- North America’s data center vacancy dropped to a historic low of 1.6% in H1 2025, as AI and hyperscale occupiers aggressively prelease space to secure future power and capacity.

- Northern Virginia remains the top-performing market, with 538.6 MW of net absorption and a massive surge in under-construction capacity.

- Pricing remains elevated at $200+/kW/month, particularly for large 10+ MW deals, and nearly three-quarters of capacity under construction is already preleased.

Demand Outpaces Supply Across The Board

North America’s data center market is tighter than ever, reports CBRE. With vacancy at just 1.6%, AI and hyperscale tenants are rapidly leasing space years in advance to lock in power availability and capacity. This trend, detailed in CBRE’s upcoming North America Data Center Trends H1 2025 report, underscores how persistent demand and infrastructure constraints are reshaping market dynamics.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Large Requirements Drive Pricing And Site Competition

Demand for single and continuous deployments of 10 MW or more saw the steepest increase in lease rates. The main drivers? Soaring hyperscale demand, limited near-term power access, and elevated construction costs. As a result, landlords can command premiums—particularly for high-capacity, long-duration leases.

Market Highlights

net absorption, and rental rates across key cities like Northern Virginia, Atlanta, Dallas, and more.” class=”wp-image-209099″/>

net absorption, and rental rates across key cities like Northern Virginia, Atlanta, Dallas, and more.” class=”wp-image-209099″/>

- Northern Virginia remains the leader, clocking in 538.6 MW of net absorption and an 80% jump in capacity under construction.

- Atlanta led inventory growth in H1 2025, adding 969.4 MW—the highest year-over-year increase in North America.

- Dallas-Fort Worth is expected to double in size by the end of 2026, with current developments and completions gaining momentum.

- 74.3% of all capacity under construction is already preleased, signaling how cloud and AI companies are racing to secure infrastructure.

Tight Conditions, Shifting Geography

Lease rates are expected to remain elevated, similar to levels seen in 2011–2012. However, CBRE does not anticipate continued double-digit increases year over year. Still, larger tenants (10–30 MW) will face stiffer pricing and fewer options, especially in established markets facing power constraints.

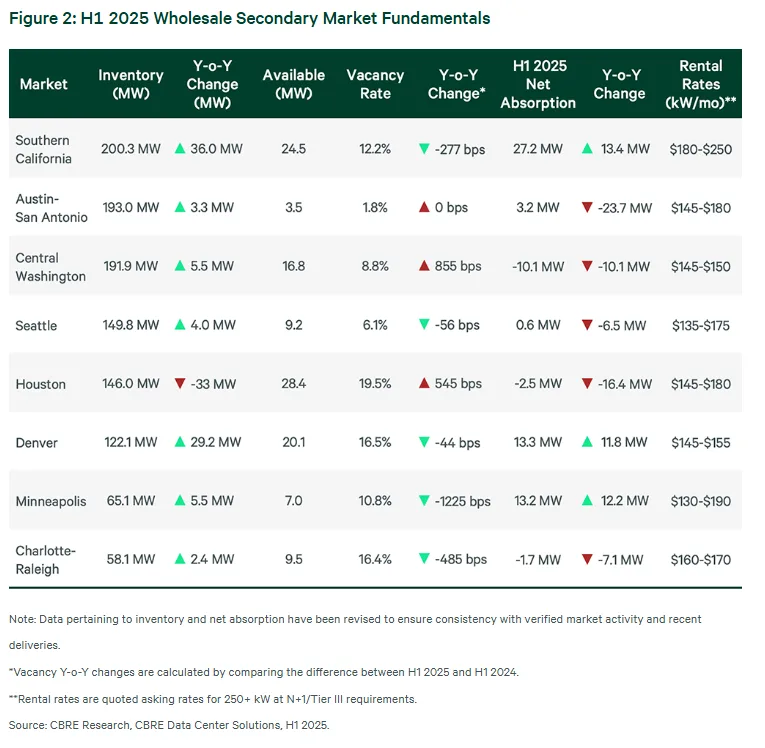

Emerging markets such as Charlotte-Raleigh, Austin, and San Antonio are gaining attention, driven by more accessible power and faster development timelines. Meanwhile, traditional hubs may see slower growth due to grid limitations and permitting challenges.

Why It Matters

AI and hyperscale adoption is not just influencing tech—it’s reshaping the real estate underpinning the digital economy. As power availability becomes a gating factor, both developers and occupiers are adjusting strategies to stay ahead in the race for infrastructure. With preleasing reaching new heights, the market will likely stay tight well into 2026.

What’s Next

CBRE’s full H1 2025 Data Center Trends report, expected in September, will offer deeper insights into pricing, construction timelines, and emerging market performance. Stay tuned as demand dynamics continue to reshape North America’s digital infrastructure landscape.