- RevPAR declined 0.7% for the week ending Sept. 6, marking the 10th consecutive week of stagnant or negative growth in the US hotel industry.

- Top 25 hotel markets underperformed, with Houston and Las Vegas dragging overall results, while San Francisco led with a 24.7% RevPAR increase.

- Labor Day travel had limited impact, with only modest gains, and event-driven demand like college football provided uneven, localized boosts.

- Economy hotels saw the steepest declines, especially in major markets, while luxury hotels posted modest weekday and weekend growth.

Tepid Trend Persists

The US hotel industry kicked off September on a weak note, as RevPAR declined 0.7% for the week ending Sept. 6, reports CoStar. This marks the 10th straight week where RevPAR changes have remained within a narrow +/-0.5% range. The last time such a pattern occurred was in early 2021. Prior to that, similar streaks were seen during economic slowdowns in 2009 and 2002.

Occupancy continues to drive the trend, although ADR’s 0.2% dip this week also contributed to the decline. In total, 84 markets reported negative RevPAR comparisons. This is a slight improvement from the 88 markets recorded the previous week. However, the numbers still point to a sluggish outlook for the industry.

Major Markets, Mixed Results

The top 25 hotel markets fared worse than smaller ones again, with a 1.5% RevPAR decrease compared to a near-flat performance (-0.1%) elsewhere. This marks 11 straight weeks of underperformance for the top 25, weighed down by poor results in Houston and Las Vegas.

- Houston RevPAR plunged 18.7%, largely due to tough comparisons against last year’s post-storm demand surge.

- Las Vegas also dragged, impacted by reduced international travel and broader economic softness.

- San Francisco was a standout, leading all markets with a 24.7% RevPAR increase driven by improvements in both occupancy and ADR.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Labor Day Provided Little Lift

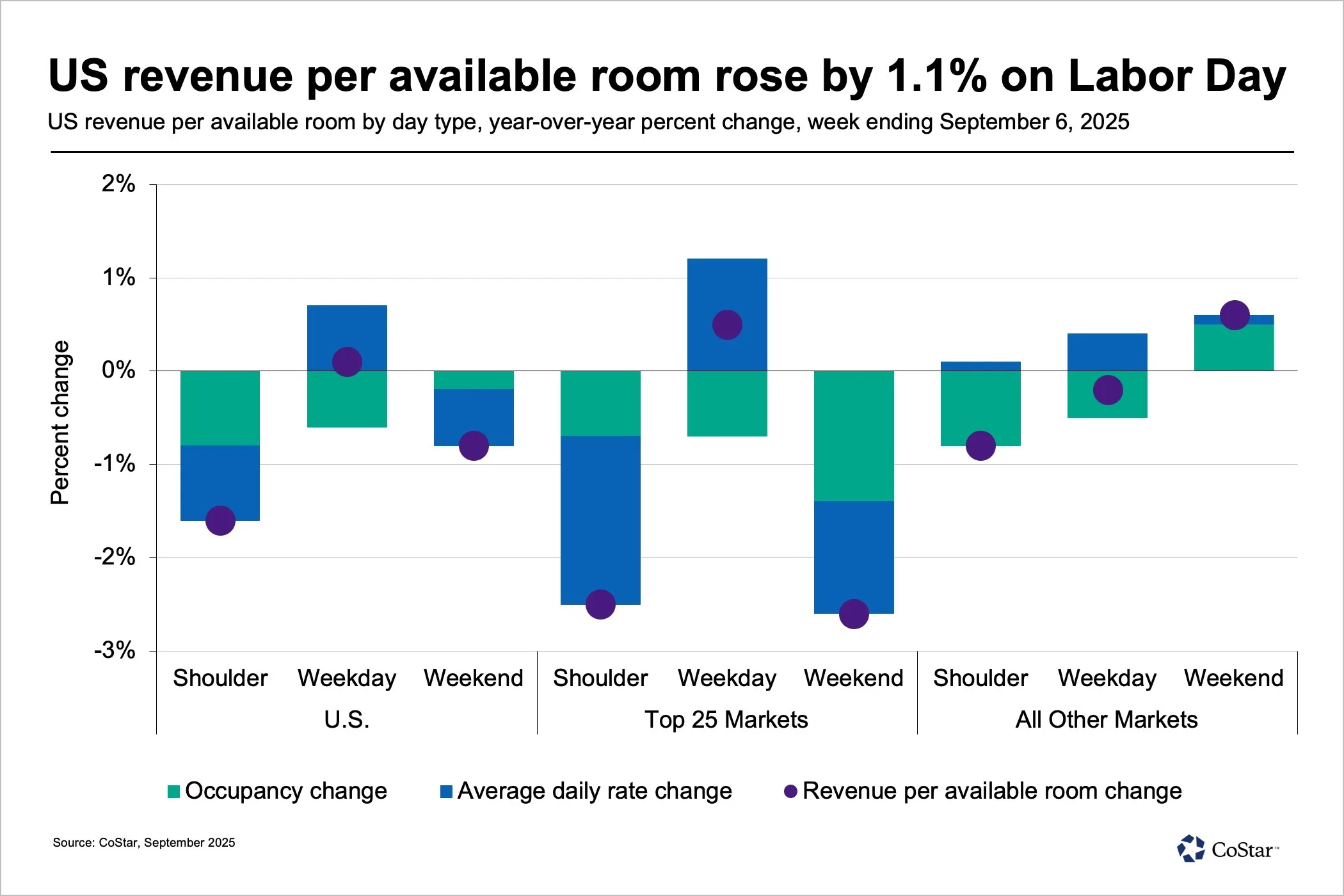

Despite including Labor Day, the week’s performance was underwhelming. Weekday RevPAR rose slightly (+0.1%) due to strength in San Francisco and San Diego, while Labor Day itself saw a modest 1.1% RevPAR gain.

However, weekend and shoulder day performance lagged, with Friday-Saturday RevPAR down 0.8% and Sunday-Thursday down 1.6%.

College football did bring localized boosts, with:

- Oklahoma City up 72.5%

- Wisconsin North up 47.3%

- Missouri North up 43.2%

But these gains were offset by declines in other markets, highlighting the volatility tied to event-based demand.

Hotel Class Performance Still Split

Hotel performance continues to vary significantly by class:

- Luxury hotels saw weekday RevPAR increase 4%, with gains also observed over the weekend.

- Economy hotels declined the most, with a 5.6% weekend drop driven by equal reductions in occupancy and ADR.

- Economy hotels in top 25 markets have fared especially poorly, with RevPAR down 9.3% last week and 10.8% over the past eight weeks.

Looking Ahead

Industry analysts expect modest rebounds over the next two weeks, citing cleaner calendar comparisons and fewer holiday disruptions. However, Rosh Hashanah (Sept. 22–24), Yom Kippur (Oct. 1), and lingering effects from last year’s hurricanes may dampen results later this month and into October.

Global Context

International hotel markets continued to outperform the US:

- Global RevPAR rose 3.7% despite a slowdown in occupancy.

- Markets like Italy, France, Japan, and India saw double-digit growth.

- Canada (+3.6%) and Mexico (+3.7%) both slowed due to seasonal declines in occupancy but still posted solid gains.

Bottom Line

US hotels are in a prolonged period of stagnation, with RevPAR stuck in neutral due to persistent occupancy declines and economic pressures. While certain segments and international markets show resilience, the broader US hotel industry faces a challenging path ahead as it enters the fall travel season.