- NYC rent-stabilized landlords report deep financial distress due to rising costs and strict rent caps under the 2019 HSTPA law.

- Financial records from 4,300 units show declining income, increased vacancies, and deferred repairs across portfolios.

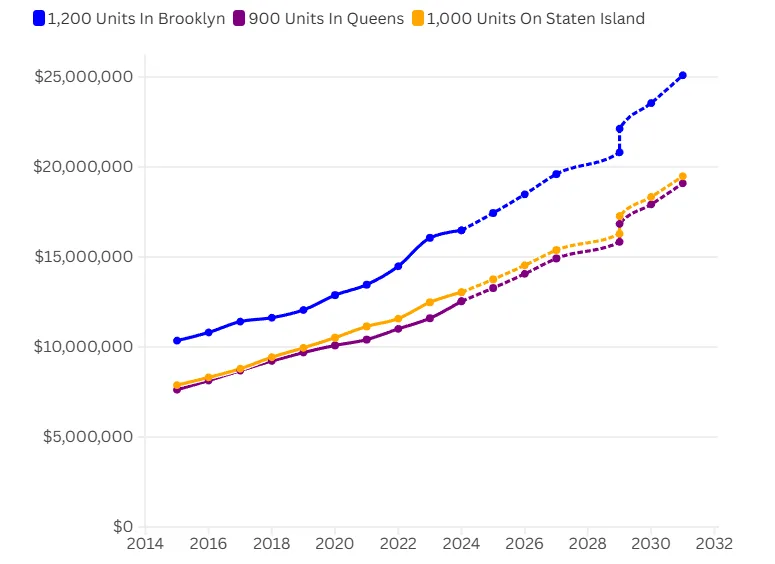

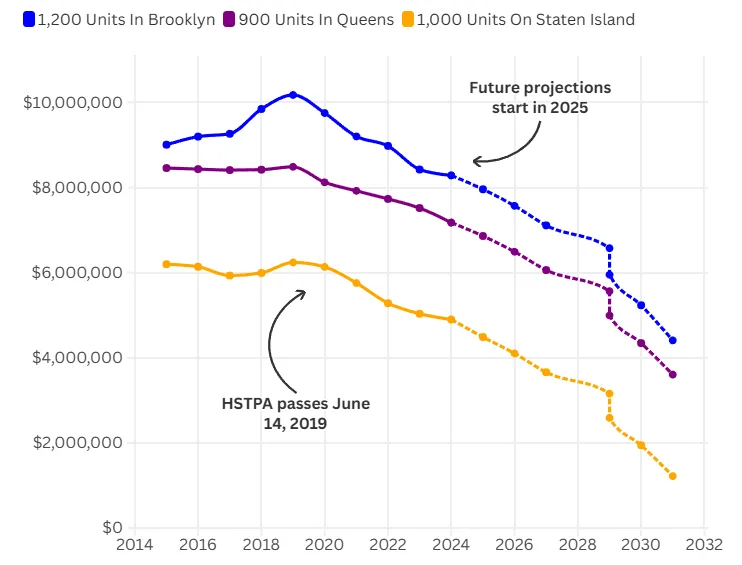

- Property values for rent-stabilized buildings have plummeted, making sales and refinancing difficult.

- Experts warn the current model is unsustainable and could lead to widespread housing decline without legislative changes.

A Law That Reshaped NYC Housing Economics

Next month, as the Rent Guidelines Board (RGB) meets to set new caps for nearly a million rent-stabilized apartments, tensions between tenants and landlords will again take center stage. But for many property owners, the debate is now less about annual increases and more about survival, reports Bisnow.

Nearly six years after the passage of HSTPA, which eliminated mechanisms for rent increases tied to renovations and capped vacancy-related hikes, landlords say they are stuck with an economically unsustainable model. “The crisis has already started,” said one of two landlords who shared data on 4,300 outer-borough apartments under anonymity. “It’s just getting everybody to realize how bad it really is.”

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Financials Paint A Bleak Picture

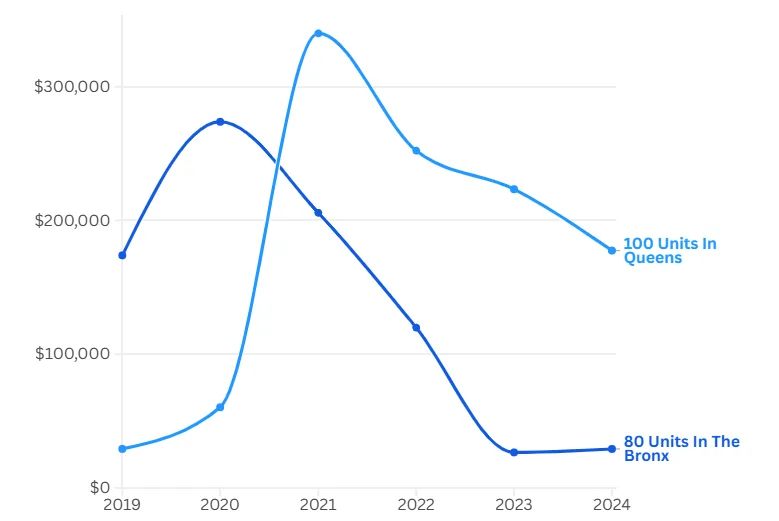

Spreadsheets shared with Bisnow show an accelerating drop in net operating income, even as rents remain frozen or limited in growth. For example, one Bronx building saw net income fall from $274K in 2020 to just $29K in 2024. Meanwhile, insurance premiums, taxes, and repair costs have more than doubled.

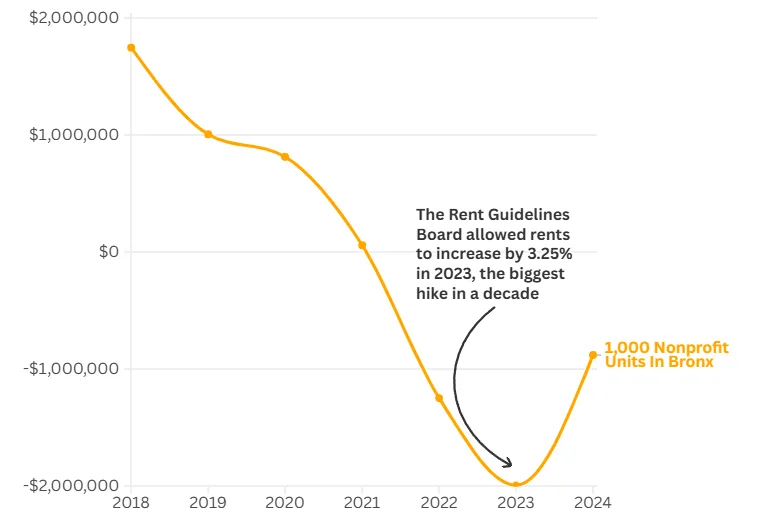

One nonprofit operator of 1K Bronx units is now losing over $1M annually. The group’s cash reserves shrank from $7M in 2020 to just $1M this spring.

A System At Risk Of Collapse

The stakes are high. As deferred maintenance piles up and values nosedive, investors and owners warn that many buildings could become uninhabitable without policy change. One landlord said they’re already delaying critical repairs due to lack of funds — including boiler and roof replacements.

Landlords and analysts point to parallels with the housing decay seen in New York during the 1970s and ’80s. “If you can’t cover your costs or make the necessary improvements, the whole system breaks down,” said NYU Furman Center policy fellow Mark Willis.

Values Cut In Half — Or Worse

According to the University Neighborhood Housing Program, median prices for rent-stabilized units have collapsed: from $290K to $122K in Manhattan and from $275K to $196K in Brooklyn. The Bronx saw median unit prices drop to just $112K.

Even a slight rollback of HSTPA policies hasn’t staved off distress. Though the state raised caps on post-vacancy renovations to $30K, over 26K stabilized units remain vacant and off-market, often because the costs to make them livable far exceed allowable rent increases.

Policy Pushback, With Few Wins

Despite multiple lawsuits and lobbying efforts, landlords have failed to overturn HSTPA. Even former Gov. Andrew Cuomo, who once hailed the law, has reportedly softened his stance amid mounting pressure and a worsening housing crisis.

Construction of new units has slowed, and the city’s vacancy rate has fallen to just 1.4%, its lowest in decades. Yet, distressed rent-stabilized portfolios continue to grow. Older properties built before 1974 now show a 25% distress rate by balance, according to KBRA.

What Comes Next?

With lenders tightening standards and even Community Stabilization Partners beginning foreclosures, experts say properties are increasingly falling into speculative hands. But even buyers scooping up buildings for pennies on the dollar may struggle to make the numbers work.

“Even if they get these buildings near 10 cents on the dollar,” said Kenny Burgos of the New York Apartment Association, “some of these numbers will never pan out.”

Unless lawmakers revisit HSTPA, stakeholders warn of a growing affordability paradox: the erosion of one of the city’s largest affordable housing stocks — and the slow-motion unraveling of a critical sector in New York’s housing market.