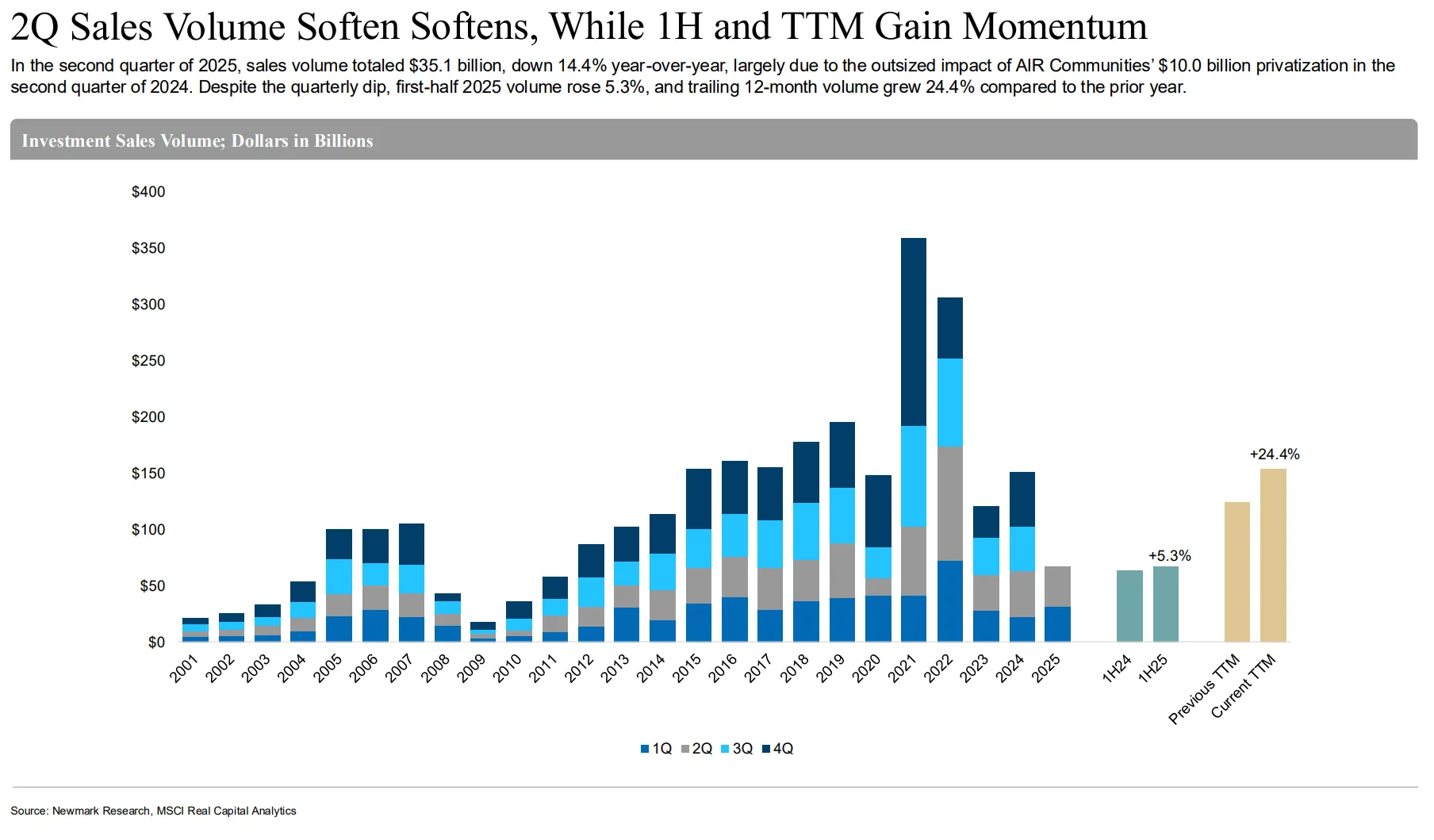

- Multifamily sales volume fell 14.4% in Q2 to $35.1B, though trailing 12-month volume rose 24.4% year-over-year, reflecting long-term investor confidence.

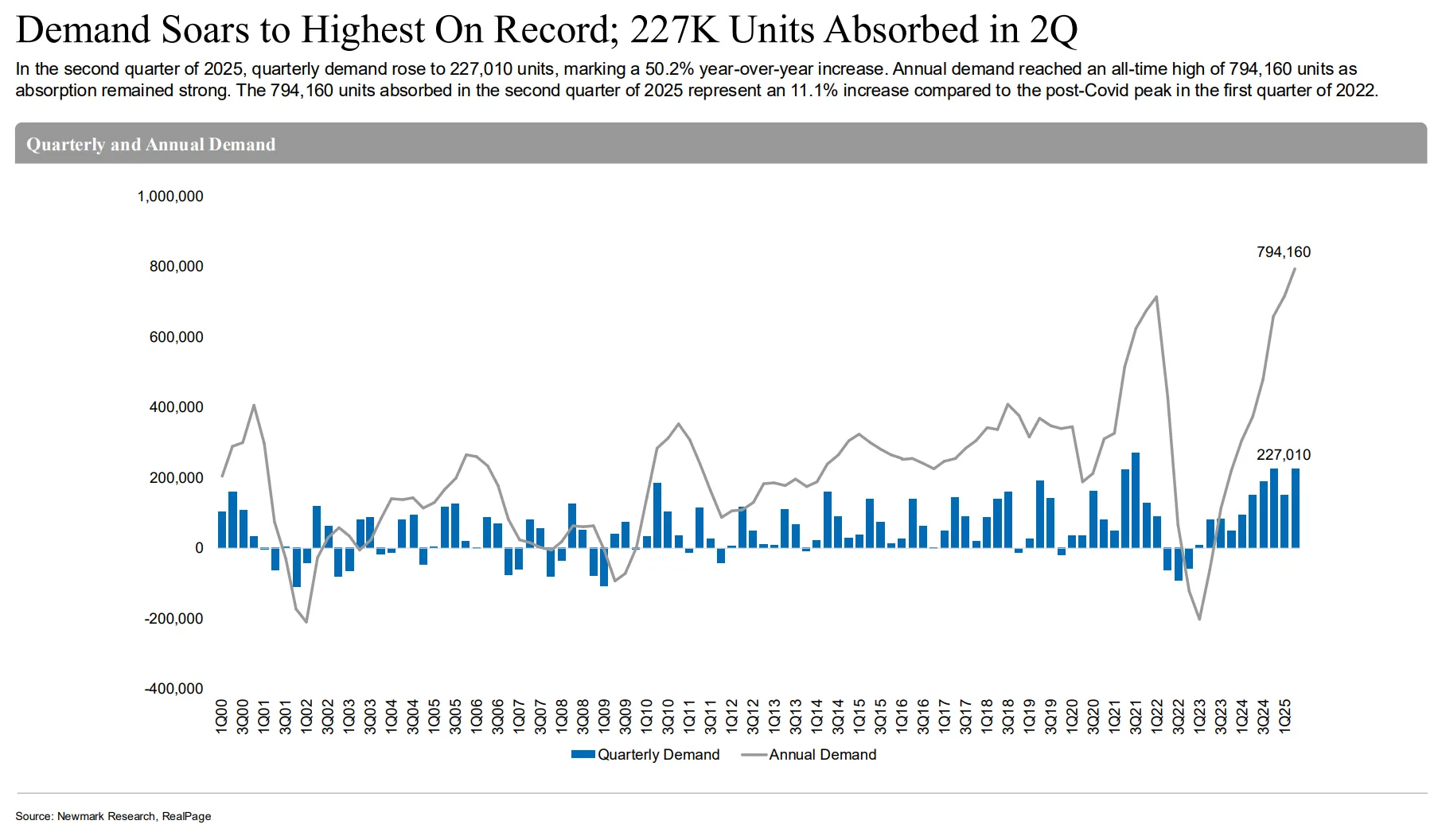

- The sector absorbed a record 794,160 units annually, while vacancy dropped to 4.3%, the lowest in nearly three years.

- Despite high demand and tightening supply, rent growth held steady at just 0.8%—marking a rare disconnect between fundamentals and pricing.

Sales Slow, But Sector Leads CRE

According to a recent Newmark report, multifamily sales dropped in Q2 2025, falling 14.4% to $35.1B. The drop was due to a $10B privatization deal by AIR Communities in Q2 2024, which skewed comparisons.

Even so, the sector gained momentum. First-half sales rose 5.3%, and volume over the past year climbed 24.4%. Multifamily made up 33.4% of total US CRE volume, making it the top asset class.

Sun Belt Leads, Midwest Gains

Sun Belt markets made up nearly half—48.9%—of all multifamily sales over the last 12 months. But investors are also turning to the Midwest. That region’s share rose to 11.5%, nearly 300 basis points above its long-term average.

Dallas led all US cities, with $5.6B in deals in the first half. That’s more than double the next highest market and up 105.6% from a year earlier. Seattle and Portland also posted gains of 75% or more.

Demand Hits New Highs

Demand remains strong. In Q2, 794,160 units were absorbed—an all-time high. That’s 11.1% above the post-COVID peak in Q1 2022.

Vacancy fell to 4.3%, dropping 150 basis points year-over-year. That puts it 120 basis points below the long-term average. The tightest markets are in the Northeast, Mid-Atlantic, and Midwest, where new supply has been limited.

At the same time, new construction is slowing. Quarterly deliveries dropped to 108,715 units. Annual supply also fell to 535,805 units. More slowdown is expected over the next 12 months.

Rent Growth Flat Despite Tight Conditions

Even with tight supply and record demand, rent growth held steady at just 0.8% year-over-year. This is well below the long-term average of 2.8%.

This disconnect is unusual. It’s the first time on record that both vacancy and demand are in the top quartile, yet rent growth remains under 1%.

Still, core markets like San Francisco, New York, and Chicago posted strong rent gains. Tampa also stood out, with rents rising 3.5% over the past year.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Investor Confidence Builds

Returns are improving. NCREIF’s apartment index posted a 5.13% annual return, beating the broader property index, which returned 4.23%. Cap rates also compressed. RCA’s average cap rate fell 38 basis points, while core assets tracked by NCREIF saw a 9-basis point drop.

Why It Matters

Despite a soft Q2, multifamily is still the top CRE sector by volume. Investor interest remains strong due to high demand, low vacancies, and solid returns. The drop in new supply could support stronger rent growth ahead.

What’s Next

Rent growth may accelerate as supply slows and demand stays high. With $769B in multifamily debt maturing by 2027, capital markets are expected to stay active. Look for more refinancing, deal flow, and renewed focus on high-growth and supply-limited markets.