- AI-skilled tech talent surged 50%, with San Francisco, Seattle, and Toronto leading in workforce growth and job concentration.

- Traditional high-tech sectors shrank, while finance, logistics, and business services increasingly absorbed tech talent.

- Rising costs in major hubs are driving employers to emerging markets like Calgary, Waterloo Region, and Nashville for affordable, skilled labor.

AI Skills Redefining Tech Talent Demand

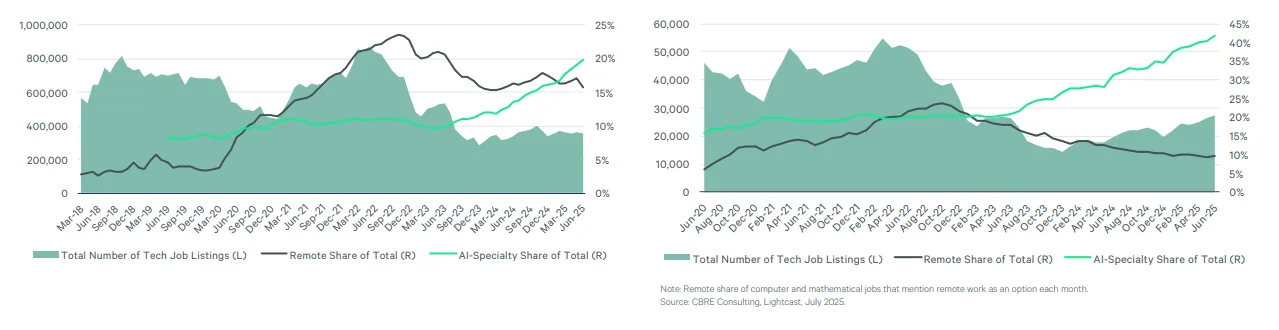

Employers across North America are aggressively realigning their tech talent workforces to support artificial intelligence initiatives, reports CBRE. As a result, AI-skilled tech professionals increased by over 50% in the past year. The San Francisco Bay Area alone recorded 11,400 AI job postings in June 2025. AI roles made up 42% of total tech job postings in the region—up from just 20% three years ago.

Remote work is declining across tech roles, particularly in AI. In San Francisco, just 10% of tech job postings offered remote options as of June, down from 24% in mid-2022.

AI and Remote Job Share Trends

Winners & Losers

The US tech talent workforce grew by just 1.1% in 2024, a significant slowdown from 3.6% in 2023. The traditional high-tech sector lost 76,230 jobs. In contrast, sectors like finance, transportation, and logistics saw the strongest growth in tech talent.

Canada outpaced the US, with 5.9% tech workforce growth. Canadian high-tech employment rose by 11.2%, signaling stronger momentum north of the border.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

The Geography Of AI Talent

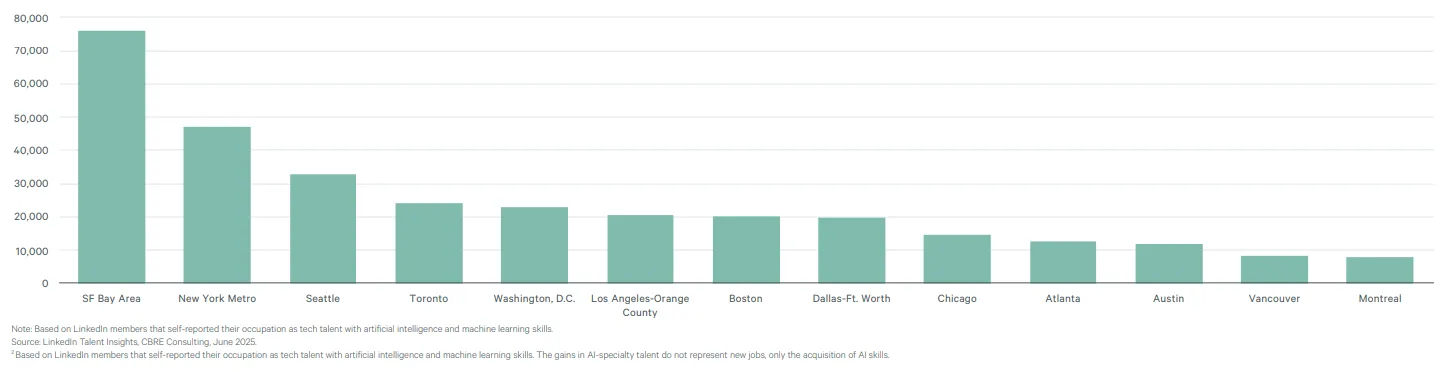

The top markets for AI-specialty talent in the US are:

- San Francisco Bay Area

- New York Metro

- Seattle

In Canada, it’s:

- Toronto

- Vancouver

- Montreal

AI Tech Talent by Market

These markets account for the bulk of AI-skilled workers, with San Francisco, Seattle, and Vancouver having the highest concentration of AI jobs within the tech industry.

Labor Costs Creating Opportunities Elsewhere

Cost disparities remain stark. A 500-person tech firm leasing 60K SF of office space pays:

- $87M annually in San Francisco, versus

- $35M in Edmonton, the lowest-cost market in the ranking.

Toronto, Dallas-Ft. Worth, and Calgary are creating significantly more tech jobs than they have tech-degree graduates. This gap presents strong opportunities for employers looking to relocate or expand.

Growth Of Emerging Tech Talent Hubs

Markets like Waterloo Region (+58%), Calgary (+61%), and Nashville (+29%) are gaining steam. These cities are seeing rapid growth in their populations of people in their 20s and 30s. They also have rising concentrations of college-educated talent. Together, these factors could drive future tech expansions.

Meanwhile, legacy education hubs like Boston, Washington, DC, and Los Angeles produced more tech graduates than jobs, suggesting outbound talent flow.

Diversity Challenges Remain

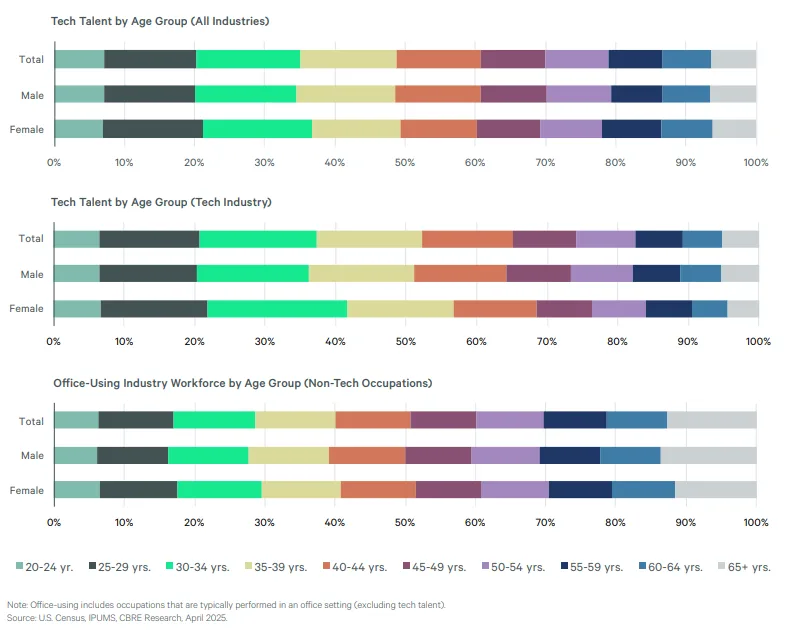

Women make up only 24% of the total tech workforce and just 20% in the tech industry specifically. Underrepresented minorities (Black, Hispanic, and Other) account for only 23% of tech jobs—lower than their share in office-using industries.

Canada’s tech workforce is slightly more diverse but still shows underrepresentation for marginalized groups.

What’s Next?

There are over 7.4M tech talent workers in the US and Canada. As AI reshapes hiring, office use, and location strategies, companies are expected to pursue growth in mid-sized and emerging markets. These areas offer abundant talent and more manageable costs.

Expect competition for AI talent to intensify and the geography of tech to continue decentralizing.