- CRE CLO distress rate dropped 410 basis points in April to 10.3%, the sharpest decline in over a year, according to CRED iQ.

- Year-to-date issuance hit $11.4B—400% more than the same period in 2024.

- Despite improvements, 63.1% of CRE CLO loans are past maturity, though many borrowers are using extensions to delay default.

Distress Rates See a Sharp Drop

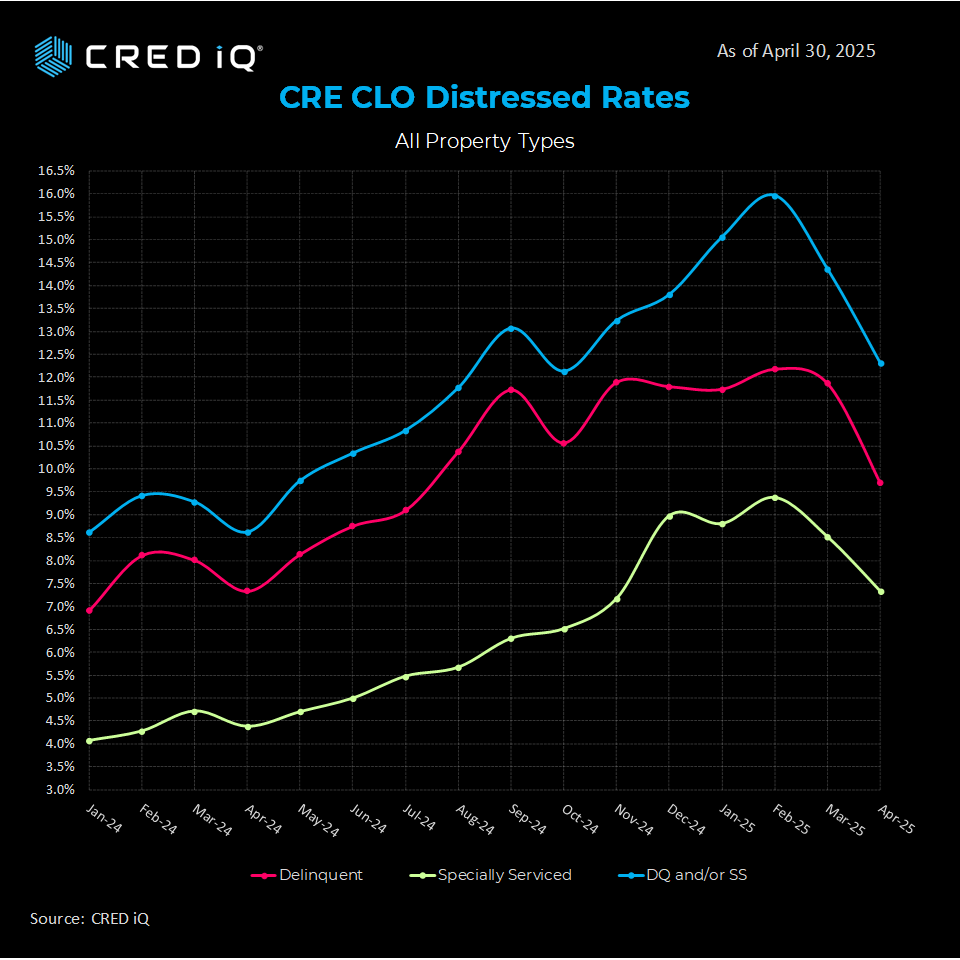

As reported by CRED IQ, the CRE CLO sector, after months of strain, is finally showing improvement. In April, CRED iQ reported a 410-basis-point drop in the distress rate, now at 10.3%. This marks the biggest monthly improvement in more than a year.

Other key metrics also improved. Delinquency dropped 220 basis points to 9.7%, and special servicing declined by 110 basis points to 7.4%. These changes suggest better loan performance across the board.

CRE CLO Issuance Picks Up Speed

The market isn’t just stabilizing—it’s growing. CRE CLO issuance reached $11.4B through April 2025. That’s a 400% increase from the $2.2B recorded during the same period last year.

Noteworthy deals include Invesco’s $1.2B debut CLO and TPG’s $1.1B issuance, of which $962M earned an investment-grade rating. These figures reflect a strong rebound in investor appetite.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Maturity Risk Still a Concern

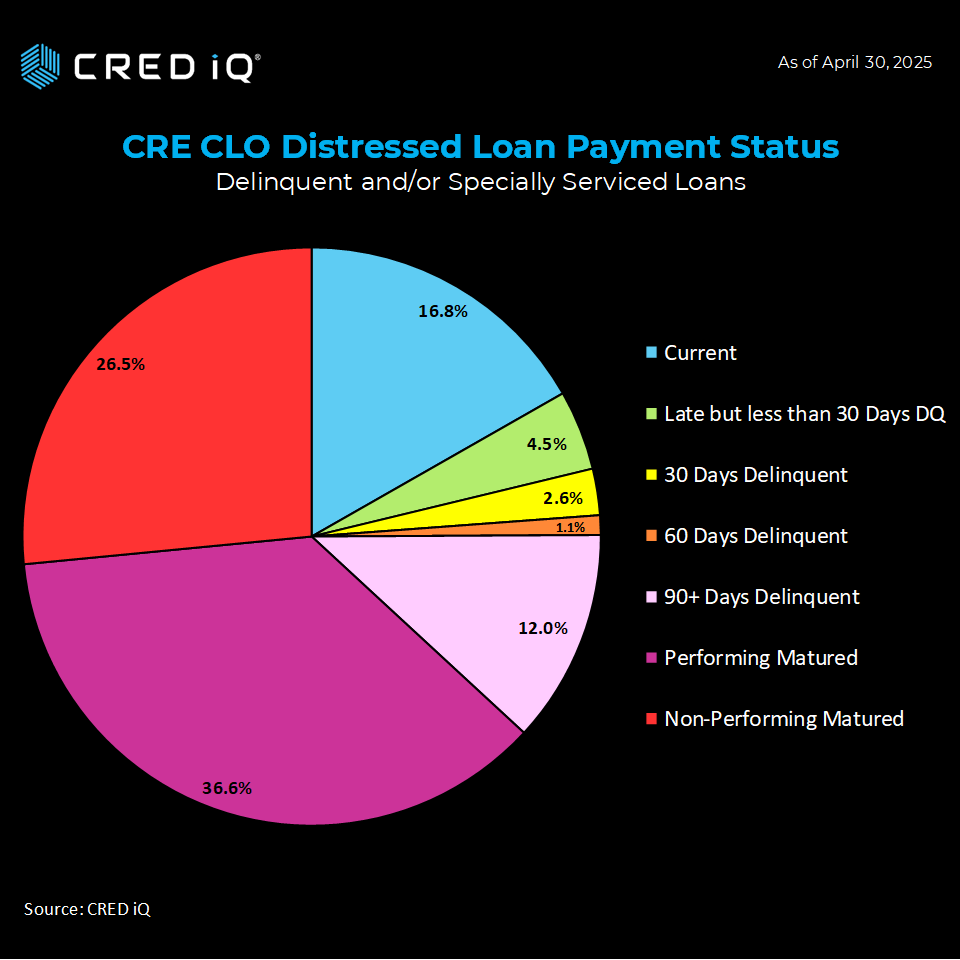

Despite better numbers, many loans remain in trouble. As of April, 63.1% of CRE CLO loans had passed their maturity date. That’s down from 69.5% in March, but still high.

- Performing Matured Loans: 36.6% (slightly down from 37.3%)

- Non-Performing Matured Loans: 36.6% (up from 32.2%)

- Current Loans: 16.8% (up from 15%)

- Delinquent (Pre-Maturity): 15.7% (up from 13.1%)

These loans, often issued in 2021 with floating rates and three-year terms, are now reaching maturity in a much tougher economic climate. Many borrowers are using short-term extensions to avoid default.

Case Study: Haven at Bellaire

The $46.3M CRE CLO loan for Haven at Bellaire, a 384-unit property in Houston, shows the stress many borrowers face. The loan was added to the servicer’s watchlist in late 2024, ahead of its April 2025 maturity. Although it includes two one-year extension options, the loan moved to “performing matured” status, showing the rising number of near-defaults.

Why It Matters

The recent data points to a shift. Distress is easing, and new deals are picking up. However, many loans still hover near default. Investors and lenders must remain cautious, especially with large portions of loans still past maturity.

CRED iQ’s data platform continues to provide insight into these trends, helping industry players make smarter decisions.

What’s Next

Expect more refinancing and new deals as borrowers try to manage upcoming maturities. At the same time, investors may keep favoring CLOs for their yield potential. Still, the maturity wall from 2021-originated loans will likely pressure the market for months to come.