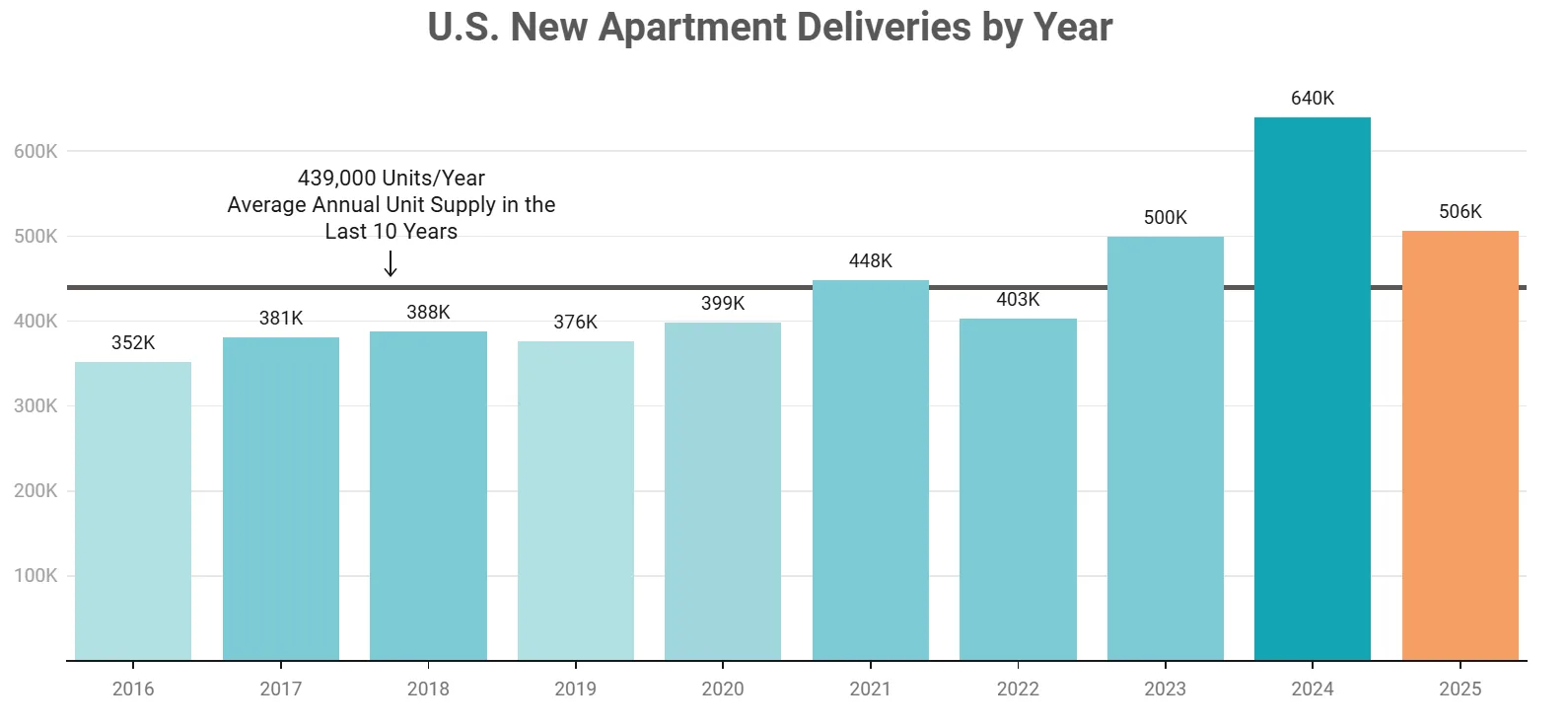

- Apartment construction remains strong in 2025, with over 500,000 new units expected nationwide.

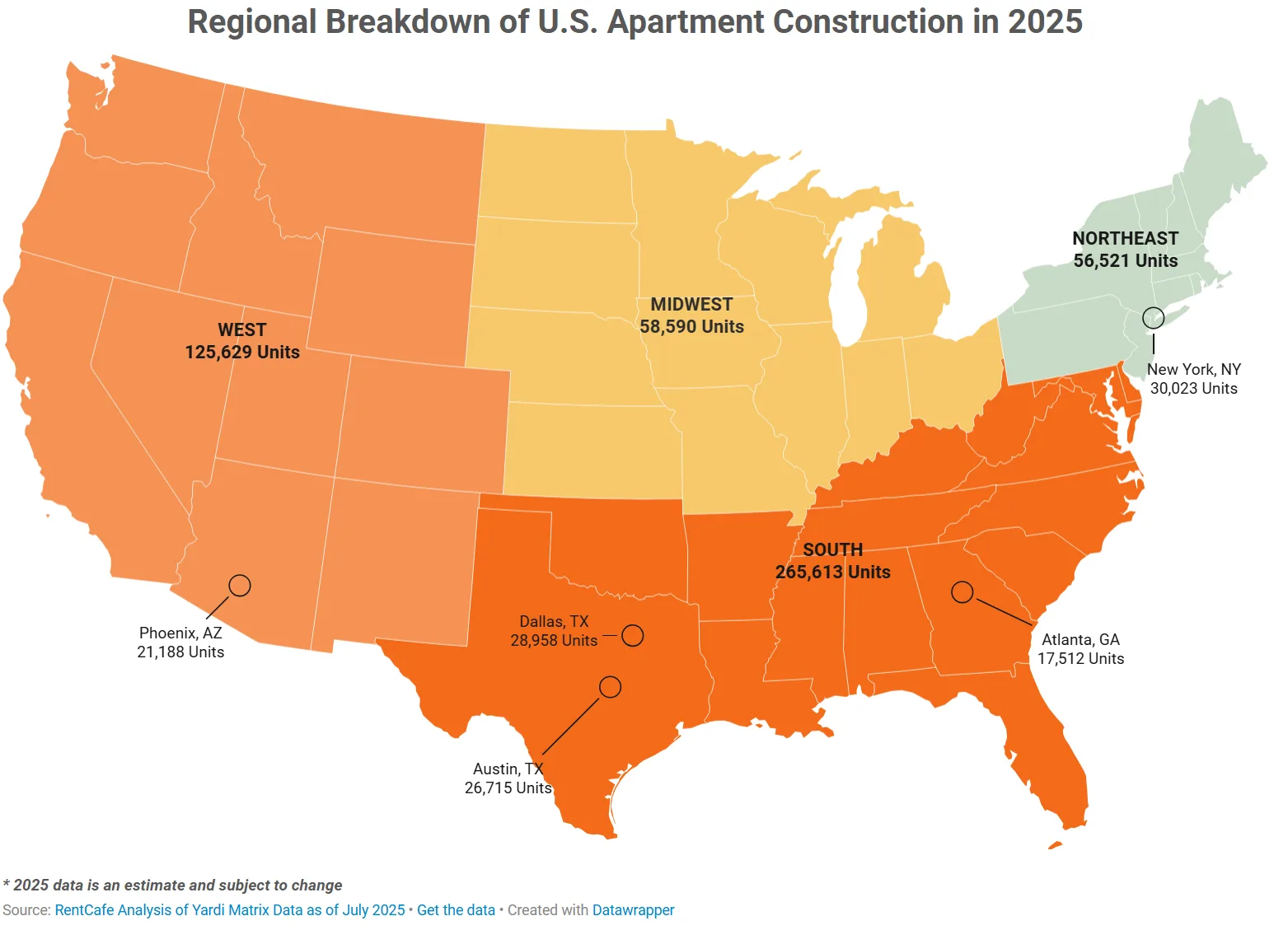

- The South leads with 52.5% of all new builds, driven by population growth and pro-development policies.

- Austin, TX ranks #1 among cities, with over 15,000 new apartments set for delivery.

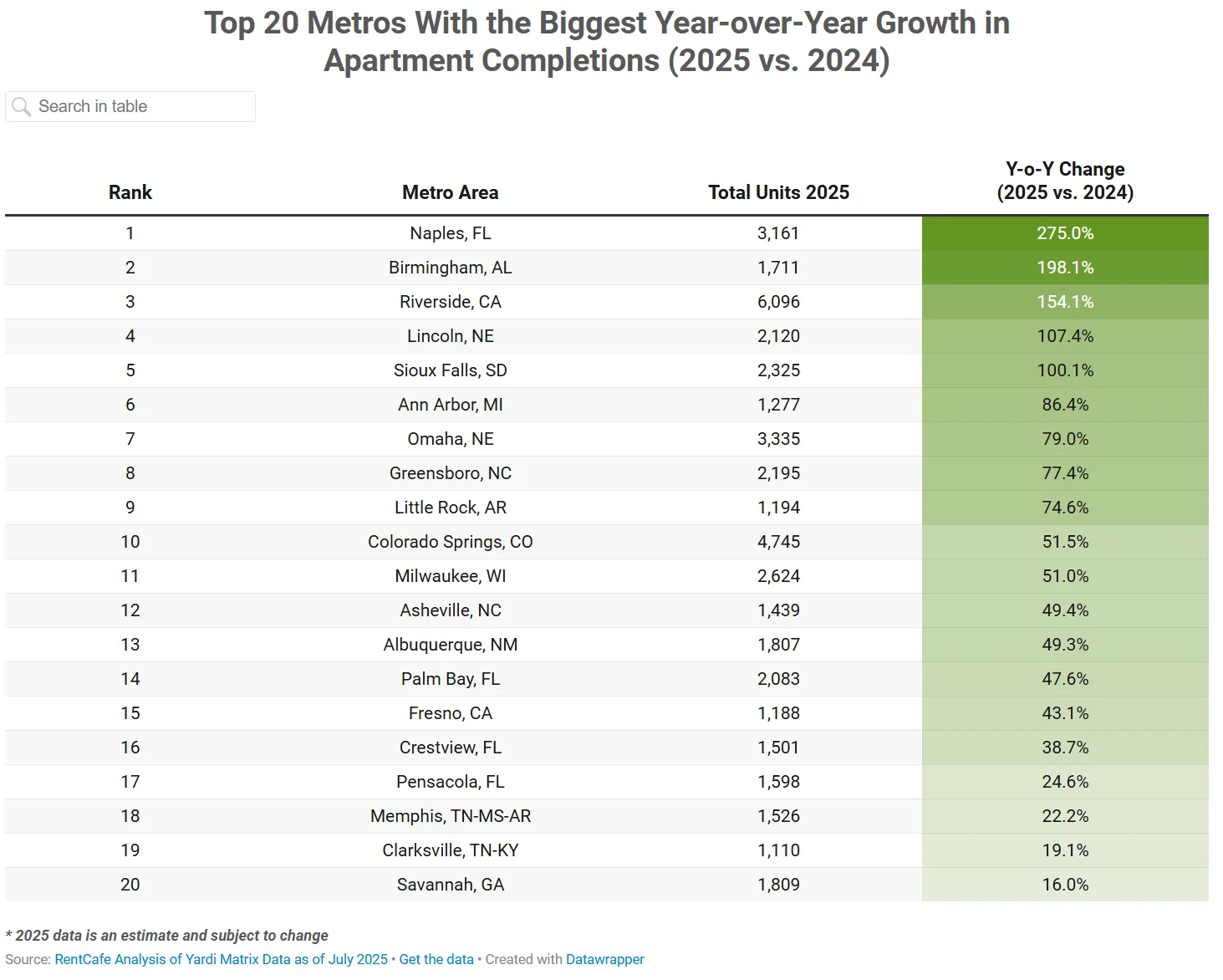

- Naples, FL sees the biggest YoY jump, while Chicago posts the sharpest decline in completions.

A New Supply Wave, But With A Southern Tilt

The US is on pace to open more than 500,000 new apartment units in 2025 — a strong showing that, while down from last year’s peak, reflects sustained demand for rental housing amid rising homeownership barriers.

But the big story this year is regional: more than half of all new apartment construction is happening in the South, where population and job growth continue to drive multifamily development.

According to Yardi Matrix data analyzed by RentCafe, the South is expected to deliver 265,613 new apartments this year, with Texas alone accounting for over 81,000 units and Florida contributing another 62,000+. Developers cite the region’s affordability, strong migration patterns, and more lenient zoning laws as key tailwinds.

City-Level Spotlight: Austin Takes The Crown

While the New York metro leads nationally in apartment completions, Austin, TX ranks #1 at the city level, with 15,195 new apartments expected by year-end. The city has become a magnet for tech workers and remote professionals, and developers are now delivering units from a wave of projects launched in the early 2020s.

Other Texas cities also dominate the top 20, with Houston (7,770 units), San Antonio (5,921), Dallas (5,778), and Fort Worth (3,793) each making strong showings.

Not Just Big Cities: Smaller Metros See Huge Growth

While major metros continue to lead in total units, smaller and mid-sized metros are posting the largest year-over-year gains in construction.

- Naples, FL saw a 275% increase in completions as population overflow from pricier Florida metros fuels new supply.

- Birmingham, AL nearly tripled its output, driven by downtown revitalization and an emerging tech sector.

- Riverside, CA grew completions by 154%, as Southern Californians seek affordability inland.

Some Markets Are Cooling Off — Fast

Several metros have dramatically pulled back on new apartment construction. Chicago saw the steepest drop, with deliveries down 60.4% compared to 2024, citing cost pressures and waning demand.

Other notable slowdowns:

- Madison, WI (-59.3%)

- Minneapolis-St. Paul (-56.5%)

- Portland, OR (-53.5%)

- San Francisco, CA (-51.0%)

Many of these metros are experiencing a cooling post-pandemic development cycle, paired with tighter financing and regulatory uncertainty.

Why It Matters

Despite the slight year-over-year dip, 2025 marks another strong year for apartment construction — and a reshaping of where developers are choosing to build. The Sunbelt’s continued rise, alongside surging construction in smaller markets, reflects the ongoing shift in US migration and affordability trends.

What’s Next

With interest rates still elevated and homeownership increasingly out of reach, demand for rental housing isn’t going anywhere — especially in metros where job growth and affordability align. Expect continued momentum in Southern cities and a growing share of development in mid-tier metros that offer livability at a lower price point.

At the same time, watch for potential slowdowns in previously overheated markets where high costs, regulatory barriers, and saturation are starting to dampen activity.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes