- CBRE’s H1 2025 Cap Rate Survey reveals a slight decline in average cap rates, suggesting yields may be at or past their peak, marking a potential turning point for CRE pricing.

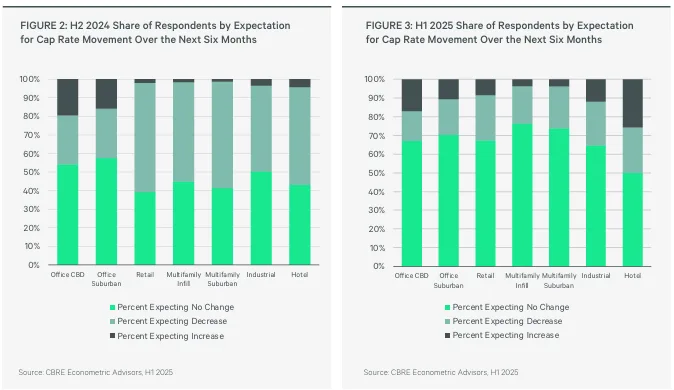

- Despite market turbulence from interest rate swings and April’s tariff shock, respondents across property types mostly expect cap rates to remain stable or begin compressing.

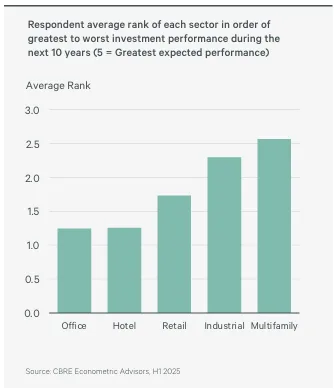

- Multifamily is now the top-performing sector for expected returns over the next decade, surpassing industrial, while office continues to rank lowest in investor sentiment.

Cap Rate Stabilization in Sight

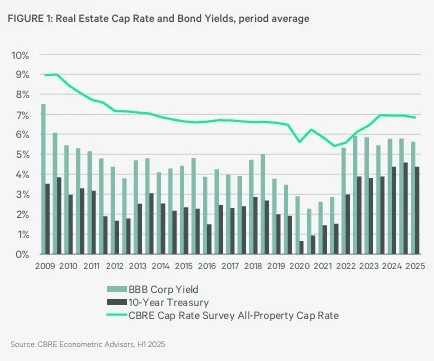

The latest Cap Rate Survey from CBRE suggests that U.S. commercial real estate may be entering a new phase of yield compression. Based on data from over 3,600 estimates across 50+ markets, the average cap rate fell by 9 basis points during the first half of 2025. This is despite a volatile macro backdrop that included interest rate swings, an unexpected tariff announcement in April, and a U.S. credit downgrade.

Signs of a Peak

A significant share of CBRE professionals now believe that cap rates have topped out. Nearly 25% of respondents in the retail, industrial, and hotel sectors expect cap rates to decline over the next six months. Meanwhile, the percentage of those expecting no change in cap rates rose across all sectors—pointing to a stabilizing sentiment even as uncertainty persists.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Market Uncertainty Persists

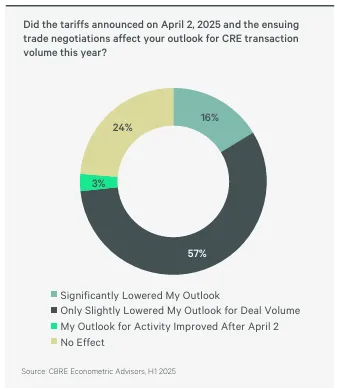

April’s tariff announcement negatively impacted investor confidence. More than 70% of survey participants said the move either slightly or significantly reduced their outlook for commercial real estate transaction volume in 2025. Despite this, the 10-year Treasury yield has steadied at around 4.2% by mid-year after sharp fluctuations.

Office Diverges Sharply

While cap rates held steady in most sectors, office continues to reflect a wide range of investor uncertainty. Especially in the Class B and C segments, some markets posted notably expanded cap rate ranges. The average spread between upper and lower estimates for office has continued to widen, reinforcing market hesitancy.

Multifamily Leads Long-Term Outlook

Multifamily assets now top investor expectations for the best-performing property type over the next decade, narrowly overtaking industrial. Retail remains mid-tier, while office sits firmly at the bottom of investor confidence rankings.

Why It Matters

With cap rates stabilizing or compressing slightly, the cre market may be signaling a bottoming-out phase. For investors, this could mark a window of opportunity—particularly in high-performing sectors like multifamily and industrial—as yields begin to tighten again.