- The spread between REIT cap rates and private real estate appraisals widened again in mid-2025, slowing deals and pricing clarity.

- In past cycles, wide spreads have often been followed by REITs outperforming private real estate by large margins.

- REITs may keep a performance edge in the months ahead as they adjust faster to market shifts.

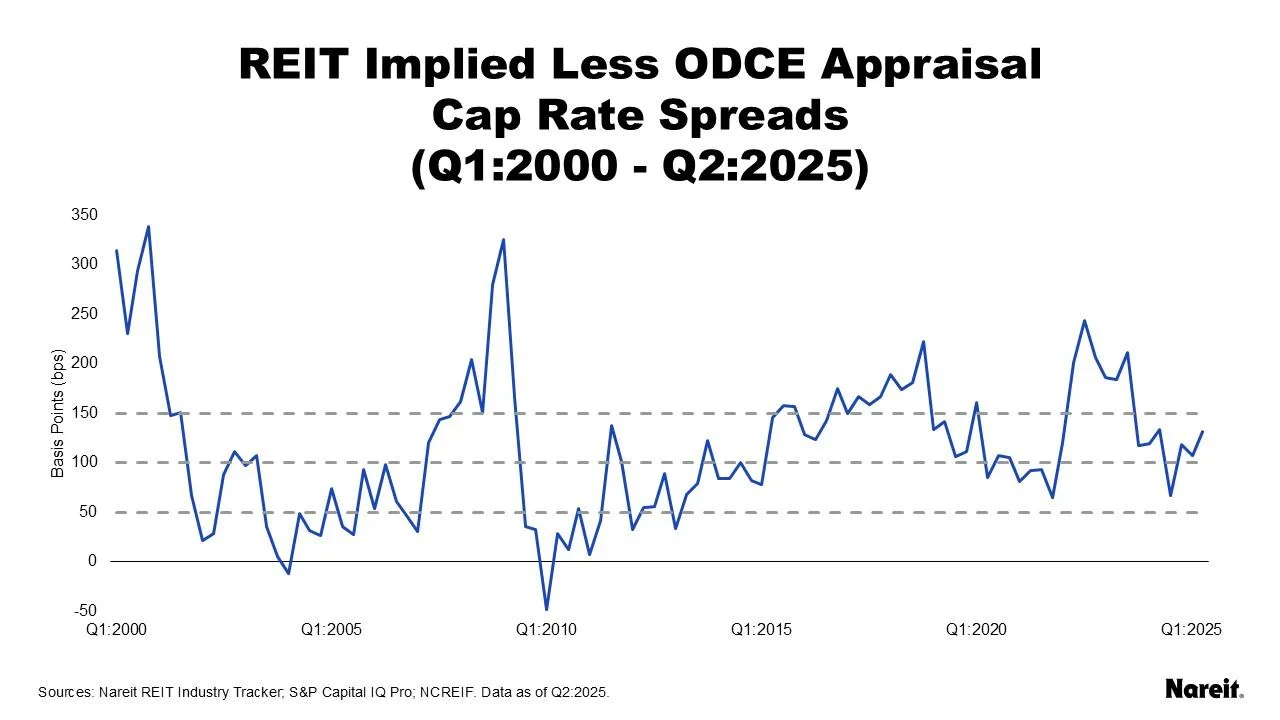

Commercial real estate has been dealing with an unwanted guest: a stubborn valuation gap between public and private valuations, reports Nareit. Many hoped the divide would narrow in 2025, but by mid-year, it grew again. REIT cap rates rose while private appraisal rates barely moved.

The Spread Story

Since 2000, the gap between REITs and private open-end core equity (ODCE) funds has spiked four times. Each spike tied to stress in the economy: the dot-com bust, the global financial crisis, COVID, and the 2022 interest rate surge. After each peak, the spread dropped, and public and private values came closer together.

Today, the spread sits above 130 basis points—almost double last year’s level. This signals that the market is still far from aligned.

REITs’ Post-Peak Advantage

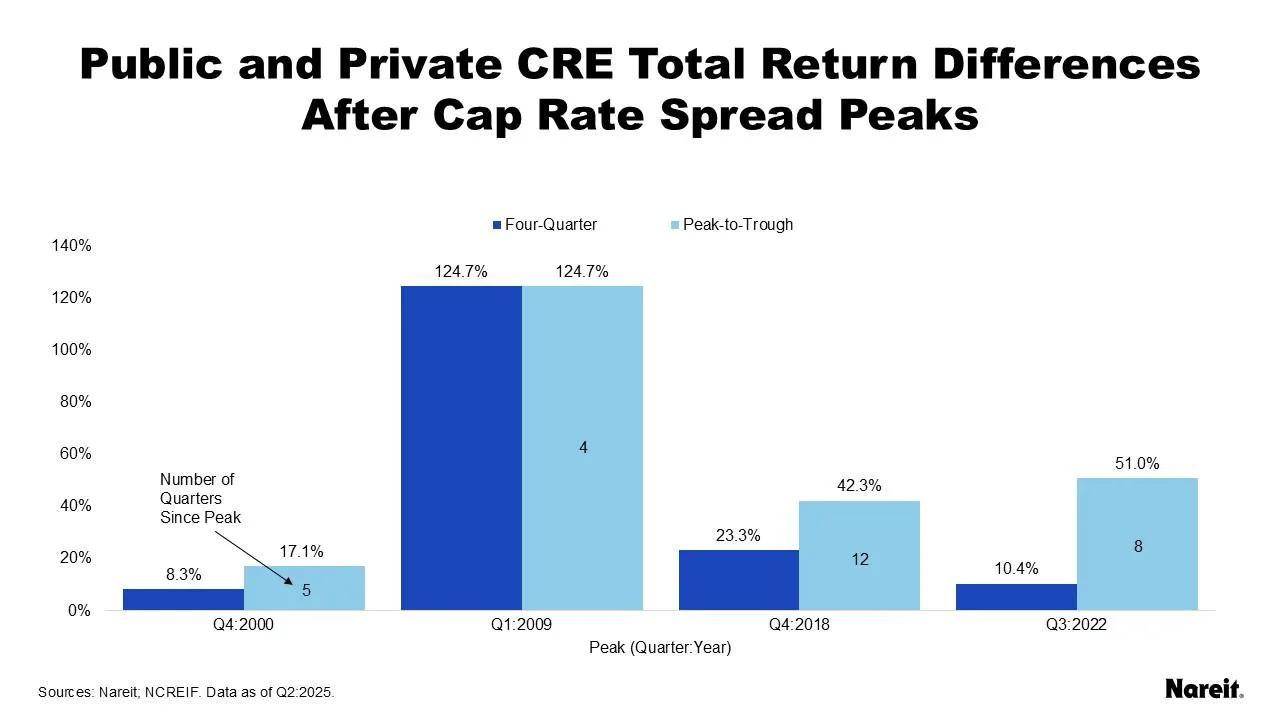

History shows that REITs tend to beat private real estate after valuation gap peaks. Over four quarters, REIT outperformance has ranged from 8% to more than 120%. From peak to trough, the average gain over private funds was almost 59%.

Even during the most recent cycle, when both public and private returns fell under pressure from higher rates, REITs still pulled ahead by more than 50%.

Why It Matters

Private valuations have not moved much even as capital markets shifted. This lack of change has slowed deals and made price discovery harder. For investors, though, this misalignment means REITs may once again benefit from adjusting more quickly to market conditions.

What’s Next

As values slowly move back in line, REITs may keep an advantage in both performance and acquisitions. If history repeats, today’s wide spread could set the stage for REITs to deliver stronger returns than private real estate in the near term.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes