- Retail pricing climbed 6.90% YoY, driven by demand for necessity assets, though tariffs are reshaping inventory and leasing strategies.rn

- Office remains slow-moving, with a 9.64% YoY price rise but 239 days on market, reflecting cautious buyers and lender hesitation.rn

- Industrial momentum cooled, as pricing dipped 1.94% MoM and deals took longer to close amid tighter underwriting standards.rn

- Multifamily held steady, with 1.20% YoY price growth and sustained demand for stabilized, well-located communities.rnrnrn

Retail Holds Steady Amid External Headwinds

As reported by Crexi, retail was a standout performer in the cre market in August, with median sale pricing hitting $214.74/SF — a 6.14% MoM and 6.90% YoY gain. This uptick follows a slower July and reflects renewed investor appetite for stabilized grocery-anchored and experiential centers. Cap rates compressed slightly, and effective lease rates rose 4.19% MoM, suggesting fewer concessions and stronger tenant demand.

Still, the backdrop isn’t all tailwinds. Tariffs are impacting retailer inventory strategies, with 2025 import volumes expected to decline 5.6% from last year. Supply chain uncertainty is influencing leasing timelines, especially for short-term space needs.

Office Sees Higher Pricing but Long Waits

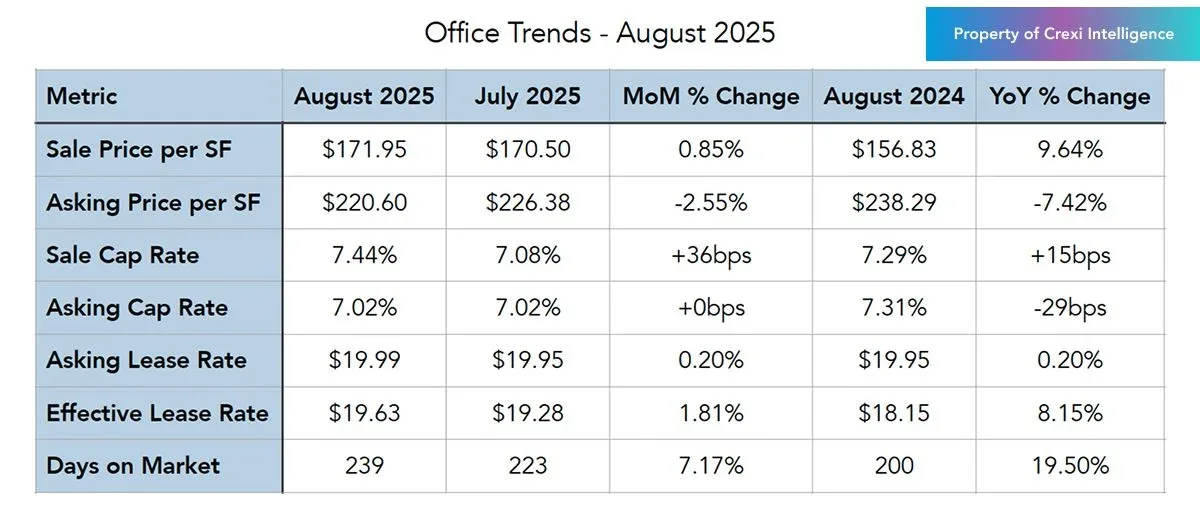

Despite an encouraging 9.64% YoY gain in sold pricing, office remains CRE’s most challenged sector. Properties lingered on the market for 239 days on average — a 19.50% YoY jump — as buyers demand greater returns amid ongoing leasing risk and capital expenditure requirements.

Cap rates on closed sales rose to 7.44%, while asking yields held at 7.02%, underlining a disconnect between buyer expectations and seller pricing. Conversions and demolitions are helping reduce oversupply, but elevated vacancy (near 19.4%) continues to weigh on legacy assets.

Industrial Activity Cools, But Long-Term Demand Endures

Industrial showed signs of deceleration, with sold pricing dipping 1.94% MoM to $107.15/SF, though still up 8.39% YoY. Cap rates compressed as buyers prioritized well-located, modern logistics facilities. However, days on market rose to 240, indicating lengthier deal timelines, especially in secondary markets.

National absorption remained healthy, at 29.6M SF in Q2, but new deliveries and tariff-related supply chain shifts are creating short-term volatility. The development pipeline has slowed, which could help normalize market conditions into 2026.

Multifamily Remains Resilient and In-Demand

Multifamily continues to outperform other asset types in stability. Median sold pricing rose 3.55% MoM to $210.28/SF, with properties trading faster than industrial and office. cap rate spreads between sold and asking indicate ongoing price discovery, but underlying rental demand remains robust.

San Francisco saw one of the strongest rebounds, with rents jumping 11% YoY, buoyed by tighter vacancies and increased office attendance. National rent growth is modest, but broad affordability challenges in the housing market continue to sustain multifamily demand.

Looking Ahead

The Fed’s July rate hold, coupled with hints at possible cuts later in 2025, could ease debt costs into 2026, offering some relief across all asset classes. Retail and multifamily are best positioned for resilience in the near term, while office and industrial face a more complex path forward amid macroeconomic and policy uncertainties.

Crexi’s data shows that while the CRE market remains uneven, selective opportunities exist — especially for investors focused on stabilized, well-located assets in sectors with durable fundamentals.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes