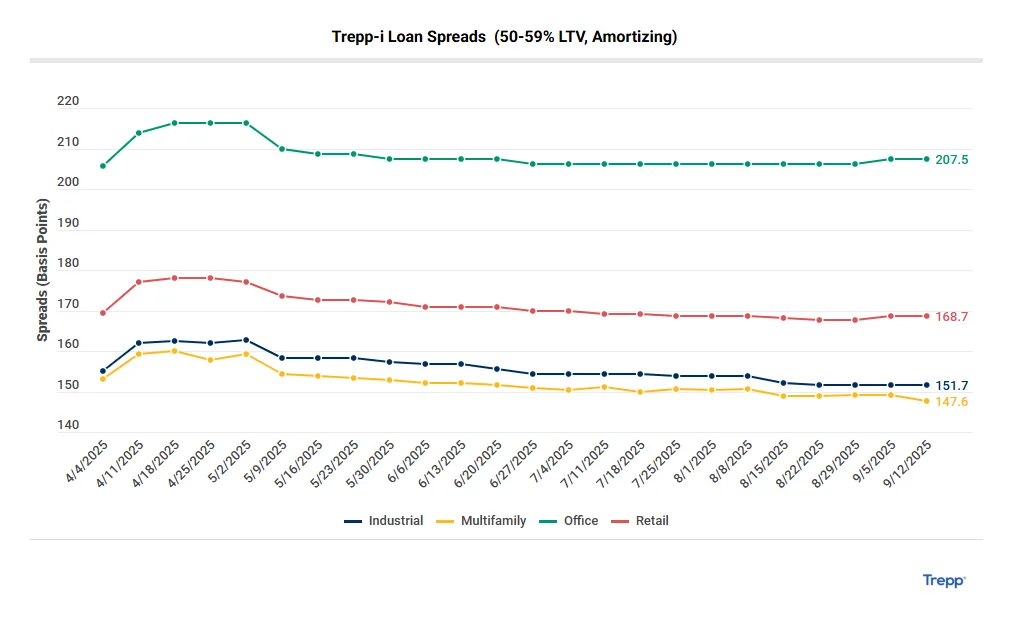

Trepp-i, Trepp’s weekly spread survey, aggregates data from balance sheet lenders across property types and LTV buckets, offering a real-time snapshot of lending sentiment. For the week ending September 12:

- Multifamily: Spreads tightened by nearly 2 basis points, coming within 8 bps of the record tight set in February 2022.

- Retail: Held steady at 168 basis points over the 10-year Treasury, just 4.5 bps above its February 2022 tight.

- Industrial: Unchanged at 151 bps, still 11 bps wider than February 2022 levels.

- Office: Flat at 207 bps—30 bps tighter than the 2023 peak, but still far from the February 2022 low.

Why It Matters

Loan spreads serve as a key barometer of lender risk appetite and capital availability. Trepp’s data suggests that lenders are increasingly confident in the performance of lower-leverage loans, even as macroeconomic signals remain mixed. Compared to the volatility seen during previous market disruptions, the current stability in spreads indicates resilience among both borrowers and lenders.

What’s Next

Should the Fed announce a rate cut as expected, attention will turn to how spreads react across property sectors—especially as new economic projections emerge. Trepp’s weekly CRE spread survey will remain a valuable tool for market participants benchmarking lending terms or gauging sector sentiment.