- Nationally, apartment deliveries are projected to decline nearly 34% over the next year, marking a return to more typical supply levels.

- Only 10 major apartment markets are scheduled to see an increase in new units delivered by mid-2026.

- Los Angeles leads the pack, with deliveries expected to nearly double to over 15,500 units.

- Other notable increases are forecasted in Detroit, Fort Worth, San Diego, Cincinnati, and select Northeast cities like Boston and New York.

A National Slowdown

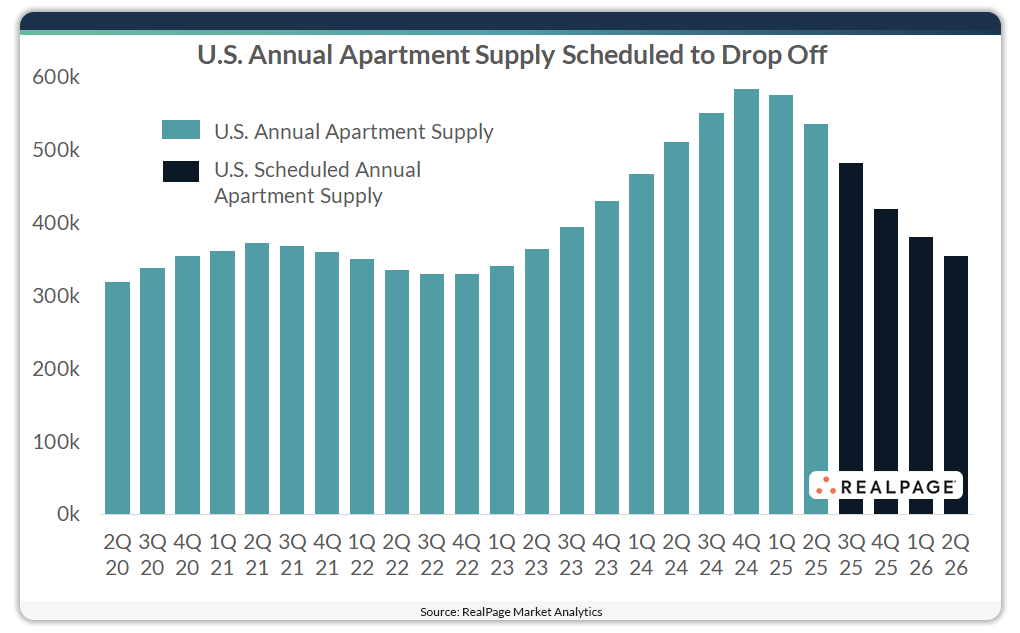

After years of elevated apartment construction, the US multifamily market is entering a cooldown period, reports RealPage. According to RealPage Market Analytics, apartment completions nationwide are expected to fall by 33.9% over the next 12 months. This decline marks a return to more typical supply levels. Delivery volumes are gradually aligning with long-term historical averages.

However, not every market is pulling back.

Markets Defying The Trend

Out of the 50 largest US apartment markets, just 10 are projected to see an uptick in deliveries in the next year. Here’s where construction is still gaining momentum:

1. Los Angeles, CA

- Expected Deliveries: 15,500+ units

- YoY Increase: Nearly 100%

- Why It Matters: LA is set for the largest increase nationwide, despite frequent construction delays.

2. Detroit, MI

- Expected Deliveries: 3,100+ units

- YoY Increase: 77.5%

- Why It Matters: The second-highest increase in the country, signaling a wave of investment in the Midwest.

3. San Diego, CA

- YoY Increase: 70%+

- Why It Matters: Long-starved for supply, San Diego is finally seeing delivery volumes pick up.

4. Anaheim, CA

- YoY Increase: 70%+

- Why It Matters: Another Southern California market reversing recent supply stagnation.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

5. Cincinnati, OH

- Expected Deliveries: 3,100+ units

- YoY Increase: 47.4%

- Why It Matters: A strong delivery pipeline complements the market’s leading rent growth.

6. Fort Worth, TX

- Expected Deliveries: 8,059 units

- YoY Increase: 23%

- Why It Matters: The only large Texas market with growing deliveries, contrasting with Austin, Dallas, and Houston.

Slower But Still Growing: The Northeast

Four major Northeast markets are expected to see modest increases in apartment deliveries, with year-over-year growth ranging from 5% to 17%:

- Pittsburgh, PA

- Newark, NJ

- Boston, MA

- New York, NY

While growth is slower compared to leading markets like Los Angeles or Detroit, these cities are still attracting developer interest. The pace may be cautious, but it signals continued confidence in long-term demand.

Why It Matters

This shift underscores a more selective development cycle. Only a handful of markets are expected to buck the national slowdown. Factors driving this include strong demand fundamentals, local incentives, and the completion of existing construction backlogs.

Developers and investors alike are likely to focus their attention and capital on these growth markets, especially as financing conditions and rent trends vary widely across regions.

What’s Next

Expect delivery volumes to remain below recent highs nationally, even in rising markets. Still, these 10 metros could offer opportunities for lease-up gains, rent stability, and long-term performance as the national construction wave recedes.