- US multifamily rents fell 0.23% in August, marking the second straight month of flat or negative rent growth.

- Midwest and Northeast markets outperformed, while Sun Belt metros like Austin and Las Vegas saw sharper declines.

- High vacancy and continued new deliveries are putting downward pressure on rents in oversaturated markets.

- Coastal and supply-constrained metros, including San Francisco and Chicago, led in year-over-year rent growth.

Cooling National Market

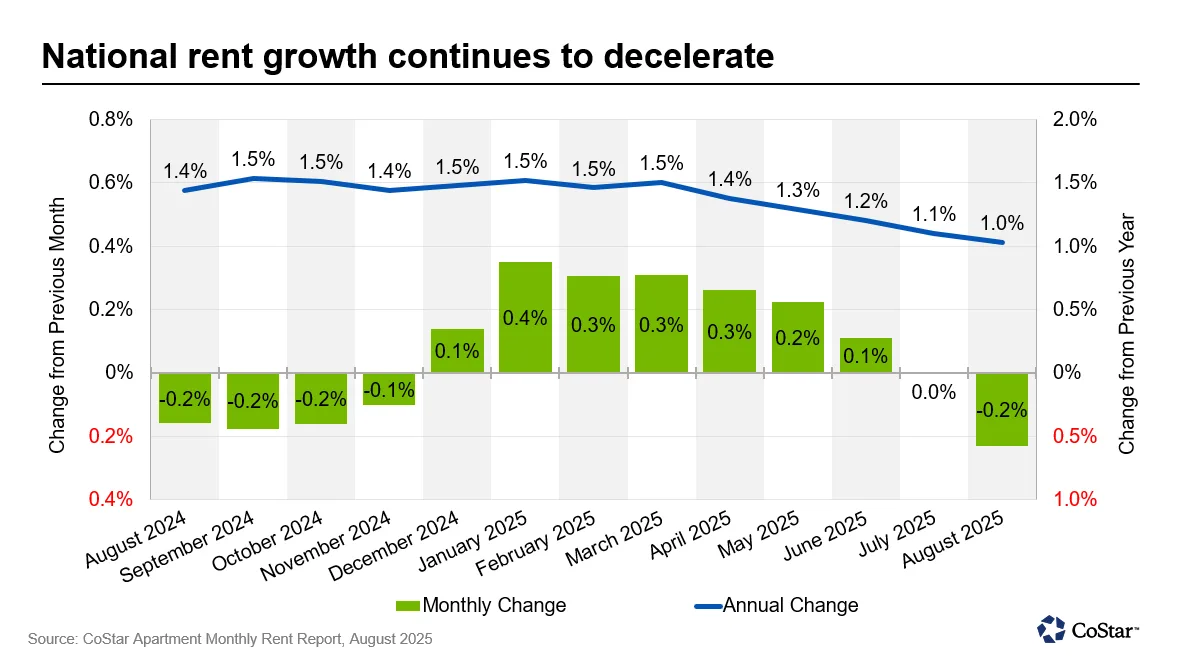

Multifamily rents dropped for a second month in August, falling 0.23% from July’s revised average of $1,719 to $1,713, per Apartments.com. Annual rent growth slowed to 1.0% in August, down from 1.1% in July. At the start of 2025, it was 1.5%. The steady decline highlights a broader cooling in the market beyond typical seasonal patterns.

This marks the sharpest monthly drop since January and underscores a market facing increased pressure from excess supply, particularly in high-growth Sun Belt metros.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

All Regions Turn Negative

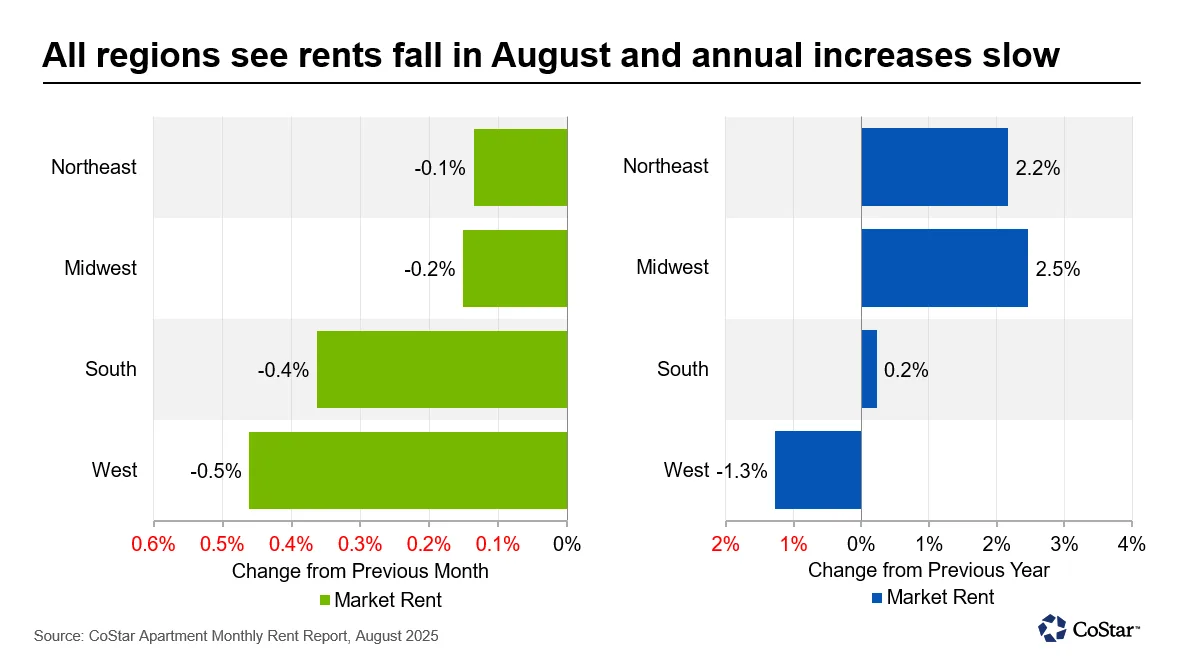

Every US region posted rent declines in August — a shift from July when the Midwest and Northeast still showed growth.

- West: -0.5% MoM

- South: -0.4%

- Midwest: -0.2%

- Northeast: -0.1%

Despite monthly softening, the Midwest and Northeast continue to lead in annual rent growth, at 2.5% and 2.2% respectively. In contrast, the West is down 1.3% year-over-year, marking the weakest performance of any region.

Metro-Level Movers

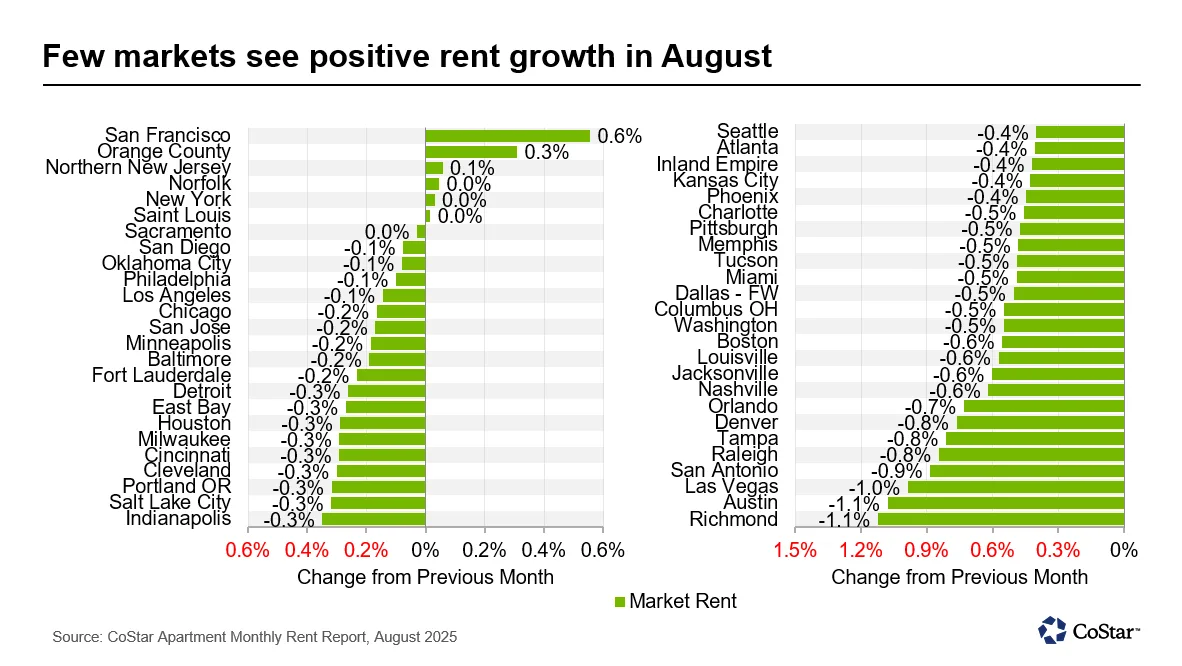

Few metros posted rent increases in August. San Francisco led with a +0.6% MoM gain, followed by Orange County (+0.3%) and Northern New Jersey (+0.1%). These markets tend to be more supply-constrained and are benefitting from stable occupancy.

Meanwhile, Sun Belt cities are seeing rent drops accelerate:

- Richmond & Austin: -1.1% MoM

- Las Vegas: -1.0%

- San Antonio: -0.9%

Austin and San Antonio also continue to report vacancy rates above 15%, with concessions common as operators compete for tenants.

Annual Trends

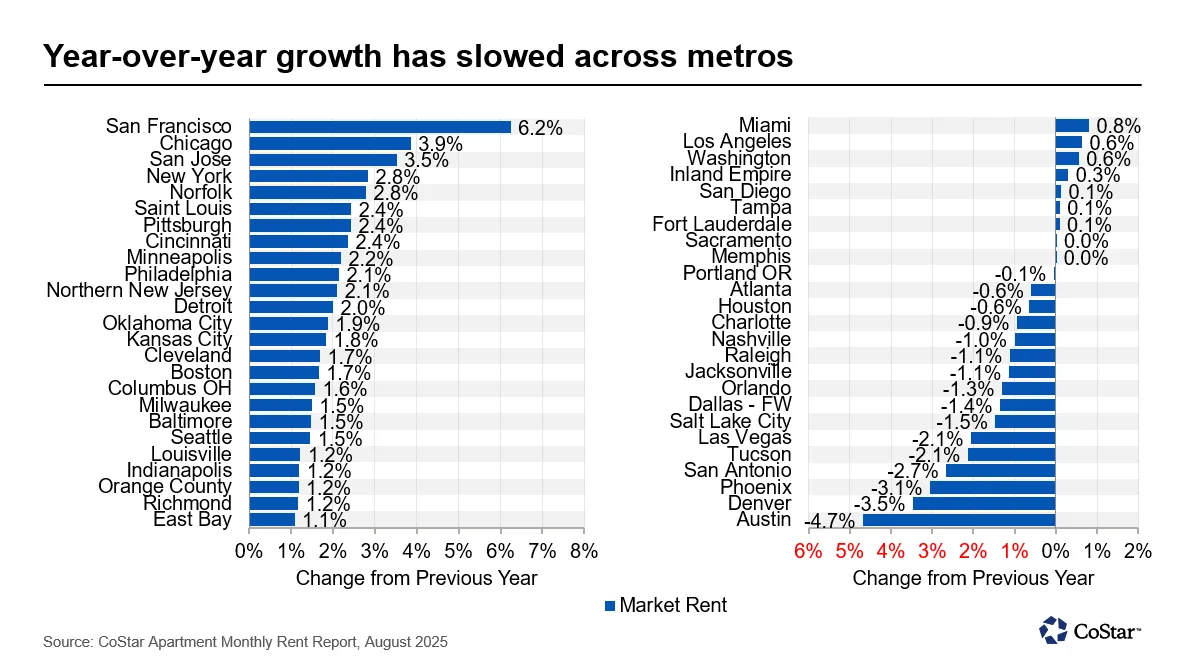

San Francisco remains the strongest national performer, up 6.2% YoY, followed by Chicago (3.9%), San Jose (3.5%), and New York (2.8%). These metros benefit from low new supply and strong local demand.

In contrast, oversupplied markets are pulling back:

- Austin: -4.7%

- Denver: -3.5%

- Phoenix: -3.1%

Florida’s Gulf Coast is also cooling rapidly. Cape Coral rents dropped 6.3%, Naples -3.2%, and Fort Myers -3.0% YoY, as vacancy remains elevated post-hurricane disruptions.

Why It Matters

Rent moderation reflects both seasonal patterns and deeper structural pressures. Developers are still delivering projects into markets with slowing absorption, making lease-up difficult and flattening rent growth. While demand remains healthy in some regions, rising inventory is capping pricing power nationally.

According to data from CoStar and Apartments.com, the gap between oversupplied and supply-constrained markets continues to widen. This growing divide is expected to influence multifamily investment and development strategies for the rest of 2025.

What’s Next

As fall approaches, national rents are expected to remain flat or decline slightly before bottoming out in winter. Supply-constrained markets — particularly in the Midwest and select coastal metros — will continue to outperform, while Sun Belt cities may see further softening unless vacancy levels stabilize.

The longer-term outlook depends on how quickly markets can absorb the backlog of new units — and whether job and population growth can support continued rent resilience in 2026.