- On-time rent payments in independently operated rental units improved in August, rising 34 basis points (bps) to 83.2%.

- Despite the monthly increase, on-time collections have now fallen year-over-year for 25 consecutive months.

- The forecast full-payment rate climbed to 93.3%, bouncing back from its post-pandemic low.

- Western states continue to outperform the rest of the country, led by Montana, South Dakota, Hawaii, and Wyoming.

National Overview

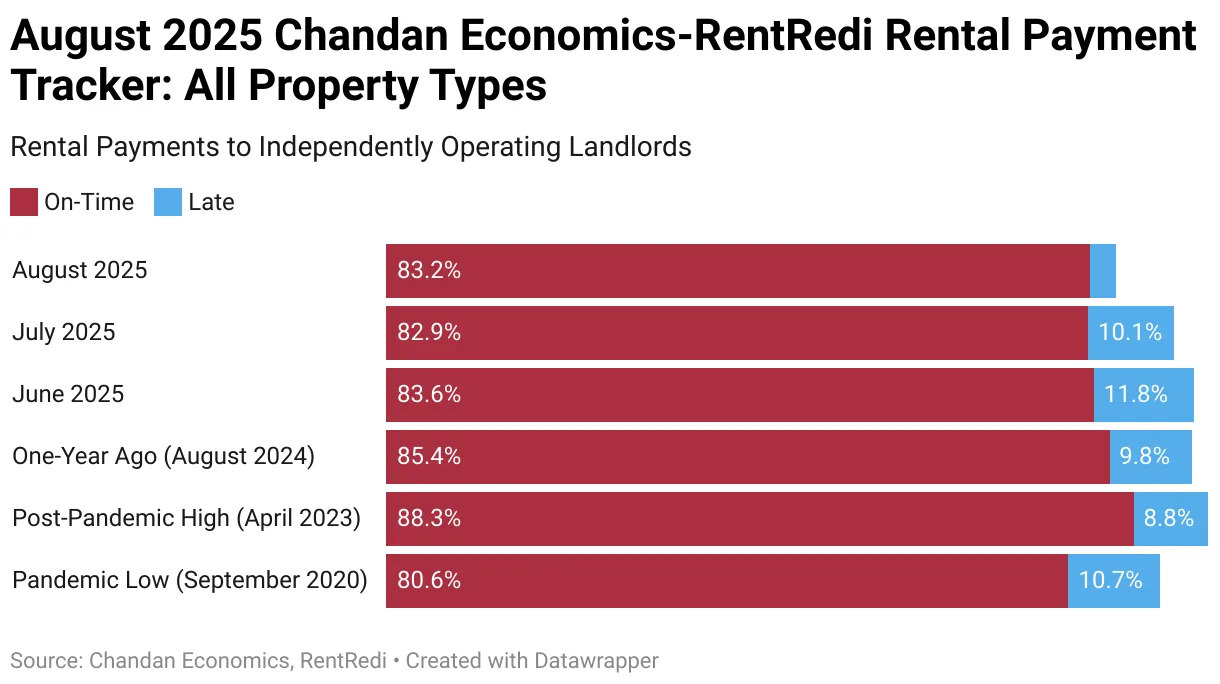

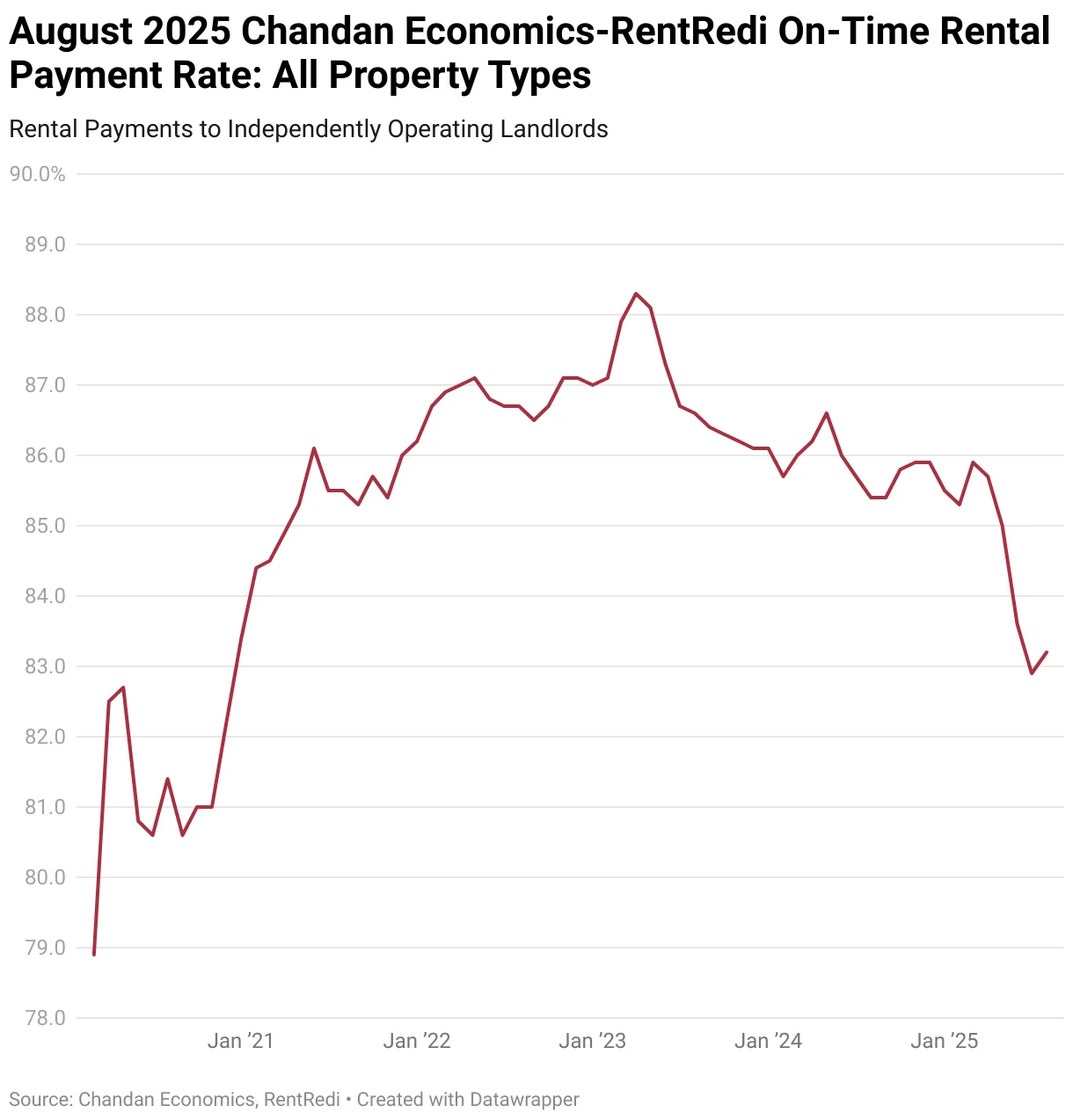

On-time rental payments showed modest improvement in August 2025, offering a rare bright spot in what has otherwise been a year of weakening performance for independent landlords. According to Chandan Economics’ first estimate, 83.2% of units paid rent in full and on time — up 34 bps from July.

Revisions, however, paint a slightly dimmer picture of the prior month. July’s initially reported rate of 83.6% was adjusted down to 82.9%, now standing as the lowest post-pandemic collection rate.

Despite the monthly uptick, collections remain under strain. Compared to August 2024, on-time payments are down 216 bps. While this marks an improvement over July’s sharper annual decline (-279 bps), it still underscores ongoing household financial pressure.

In fact, August marks the 25th consecutive month of year-over-year declines, with on-time collections down a cumulative 502 bps since mid-2023.

Year-over-Year Change

Despite the monthly uptick, collections remain under strain. Compared to August 2024, on-time payments are down 216 bps. While this marks an improvement over July’s sharper annual decline (-279 bps), it still underscores ongoing household financial pressure.

In fact, August marks the 25th consecutive month of year-over-year declines, with on-time collections down a cumulative 502 bps since mid-2023.

Full-Payment Forecast

The forecast full-payment rate — which includes both on-time and anticipated late payments — also strengthened. August’s projection landed at 93.3%, a 43 bps improvement from July.

While still well below the January 2023 peak of 97.6%, the overall decline in full payments (428 bps) has been less severe than the sharper deterioration in strictly on-time payments (502 bps). This suggests more renters are paying, just not always by the due date.

Late Payments

The widening gap between on-time and full collections points to the rising prevalence of late payments. The three-month moving average of late rents has steadily climbed since mid-2024, peaking at 11.7% in June 2025, up from just 8.8% a year earlier.

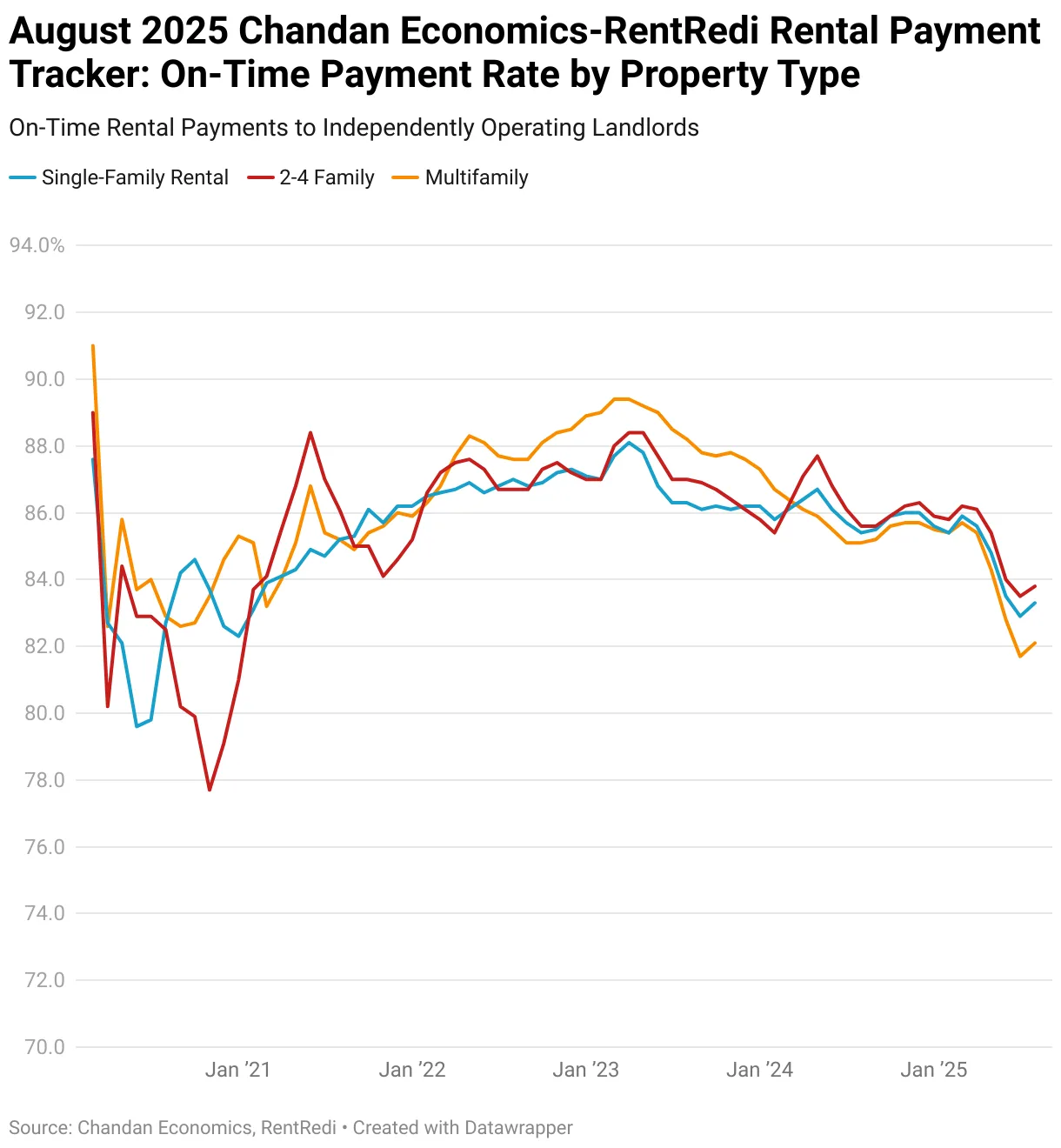

Performance by Property Type

- 2–4-unit rentals: 83.8% (highest performance)

- Single-family rentals (SFRs): 83.3%

- Multifamily properties: 82.1% (lowest performance)

Regional Differences

The West continues to lead the nation in payment performance. In August, the states with the highest on-time payment rates were:

- Montana – 94.9%

- South Dakota – 93.3%

- Hawaii – 92.5%

- Wyoming – 92.3%

- New Hampshire – 92.1% (the only non-Western state in the top 12)

Analysis

After four consecutive months of falling collections (April–July), August’s data provides a welcome sign of stabilization. Between April and July, on-time payments fell 298 bps, marking one of the sharpest short-term declines since the pandemic.

While it’s too early to call a recovery, August may signal that the bottom has been reached. Still, the broader outlook remains uncertain. Job growth has slowed, and household financial health is deteriorating, particularly among younger renters. The NY Fed’s Q2 Household Debt and Credit Survey shows rising delinquencies for borrowers under 40 — a concerning trend for rental markets dependent on younger tenants.

If the US economy can avoid slipping into recession, rent collection rates may stabilize at or slightly above current levels.

Importance of the Report

The Independent Landlord Rental Performance Report tracks rent payments across 66,138 units using data from RentRedi’s property management platform. Published monthly by Chandan Economics, the report offers unique visibility into the financial health of small, non-institutional landlords — a critical but often underreported segment of the rental market.

For investors, brokers, and policymakers, these trends highlight the financial pressures on “mom-and-pop” landlords and their tenants, providing a benchmark for rental market performance nationwide.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes