- Yieldstreet, a fintech startup promising retail access to alternative assets, is under fire after multiple real estate investments failed, resulting in significant investor losses.

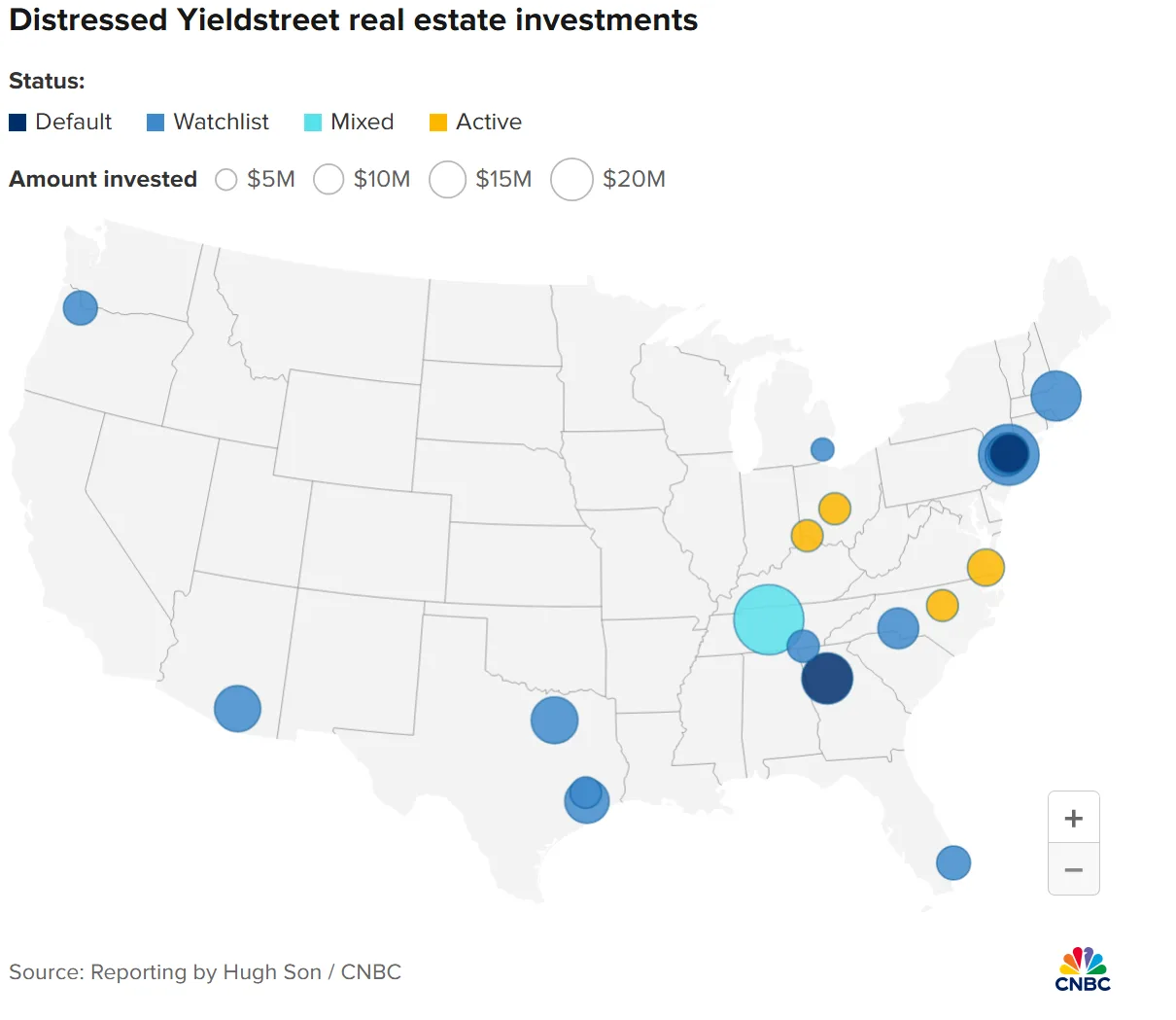

- Of 30 real estate deals reviewed, 4 were declared total losses, and 23 are now on a “watchlist” as the company scrambles to recover value.

- Rising interest rates, market downturns, and aggressive leverage have eroded the performance of real estate projects offered between 2021 and 2024.

- Some investors report losing hundreds of thousands of dollars and accuse Yieldstreet of misrepresenting risk and lacking transparency.

The Promise of Democratized Investing Unravels

Yieldstreet launched in 2015 with a bold mission: open the door for everyday investors to access private market deals — including real estate — traditionally available only to the ultra-rich. But CNBC reports that for many users, particularly those who invested between 2021 and 2024, that promise has unraveled.

As market conditions shifted and interest rates surged, dozens of Yieldstreet’s real estate deals have faltered. Investors now say they’ve suffered catastrophic losses and allege the company failed to disclose the full extent of the risks.

Mounting Losses: 90% of Reviewed Deals Show Trouble

A CNBC investigation reviewed 30 Yieldstreet real estate investments. Of those:

- 4 were written down to zero.

- 23 are on a “watchlist”, meaning Yieldstreet is actively working to salvage them.

- 3 deals are “active” but no longer making payouts.

In total, the deals accounted for more than $370M in investor capital, with $78M already recognized as defaults. Many investors now expect to lose most — or all — of their capital.

Retail Investors Hit Hard

Investors like Justin Klish and Mark Underhill say they put their trust in Yieldstreet’s advertised expertise — and paid the price:

- Klish, a Miami-based financial services professional, invested $400,000 in two deals and expects to lose nearly all of it.

- Underhill, a software engineer, has seen $200,000 in losses and says the risk disclosures were “mind-bogglingly” misleading.

- Louis Litz, 61, fears his $480,000 investment will destroy his retirement, with half his deals either in default or on watchlist.

Rising Rates, Falling Returns

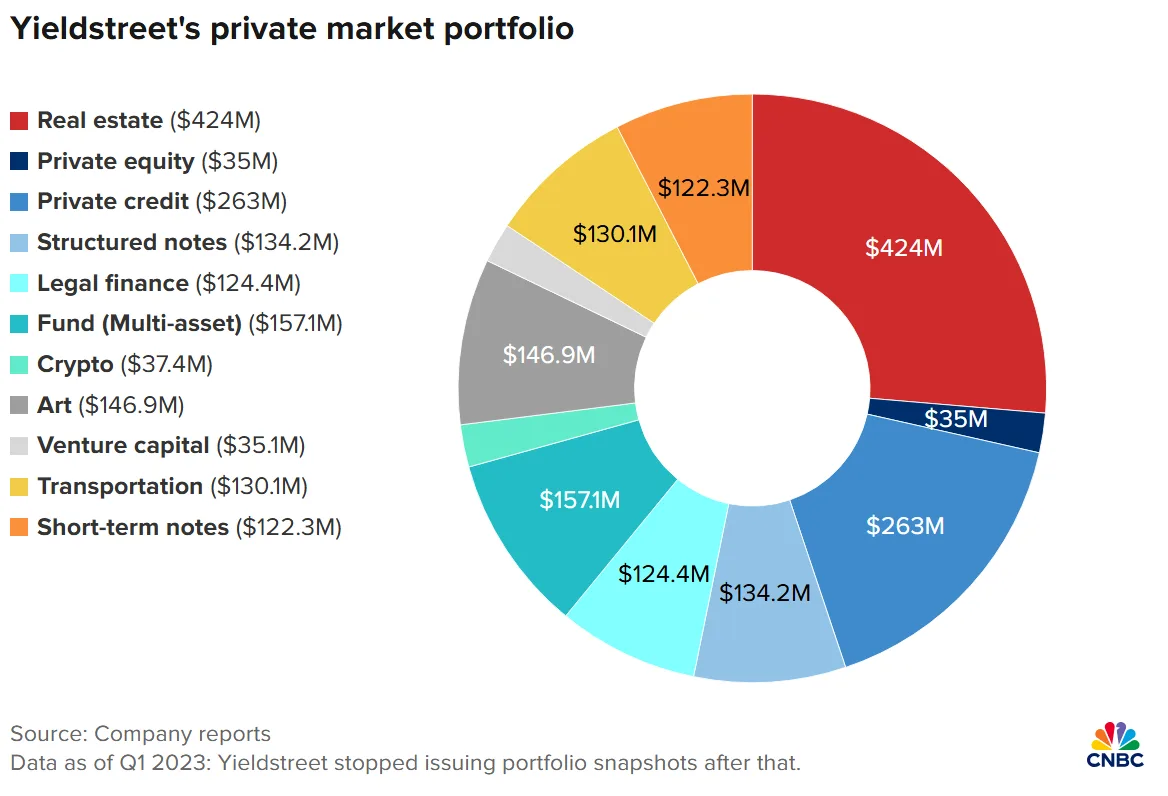

Real estate was Yieldstreet’s largest investment category by 2023, accounting for 26% of platform allocations. But much of that activity came during a period of aggressive Fed rate hikes. Multifamily property values have dropped 19% since 2022, and heavily leveraged projects struggled to adapt.

The result? Yieldstreet’s annual real estate return rate plummeted from 9.4% in 2023 to just 2% in early 2025.

In one case, Yieldstreet sold its position in a New York deal — where investors had put in $15M — for just $1.

Transparency Under Scrutiny

Investors and analysts say Yieldstreet’s communication has often fallen short:

- Investor letters are confidential, limiting information-sharing across the community.

- Yieldstreet’s website initially showed misleading 0% returns on defaulted projects — such as a Nashville apartment deal that resulted in a full loss.

- The firm stopped issuing quarterly portfolio snapshots in early 2023.

These issues have prompted complaints to the SEC, including one filed by Klish alleging Yieldstreet misled investors about the risk profile of its offerings.

SEC Fines and a Troubled Past

This isn’t the first time Yieldstreet has drawn regulatory scrutiny. In 2023, the SEC fined the firm $1.9M for misrepresentations tied to a marine loan product. The startup had sold a $14.5M investment even as it suspected fraud by the borrower — who later vanished with 13 ships used as collateral.

Yieldstreet neither admitted nor denied wrongdoing in the settlement.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

A Strategic Pivot: From Origination to Distribution

Facing mounting criticism, Yieldstreet replaced its CEO in May 2025, appointing Mitch Caplan, a former E-Trade chief. Caplan now plans to reshape the platform, shifting focus to external asset managers.

In July, the company announced a $77M raise and its official registration as a broker-dealer. It now intends to offer vetted funds from institutional giants like Goldman Sachs and The Carlyle Group.

Why It Matters: A Cautionary Tale in the Alt-Investing Boom

Yieldstreet’s collapse of confidence highlights the perils of retail access to complex, opaque markets. While democratization of alternative investing remains a powerful idea, Yieldstreet’s failures underscore the importance of transparency, risk discipline, and accountability.

The question now is whether this pivot to become a Wall Street-aligned distribution platform is too little, too late — especially for the retail investors left holding the bag.

What’s Next

As Yieldstreet continues to unwind troubled projects and repositions itself in the market, more scrutiny — from regulators and investors alike — is likely. For retail investors navigating the next wave of alternative investment platforms, the Yieldstreet saga serves as a stark reminder: not all that glitters in private markets is gold.