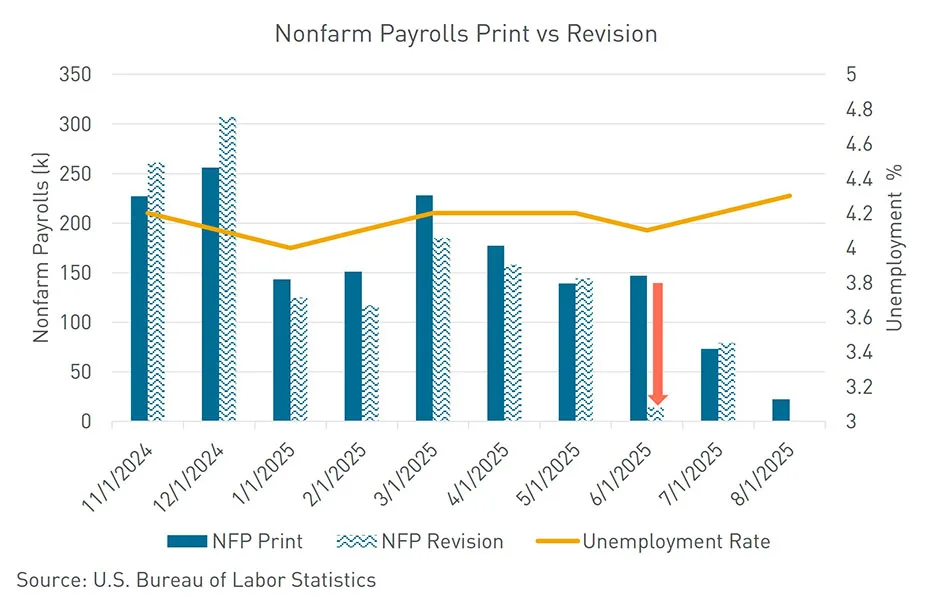

- August Nonfarm Payrolls increased by just 22,000, well below the 75,000 consensus estimate, while the unemployment rate ticked up to 4.3%, matching the cycle high.

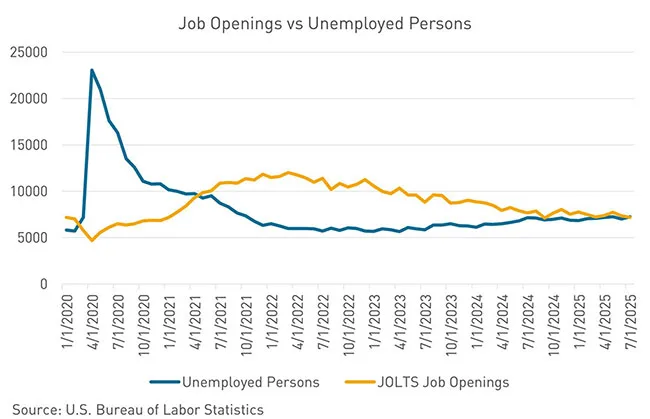

- The July JOLTS report showed job openings falling to a 10-month low, with the number of unemployed workers now equal to the number of available jobs.

- Traders have largely priced in a September rate cut, with attention shifting to how many additional cuts the Fed could deliver in 2025.

A Labor Market Slowdown Takes Hold

The Federal Reserve enters its September meeting with unmistakable evidence of labor market weakness. Berkadia’s recent jobs data shows hiring momentum slowing sharply, extending the weakest stretch since the pandemic.

Nonfarm Payrolls rose just 22,000 in August, far below expectations. The unemployment rate edged higher to 4.3%, tying the highest level of the cycle. Along with downward revisions to prior months, employment growth has averaged only 29,000 jobs over the last three months.

Revisions to June and July data highlight the decline. June was cut to –13,000, while July was revised upward to +79,000. The broader trend still reflects a labor market losing strength across most sectors.

Sector Breakdown: Modest Gains, Government Drag

Hiring in health care (+47,000) and leisure and hospitality (+28,000) drove August’s limited growth. Yet health care posted its smallest monthly increase since January 2022.

Federal government payrolls fell by 15,000 in August. Employment in the sector has now declined by 97,000 since January, reflecting policies from the Department of Government Efficiency.

Economists describe conditions as “low-hiring, low-firing.” However, rising layoffs suggest labor market slack is starting to build.

Job Openings Fall To Parity With Unemployment

The July JOLTS report delivered another warning sign. Job openings fell to 7.18 million, a 10-month low. Vacancies dropped most sharply in health care, retail trade, and leisure and hospitality.

For the first time this cycle, unemployed workers now equal job openings — a 1:1 ratio. At the peak in 2022, the ratio was 2:1.

This measure, closely tracked by Fed officials, shows supply and demand for labor are in balance. It also suggests the labor market is no longer fueling inflationary pressure.

Market Reaction And Fed Outlook

Traders have almost fully priced in a September rate cut, with Treasury yields sliding in anticipation. The 10-year yield has fallen nearly 20 basis points since Labor Day.

The September cut looks assured, but the Fed’s path beyond remains uncertain. Market odds for a third rate cut in 2025 rose notably this week, reflecting expectations of deeper easing if job growth continues to weaken.

Why It Matters

The Federal Reserve has emphasized its data-dependent approach. Weak labor prints now leave little room for inaction.

With job growth faltering, unemployment climbing, and openings at cycle lows, the Fed faces pressure to prevent a deeper slowdown. That urgency persists even though the inflation picture remains mixed.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes