- Mall traffic slowed in August, capping off a summer of weaker performance, though indoor malls posted modest YoY growth and outlet malls narrowed their visit gap.

- Shorter visit durations and a softer Labor Day weekend suggest consumers are pulling back on discretionary purchases and seeking routine value over promotional events.

- Malls now face a critical holiday season where value-oriented deals and experiential shopping could help recapture momentum amid changing consumer behavior.

Slowing Momentum Continues In August

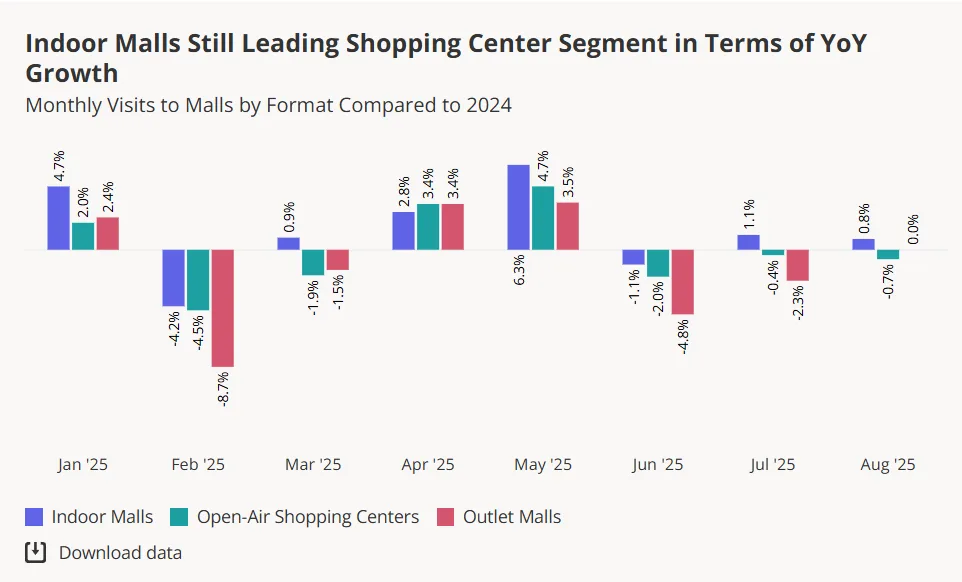

After a strong spring, mall visitation trends lost steam through the summer, reports Placer.ai. According to their August 2025 Mall Index, overall visits in June declined year-over-year across all mall types. July and August saw stabilized, yet muted, performance.

Indoor malls were the only format to register year-over-year growth in both July and August, although the gains were modest. Outlet malls also made up ground during this period, likely driven by back-to-school shopping. The resilience of both formats suggests shoppers are focusing more on value-driven purchases.

Labor Day Traffic Shows Consumer Restraint

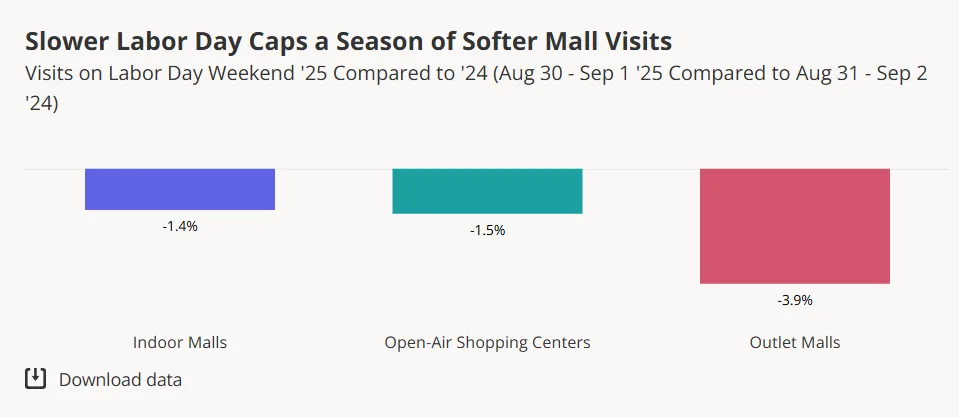

Labor Day weekend, typically a high-traffic retail moment, ended the summer on a quieter note. All mall formats saw slight year-over-year declines in traffic, with outlet malls recording the steepest drop. Indoor malls again outperformed with the smallest YoY gap.

Rather than waiting for promotions, consumers may have shifted their shopping to earlier in August. This highlights a trend of spreading out value-based purchases instead of concentrating them around major retail holidays.

Visit Duration Declines – A Shift In Behavior?

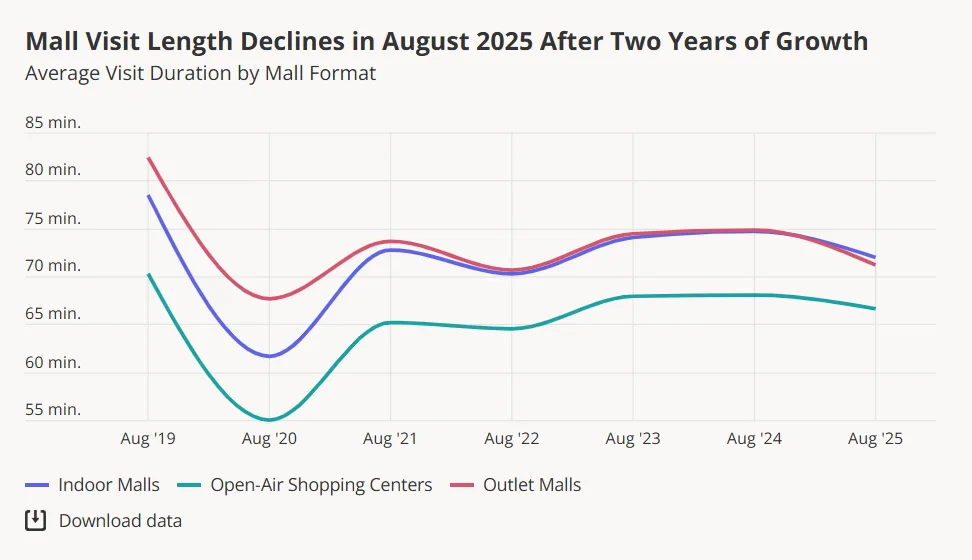

Another key data point: visit duration. While mall visit lengths had been recovering since the pandemic, August marked a reversal. Average visit time declined, pointing to more targeted shopping trips and a pullback from browsing or leisure-driven visits.

This signals a shift in how consumers are approaching in-person retail—more focused, more frugal, and less inclined to linger.

Cautious Optimism Heading Into Holiday Season

Despite recent softness, it may be premature to declare a long-term downturn in mall performance. Strong spring traffic, along with indoor malls’ continued resilience, suggests that demand for in-person retail remains. Outlet centers closing their visit gaps further supports this, though the focus has shifted toward value and efficiency.

Looking ahead, the holiday season presents a pivotal opportunity. Malls that blend promotions with immersive experiences could stand out in a market where consumers are still willing to spend, but more selectively. With inflation pressures and caution still in play, delivering everyday value alongside festive appeal will be key to winning foot traffic and wallet share.

Bottom Line

Malls aren’t out of favor—but consumers are more value-conscious than ever. To stay relevant, shopping centers must evolve from being pure retail hubs to becoming destinations where savings meet experience.