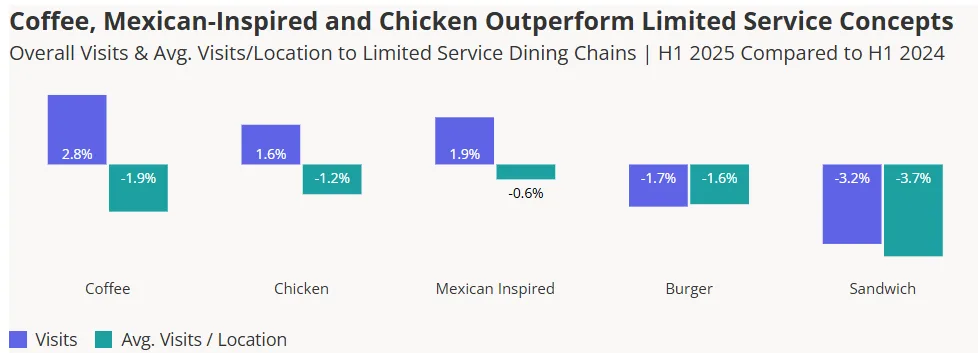

- Coffee, chicken, and Mexican-inspired QSR chains outpaced other limited-service categories in visit growth during the first half of 2025, thanks to customizable formats and protein-forward menus.

- Visits per location declined across all major QSR segments, signaling potential overexpansion and weakening per-unit performance.

- Summer softness and August declines underscore consumer caution, highlighting the importance of sustainable, demand-driven growth strategies.

Chicken, Mexican, And Coffee Chains Lead 2025 QSR Trends

QSR operators have faced mounting challenges in 2025, from inflationary pressures to shifting consumer spending habits. While overall traffic has softened across the industry, coffee, chicken, and Mexican-inspired brands have emerged as relative bright spots, reports Placer.ai.

These categories appear to be benefitting from consumer demand for affordable, customizable, and protein-rich options. Coffee has remained resilient as a daily ritual. Chicken and Mexican chains, meanwhile, have leaned into fast, flexible menus. These offerings continue to resonate with cost-conscious diners.

Visit Growth VS. Visit Efficiency

While overall visits to these categories were up, the story changes when looking at per-location traffic. Across the board — including the high-performing categories — visits per store declined, indicating that unit expansion may be running ahead of demand.

This disconnect suggests a looming risk of saturation. Operators pushing aggressive growth strategies without corresponding demand could see diminishing returns at the store level, despite positive headline traffic numbers.

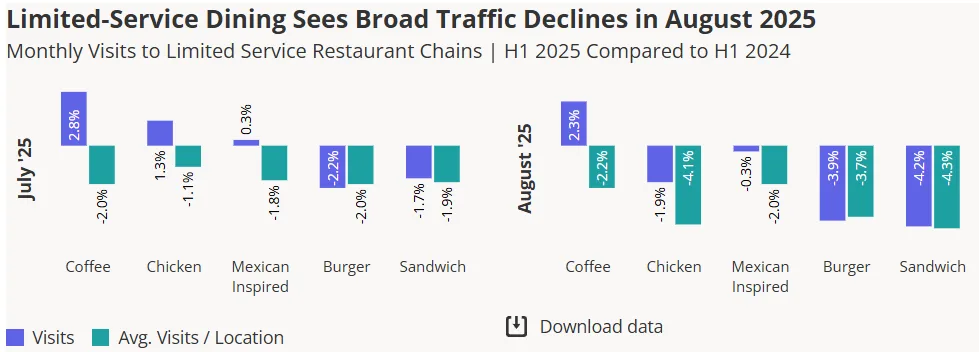

August Numbers Reflect A Cautionary Trend

After solid performance in the first half of the year, traffic began to slow in July and August. The decline was especially noticeable for chicken and Mexican QSRs. By August, visit declines were broad-based, and chicken chains experienced a steep drop in per-location traffic. Coffee was the only major segment to sustain growth through the summer.

This pullback coincides with continued economic uncertainty. It points to growing consumer hesitancy to spend, even in traditionally budget-friendly QSR categories.

What’s Next

Despite near-term volatility, consumer preferences for convenience, customization, and value remain clear. As the economy stabilizes, QSR brands that resist overexpansion will be better positioned for long-term success. Focusing on menu innovation, digital loyalty, and operational efficiency can help them capture renewed traffic.

Operators who can drive higher productivity per store and build brand affinity are likely to outperform — especially when demand begins to rebound in a more stable economic environment.

Bottom Line

Coffee, chicken, and Mexican-inspired QSRs are leading category growth in 2025. However, the industry’s next chapter will depend on smart scaling and sustainable operations—not just adding more locations.