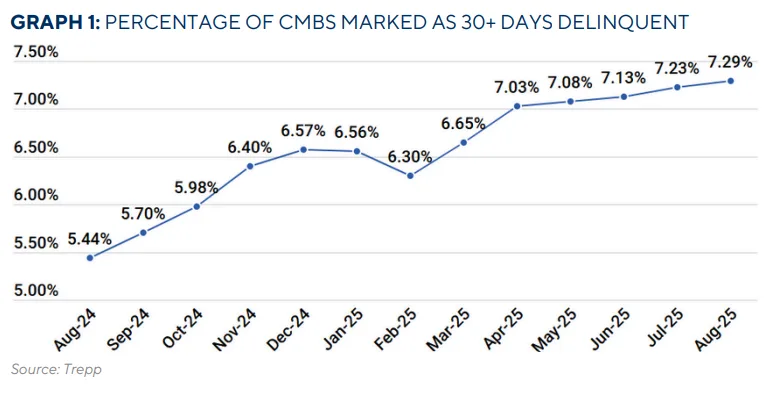

- The overall CMBS delinquency rate increased to 7.29% in August, up six basis points from July.

- Office and multifamily delinquency rates reached new records, with office at 11.66% and multifamily at a nine-year high of 6.86%.

- Retail improved, dropping 48 basis points to 6.42%—its lowest level in the past year.

- The percentage of seriously delinquent loans rose slightly to 6.88%.

Delinquency Keeps Climbing

In August, Trepp’s report showed that CMBS delinquency rate rose again, reaching 7.29%. This marks the sixth straight month of increases and a year-over-year jump of 185 basis points.

Additionally, the total delinquent balance grew to $44.1B, up from $43.3B in July. Meanwhile, the total outstanding balance increased to $604.6B, reflecting the size and impact of the market.

Office and Multifamily Face Growing Trouble

Both the office and multifamily sectors were responsible for much of the increase.

- Office delinquencies hit 11.66%, up 62 basis points from the previous month.

- Multifamily jumped to 6.86%, a 71-basis-point rise and the highest level since 2016.

These two property types continue to face economic pressure. Office buildings, in particular, are struggling with high vacancies and lower demand, while multifamily properties face oversupply and affordability issues.

In August, the office sector added $2.5B in new delinquencies, while only $1.3B in loans were cured.

Retail Shows Signs of Stability

Unlike office and multifamily, the retail sector improved. Its delinquency rate fell to 6.42%, down from 6.90% in July.

This was helped by $700M in cured loans, which far outweighed the $300M in new delinquencies. As a result, retail reached its lowest delinquency rate in the past year.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Loan Performance Breakdown

Looking at loan status across the board:

- 30-day delinquencies rose to 0.41%, up 11 basis points.

- The percentage of seriously delinquent loans—those 60+ days late, in foreclosure, REO, or non-performing balloons—increased to 6.88%.

- If defeased loans were excluded, the overall delinquency rate would have been 7.48% in August.

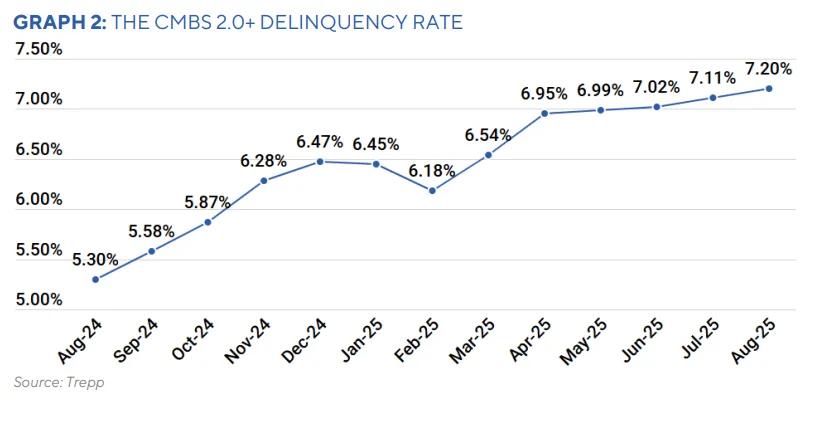

CMBS 2.0+: Still Under Pressure

The newer generation of CMBS, known as CMBS 2.0+, also saw a rise in delinquencies. In August:

- The overall 2.0+ rate climbed to 7.20%, up nine basis points.

- Seriously delinquent 2.0+ loans actually dropped slightly to 6.79%.

- Without defeased loans, the rate would be 7.37%.

By property type:

- Office: 11.52% (+61 bps)

- Multifamily: 6.86% (+72 bps)

- Industrial: 0.60% (+8 bps)

- Lodging: 6.47% (−5 bps)

- Retail: 6.10% (−49 bps)

Why This Matters

These figures show that the CMBS market remains under stress, especially in the office sector, which is facing long-term challenges due to changing workplace habits. Multifamily is also feeling the effects of high construction volume and tight consumer budgets.

At the same time, retail continues to recover, showing that not all property types are being hit equally.

What to Watch Going Forward

Looking ahead, the trend may continue as more loans reach maturity and property cash flows remain tight. August alone saw $4.8B in new delinquencies, suggesting lenders and borrowers are still struggling to manage current market conditions.

While some sectors may stabilize, rising rates and shifting demand will likely keep pressure on commercial real estate through the end of 2025.