Texas and California Dominate “Opportunity Zone 2.0” Rollout

Opportunity Zone 2.0 will shrink the playing field, but Texas and California still dominate.

Good morning. Opportunity Zone 2.0 is here — leaner, meaner, and more competitive. California and Texas still top the list, but with fewer tracts and stricter rules, the fight for prime investment territory is on.

Today’s issue is brought to you by Bequest Asset Management—earn steady 8–10% returns, backed by US mortgage notes for stability, transparency, and cash flow.

🎥 Missed the live event? Catch the full replay of The Rise of Hybrid Multifamily Deals to learn how a new investment model is bridging institutional rigor with retail accessibility.

Market Snapshot

|

|

||||

|

|

*Data as of 08/14/2025 market close.

TAX BREAK

Texas and California Dominate “Opportunity Zone 2.0” Rollout

A tighter, more competitive federal Opportunity Zone program is on the way—and Houston is front and center in a map that’s getting smaller.

What’s changed? Opportunity Zone 2.0, passed under the One Big Beautiful Bill Act, makes the OZ program a permanent part of the federal tax code and introduces a sharper, simpler framework. Key reforms include:

-

A 10-year rolling designation cycle starting in 2026, replacing the static 2017 map.

-

A new five-year capital gains deferral and 10% step-up in basis for all investors—streamlining previously deadline-driven benefits.

-

The removal of the “contiguous tract” rule, cutting zones that had crept into more affluent areas.

-

Stricter eligibility thresholds: census tracts must now fall below 70% of median family income, down from 80%.

The result? The OZ map will shrink by nearly 20%, from 7,800 zones to about 6,300, creating a more competitive and targeted field ahead of the July 1, 2026 deadline for governors to submit new designations.

Sources: Economic Innovation Group/U.S. Department of Housing and Urban Development and U.S. Census Bureau

Houston dominates the map: Houston is emerging as the biggest local winner. The city could see 631 eligible tracts, including 526 in Harris County alone—a fivefold increase from its 2017 allocation. That’s 21% of all Texas zones under the proposed framework.

California still out front: On a statewide scale, California leads with roughly 2,750 eligible census tracts, narrowly edging out Texas at 2,500. These tallies closely mirror population size—California (39.5M) and Texas (31.3M)—but also reflect regional economic complexity, particularly in dense, high-cost markets like Los Angeles and the Bay Area.

Past program impact: The first OZ round boosted apartment construction, with 68,000 more units than pre-program trends, worth an estimated $18B, per CoStar. In LA, openings rose from 1,245 pre-tax break to 3,432 in 2024, with 7,441 more underway. Nationally, OZs’ share of new units grew from 12% in 2017 to 23% today.

➥ THE TAKEAWAY

Looking ahead: While the first OZs were largely used for real estate, OZ 2.0 aims to widen the aperture. The program supports capital going into businesses—including logistics, manufacturing, and service sectors—so long as they’re rooted in designated zones. The new investment window officially opens on January 1, 2027.

TOGETHER WITH BEQUEST ASSET MANAGEMENT

Earn 8-10% Annual Preferred Returns Backed by Real Estate – Without the Volatility

The Bequest Income Fund, backed by real estate, is designed for predictable growth. Offering 8-10% annual returns, monthly distributions, or compounding options. Backed by a diversified portfolio of U.S. performing mortgage notes, it provides stability and cash flow.

Open to accredited investors. Five-year track record with zero missed payments.

What Makes Bequest Different?

-

Fiduciary-backed, with full transparency

-

Steady cash flow from every investment

-

Proprietary controls for sourcing & asset management

-

Focus on assets that benefit communities and the future

-

State-licensed Registered Investment Advisor

*This is a paid advertisement. Please see the full disclosure at the bottom of the newsletter.

✍️ Editor’s Picks

-

Debt disruption: Capitalize.io launches CRE’s first AI agents to speed up financing and tackle a looming $3.1T debt wall.

-

Argus exit? Altus Group, the maker of widely used CRE software Argus, is exploring a potential sale or merger.

-

Portfolio pressure: Brookfield’s $98B property arm narrowed its Q2 loss to $46M, down from $789M last year.

-

Cost creep: US producer prices surged 0.9% in July—the largest monthly jump in three years—as service costs soared and companies began passing higher import tariffs onto consumers.

-

Recession watch: A sharp drop in job creation and softening economic signals are pushing Treasury yields lower and boosting rate cut odds.

-

Hollywood south: Taylor Sheridan and Hillwood have launched a 450K SF production campus in Fort Worth’s AllianceTexas.

🏘️ MULTIFAMILY

-

Sunbelt squeeze: Florida apartment rents fell up to 8% YoY in Q2, as relentless new supply continues to outpace demand across most markets.

-

Developer exit: South Florida multifamily developers are offloading development sites amid high construction costs, softening rents, and a saturated market.

-

Builder blues: Single-family housing permits dropped 6.3% in early 2025, signaling fading builder confidence.

-

Rent frenzy: Manhattan hit yet another rent record in July with a median of $4,700, driven by tight supply and fierce demand.

🏭 Industrial

-

Cold commerce: Americold’s new Kansas City hub links US, Canada, and Mexico by rail, offering a model for future cross-border cold-storage logistics.

-

Grid limits: Richmond has become the fastest-growing US data center market, but its explosive rise is now facing headwinds.

-

Funding flop: Tri-Rail faces a $27M funding shortfall that could shut down service by 2027, threatening the future of South Florida’s transit-oriented developments.

🏬 RETAIL

-

Drone debate: A proposed FAA rule could remove line-of-sight limits on drone deliveries, paving the way for wider retail use.

-

Sweat equity: As big-box retailers go dark across Texas, gyms and entertainment tenants are rapidly backfilling space, keeping retail vacancy rates below historic norms.

-

Grocery grab: Amazon is massively expanding its same-day grocery delivery to 2,300 cities by year-end, shaking up supermarket stocks and doubling down on its Fresh and Whole Foods offerings.

-

Apparel alliance: Gildan is acquiring HanesBrands for $2.2B, aiming to create a vertically integrated global apparel giant.

🏢 OFFICE

-

Loan distress: A $177M CMBS loan backed by Austin’s 7700 Parmer office campus has been sent to special servicing after major tenants exited, dropping occupancy from 99% to 74%.

-

Bunny era: Playboy is moving its HQ to Miami Beach and launching a new luxury club concept.

-

Global gap: US banks require more in-office days than European ones, deepening global workplace policy splits.

-

Shared space: US coworking growth has slowed, but rising corporate demand and suburban expansion signal a promising new phase for the industry.

-

Value collapse: The 1000 Wilshire office tower in DTLA lost major tenants and saw its value plummet 69%.

🏨 HOSPITALITY

-

Deal doubts: Caesars Palace Times Square faces mixed community feedback, with some praising economic benefits and others raising concerns about crime, youth safety, and transparency.

-

Resort reboot: Brookfield secured a $1.93B refinancing for its Atlantis Paradise Island resort, fueling upgrades and future development on the Bahamian property.

📈 CHART OF THE DAY

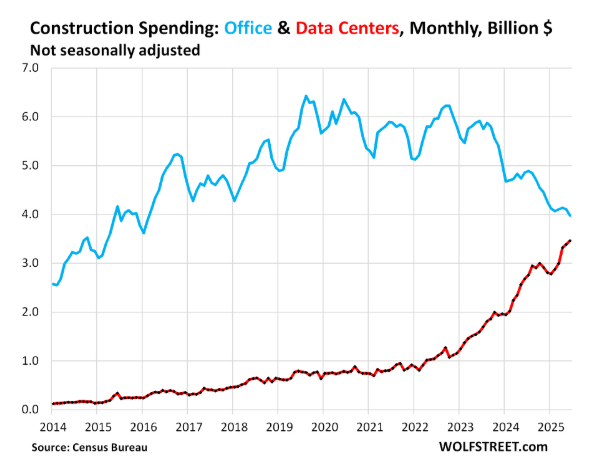

While data center construction has surged, a steep drop in traditional office spending has kept overall office construction growth modest at 17% since 2022.

You currently have 0 referrals, only 1 away from receiving Multifamily Stress Test Model.

What did you think of today's newsletter? |